The Labour Party has been at pains to reassure several groups of people – the middle classes, business and even those who might be subject to a wealth tax, to name just three – that it will not hike taxes and maim the economy if Sir Keir Starmer wins the next general election. But there are some people who have not received the same treatment: the UK’s 54,300 or so resident non-doms.

In April last year, following a media furore around the non-dom status of Rishi Sunak’s wife, Akshata Murty, Labour announced that it would replace the UK’s non-dom regime with a shorter-duration scheme for foreign-domiciled UK tax residents. ‘With Labour, people who make the UK their home will contribute to this country by paying tax on their global income,’ shadow chancellor Rachel Reeves told the BBC at the time.

Non-doms currently benefit from the ‘remittance basis’, which means no tax is payable on foreign income as long as it is not brought into the UK. (The arrangement can include an annual charge, depending on how long a non-dom has been in the UK, of £30,000 or £60,000.) However, abolishing the current regime could bring an extra £3.6 billion to the Treasury, according to the Wealth Tax Commission.

HMRC’s rules have already become less generous for non-doms in the past 15 years. Changes in 2017 meant those living in the UK for 15 of the past 20 years are now treated as ‘deemed domiciled’, at which point they have to pay UK tax on their global income, as other UK-domiciled taxpayers do.

Unsurprisingly, the numbers of non-doms have begun to fall. In 2008, 137,000 UK taxpayers were using the non-dom rules. The figure fell to less than 80,000 in 2018. Despite this, the tax take from non-doms and deemed domiciles hit a record level of £12.4 billion in 2022.

[Why non-doms paid a record tax take to HMRC last year]

‘Fire escape plans’: New residency options and new tax regimes

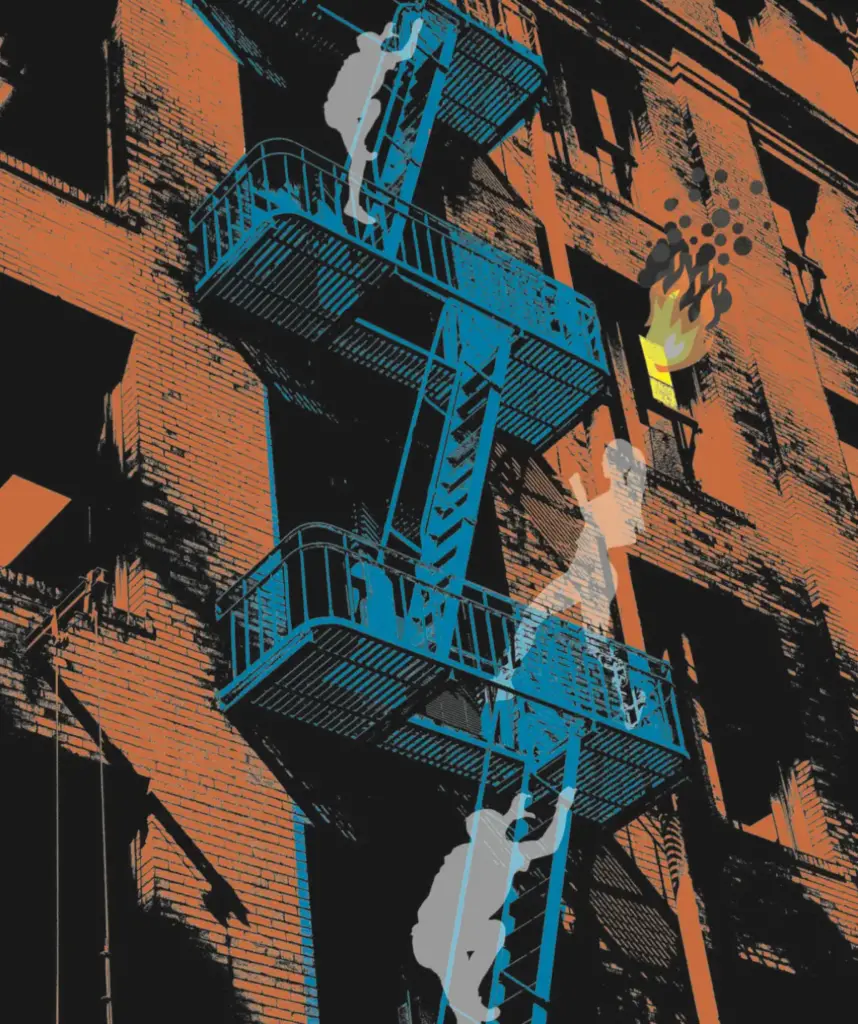

Now, though, in anticipation of a Labour victory at the general election, many non-doms are weighing up their tax-planning options, or even considering heading for the ‘exit door’ of UK Plc altogether. Some tax advisers are helping their wealthy clients to draw up what are being called ‘fire escape plans’: emergency exit preparations that provide internationally mobile HNWs with new options concerning citizenship and residency, which come with access to other, more attractive tax regimes.

Many international HNWs who were once wooed by the UK’s culture, legal system, business climate, advisory services and world-class schools are now wondering what staying put could cost them, notes David Lesperance, a tax adviser to UHNW clients. London is ‘easy to sell at the breakfast table’, he says, pointing to its appeal as a place for families to live.

But now that Starmer has ‘nailed his colours to the mast by going after Sunak’s wife’, Lesperance says many of these same non-doms are asking what the consequences would be if they were suddenly subject to UK taxes on their worldwide income.

