UK non-domiciled and deemed-domiciled residents paid £12.4 billion in taxes to HMRC in 2022 – the largest annual tax liabilities for the combined group since the taxman began releasing its figures in 2008.

Although the number of ‘non-doms’ and deemed-domiciled residents in the UK rose very slightly in 2022, up to an estimated 78,700 from 78,100 in 2021, their payments of income tax, capital gains tax (CGT) and National Insurance contributions shot up from £11.3 billion to £12.4 billion.

With their tax burden at a record high, the number of tax payers using the non-dom status has tumbled in the past 15 years. In 2008, there were 137,000 tax payers using the non-dom rules, which fell to fewer than 80,000 in 2018.

Lucy Woodward, a tax partner at Saffery Champness, who specialises in advising HNWs and those with the non-dom status, said that the record tax take ‘demonstrates that the regime is by no means generous enough to neutralise the all-consuming effects of fiscal drag, but also what a potential money-spinner the non-dom status has the potential to be for the UK Treasury.’

Meanwhile, Richard Bull, private client partner at Crowe UK, said the data reflected the impact of tax rule changes in 2017, which changed the length of time for which non-dom residents could claim the remittance basis before they were deemed domiciled. From then on, non-doms who had been in the UK for 15 of the past 20 years would not be able to benefit from the regime.

'While collecting more taxes overall from a smaller group of people will be hailed as a success for HMRC, beneath the headlines there is a more precarious position,' Bull said. 'Despite an increase of nearly £3 billion to £12.4 billion in taxes paid by non-domiciles in 2022, the impact of annual inflation over the last seven years means the actual difference is much smaller and, more problematically for Government coffers, there are continuing issues identifying the correct amount of tax to be collected.'

Not all those who are 'deemed domiciled' need to declare their status on a self assessment tax return. For this reason, in its recent statistical analysis, HMRC states that total tax liability for non-doms and deemed-domiciled residents is likely to be higher than the £12.4 billion figure.

Fears of a wealth exodus

The rising tax bill for a dwindling number of super-wealthy residents is likely to prompt further fears of a 'wealth exodus' from the UK. Henley Global and Partners predicts that 3,200 HNWs are set to leave the UK this year, more than double the firm's prediction of 1,500 in 2022.

Henley's managing partner Stuart Wakeling previously told Spear's that some of his firm's clients were 'looking for a more favourable tax regime in other jurisdictions and sadly, some are even just no longer happy with the country, or the way it is run.’

Although the Wealth Tax Commission has estimated that abolishing the non-dom regime could benefit the UK government to the tune of £3.6 billion, 'with non-doms currently paying almost four times that, it will be hard for some to shake the feeling that reform would be a roll of the dice from which the UK coffers might not stand to gain,' Woodward said.

'Some may interpret record non-dom tax revenue as a justification to retain the regime on the grounds that to abolish or reform it beyond recognition might persuade the highly-internationally-mobile non-dom population to go elsewhere and take their taxable income and assets with them,' Woodward added.

[See also: Why the non-dom status might not be worth it for UHNWs]

What is a non-dom?

To qualify for non-domiciled status, a UK resident must have their permanent domicile (home) abroad. The rules allow 'non-doms' to avoid paying UK tax on their foreign earnings above £2,000 a year as long as these are not brought into the UK.

Foreign income above the £2,000 threshold which is brought to the UK must be declared by a non-dom in a self-assessment tax return. UK tax must be paid on this income, but it may be reclaimed. It is also possible to claim 'the remittance basis'. This enables non-doms to pay UK tax only on foreign income or gains that are brought into the UK, although they lose certain tax free allowances and must pay an annual fee of either £30,000 or £60,000, depending on how long they have been in the UK.

Non-dom status is time-limited. If a non-dom has been a UK resident for at least 15 of the last 20 years, they will be considered 'deemed domiciled'.

People who are 'deemed domiciled' are treated in the same way by HMRC as UK-domiciled individuals.

'Deemed domicile' status applies to non-doms with a longer-term residency, who are no longer entitled to the remittance basis, and to individuals who were previously domiciled in the UK and have chosen to return to the UK.

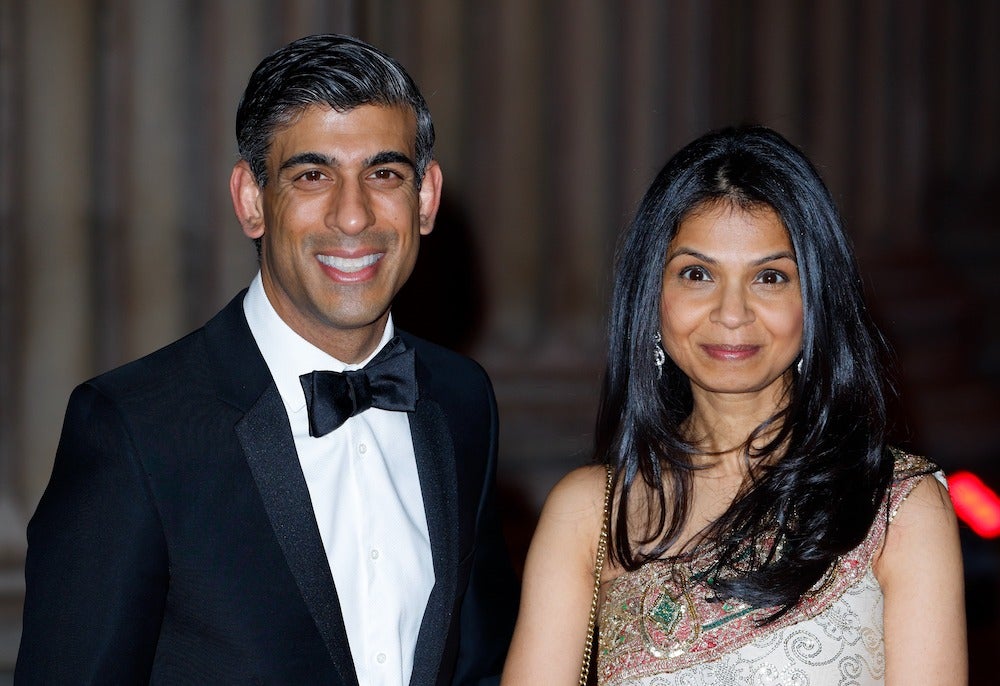

Claiming 'non-dom' status has created a lot of intrigue among the wider public in recent years. Rishi Sunak and his wife, Akshata Murty, hit the front pages in April 2022 after it was revealed that she was using 'non-dom' status, meaning that she would not have to pay UK tax on her foreign earnings, including dividend payments from India-based tech company Infosys, which was founded by her father.

Murty later agreed to pay tax on her foreign earnings, saying that she did not want the status to become a 'distraction' for her husband.

[See also: These multi-millionaires want the super-rich to pay more tax]

Will the non-dom regime be abolished?

While the Wealth Tax Commission has estimated that abolishing the non-dom regime could generate £3.6 billion (upgrading their forecast from £3.2 billion in 2022), it is unlikely before the next general election, which must be held before 28 January 2025.

If elected, Labour has pledged to axe the non-dom regime, with the shadow chancellor Rachel Reeves stating in April 2022, at the time of the policy pledge, that it was not 'right that those at the top benefit from outdated tax perks'.

'Given the political attention this small group has received over recent months, and the fact that Labour are promising tax reforms to this area if elected,' Richard Bull of Crowe added that 'it remains to be seen if further changes would unlock more tax receipts or potentially trigger an exodus of this internationally mobile part of society with the resultant loss of tax revenue.'

Recently, the campaign for the wealthiest in the UK to pay a greater share of tax has intensified. At Spear's 500 Live, which was held on 28 June at The Savoy in London, Julia Davies, a campaigner with Patriotic Millionaires UK, told the crowd that it was just 'plain good manners for people that have got the money to do so to pay more in taxation.'