It could be in the millions – particularly for international founders who might be subject to UK capital gains tax if they have a liquidity event, or if the inheritance tax net were cast wider, capturing more assets than before. ‘Sorry, you want 40 per cent of all of my stuff?’ says Leseperance. ‘As one client said to me, “London’s nice. It ain’t that nice.”

‘You’re gonna go when you smell the smoke,’ he adds, expanding the metaphor to capture the whiff of fear in many HNWs’ nostrils.

Robert Brodrick, tax partner and chair of Payne Hicks Beach, agrees that non-dom clients may want to consider their residency options: ‘Having a sort of “fire escape” and an ability to move quickly somewhere else, and become a non-UK resident, I think is a sensible precaution.’

Private client partner Piers Master says his firm, Charles Russell Speechlys, has seen ‘a lot’ of enquiries from international UHNWs about where they could move. Some are looking at Italy and Switzerland. Italy has the ‘Special Tax Regime’, which allows foreigners to pay a flat annual rate of €100,000 on their foreign income. ‘Hell, that’s what [some clients] pay to Deloitte every year,’ notes Lesperance.

‘There are particular different features of the regimes which will make some countries more or less attractive to would-be immigrants,’ Master tells Spear’s. Switzerland also allows foreign residents to pay a flat fee on international earnings, but if they do, they can’t then work in the country, ‘whereas in Italy you can work under the [flat fee] regime’.

[See also: Why the non-dom status might not be worth it for UHNWs]

Heading to the Amalfi coast

The Italian rules, introduced in 2017, allow additional family members to join with extra payments of €25,000 each, and the scheme can be used for up to 15 years. According to the Guardian, 549 and 1,339 people used the policy in 2020 and 2021 respectively.

‘I think when it was first introduced there was a lot of scepticism, because the Italian political system is so unstable,’ says Wedlake Bell’s Matthew Braithwaite. ‘Obviously, their non-dom regime has survived for a number of years now, and it’s gained traction, because people are taking the jump and making the decision to relocate. It’s probably got more credibility than it ever has done.’ However, he questions how sustainable the scheme may become for Italy if ‘an influx’ of international UHNWs comes from the UK.

The international crowd may also want to think about whether they are actually entitled to live in Italy, before they start dreaming of pastel-coloured villas on the Amalfi coast. Post-Brexit, they may need an EU-country passport to go there for more than 90 days – or an Italian investor visa. According to Italy’s Ministry of Enterprises and Made in Italy (MISE), a two-year visa can be obtained in multiple ways, for instance through injecting €250,000 into a start-up or €1 million into a philanthropic initiative.

‘Every wealthy family now is sort of looking around to see if they’ve got Irish grandparents, to give them the right to apply for an Irish passport and the ability to move to Italy without the investor visa,’ Brodrick adds wryly.

Some of the same issues would apply for UHNWs looking to explore residency options in other sunny European destinations. Portugal introduced its non-habitual residence regime (NHR) in 2009, allowing foreigners with the status to be excused from paying additional Portuguese tax on their foreign income – but the country significantly tightened its Golden Visa programme in July 2023. This meant the purchase of real estate was no longer sufficient to secure a visa, although the scheme continues to offer visas to those who make certain other kinds of investment. More than 30,000 visas have been issued since it began in 2012.

A ‘longer-lasting‘ solution than a golden visa

Citizenship (as opposed to mere residency) provides a longer-lasting solution. A successful application for Maltese citizenship could take around 28 months, according to Lesperance. For Austria, ‘you’re looking at three years’. To get there, he adds, ‘you’re going to make a big donation up front, go to a lot of balls and do a lot of dancing and a lot of handshaking‘.

While European countries are among the most popular destinations for departing UK non-doms, other options are available. Entrepreneurs with a business connection to the US could settle in North America itself or nearby, in Bermuda for example. ‘The odd person goes a little further... the Singapores or the Australias or the New Zealands. But it tends to be first Europe and then North America,’ says Lesperance.

[See also: How a decade of golden visas shaped Portugal's property market]

‘There's no point living in a gilded cage somewhere’

Putting aside the technical considerations of moving, lifestyle considerations need to be balanced with any tax savings. ‘If you’re living on an island somewhere where you’ve got absolutely no quality of life, it just doesn’t work,’ says Brodrick. ‘It’ll last six months, and your husband, wife or partner will get bored and move back to London. There’s no point in having unlimited wealth and then effectively living in a gilded cage somewhere.’

Lesperance says Monaco often attracts ‘empty-nesters’, unmoored by childcare obligations: ‘The only reason that they already spend six-plus months in the UK is if they have kids in school.’ Anglophiles could still visit for the Chelsea Flower Show or big Premier League matches, as long as they ‘watch their day count’.

For all the options available to HNWs, the tax advisers Spear’s spoke to did not anticipate a full-scale exodus of wealthy people from the UK, which could have happened if Jeremy Corbyn had entered Number 10 in 2019. But those who intend to stay will still take precautions.

Many non-doms may now consider ‘parking’ some of their money ‘outside the UK, outside their own name’, using structures such as excluded property trusts, says Braithwaite. He adds that some clients have expressed concerns Labour may look at ‘a separate, discrete tax imposed on trusts, and making trusts more draconian from a tax perspective’.

Master says: ‘While we have clues, there’s an element of crystal-ball gazing here. I think the UK does need to be careful not to kill the golden goose. And one would imagine that the Labour politicians will be being advised on that.’