The death of death tax?

At last, Hedgehog has a mole inside the Labour Party. Well, almost. Spear’s Award-winning tax lawyer (and noted free-market enthusiast) James Quarmby has been advising shadow chancellor Rachel Reeves’ team on the best way to scrap the non-dom system.

Now, having fraternised with his political enemies, he has returned with some intel.

Quarmby tells me he suspects that Labour may also axe inheritance tax. But it’s not what you think. No, the Thatcherite has not managed to persuade Reeves to cross to his side of the aisle. Rather, he believes the party’s much-anticipated abolition of the non-dom regime may mean it has to start again with IHT, which hinges on the concept of domicile.

In its place, Labour could introduce a capital transfer tax on all gifts – in life and at death – based on residency (so it’s paid if either the donor or recipient is in the UK). This could be at a low enough rate to capture gifts from the middle class bank of mum and dad and rake in billions more.

‘It also accelerates the tax take,’ notes Quarmby. ‘The problem with inheritance tax is you have to wait for your citizens to die before they pay you anything.’

[See also: The best accountants and tax advisers for high-net-worth individuals in the UK in 2023]

Ayesha’s day in the Sun

‘I grew up poor as a church mouse – now I’m the “diva of divorce” for the rich & charge duelling celebs £1.2k an hour.’ So declared The Sun in August above a profile of divorce lawyer Ayesha Vardag, who brags in the piece that ‘she believes she is “the most expensive divorce lawyer in London”’.

Detailing her upbringing – ‘her mum Barbara left her dad, who was based in Pakistan, when she was five months pregnant, and moved to Northumberland’ – and the ‘catastrophic bullying’ she experienced at school, the 55-year-old lawyer also credits Kevin Costner’s Field of Dreams and Gwen Stefani’s What You Waiting For? in inspiring her to found her own firm in 2005.

Asked how she feels about the interview, Ayesha tells Hedgehog: ‘I am very comfortable with the piece and like it a lot. I enjoyed speaking to the journalist and I thought he brought me out and reflected our conversation and his research on me well. It’s a good article, and a good way for those of our clients who read The Sun – and there are plenty – to get to know me a little better on a human level.’

The lawyer, who is described as living between London and Florence, adds: ‘I also think it’s important for other potential entrepreneurs, and especially for daughters with hard-working single mothers and no paternal support, to see that starting out completely broke, even with a face that doesn’t quite fit, doesn’t block you if you have talent, work hard and keep on pushing through. And I’ve had so much positive feedback on that, it’s been lovely.’

[See also: Spear’s Tax Survey 2023: what a Labour government could mean for the UK’s tax landscape]

Flotation tank

The dust has now settled on September’s $52 billion float of UK-based computer chip designer Arm Holdings on the Nasdaq market in New York. The launch day itself was certainly a success, with Arm shares climbing by 25 per cent by the day’s end.

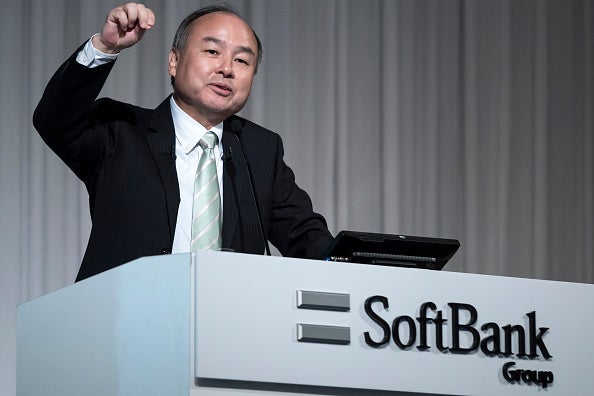

Few will have been watching developments as closely as those in the offices of the London Stock Exchange at Paternoster Square, which was snubbed in its efforts to lure the tech giant back to London, where it was listed prior to being gobbled up by SoftBank in 2016.

[See also: The FTSE at 40: Calls for ambitious reforms to regain global prominence]

‘The deal got done and there was a first-day pop,’ says Russ Mould, the seasoned investment director of stockbroker AJ Bell. ‘But an IPO isn’t just for Christmas, it’s for life, as the old saying goes, so it’s far too early to trumpet this as a successful deal. Just look at how many 2020/21/22 IPOs in the US popped higher and went up like the rocket, only to come down like the stick.’

Another City wag – who asks not to be named – is rather more bullish: ‘The LSE would have a bloody big laugh if the thing tanks.’

The plaque market

Will proposals by English Heritage to extend its blue plaque scheme from London – where 900 plaques reside on the walls of buildings with historically distinguished former occupiers – to the whole country be a boon for owners of qualified provincial or rural properties?

‘In a word, probably not,’ opines Rupert Sweeting, Knight Frank’s country supremo, over a cracking mobile. ‘However! However, it will be a stamp of approval. It will rubber-stamp the fact that us bullshitting estate agents aren’t lying when we say that “Ringo Starr lived here between 1956 and 1987”,’ he laughs. ‘The trouble is there are some blue plaques that won’t help very much – that you’d rather hide under the table.’

RFR’s Richard Rogerson agrees that the name on the plaque counts: ‘If the property itself is special, then the history and heritage might add to its appeal and potentially create some competition – or a uniqueness that drives the value up.’ Get your plaque in quick, I say.

Brics bats

It’s not every day that your own invention or coinage becomes a tool of international geopolitical rivalry. Unless, of course, you’re economist Jim O’Neill, who dreamed up the Brics acronym more than 20 years ago.

Despite recent efforts by President Xi of China to further institutionalise the annual Brics meetings of Brazil, Russia, India, China and South Africa and to expand membership in order to compete with the G7, Lord O’Neill remains unfazed.

‘I am in many ways lucky that my acronym became the basis for a political group of big [emerging market] countries,’ he tells Hedgehog. ‘Chinese policymakers often call me “the Father of the Brics”. It is a shame, like many fathers, their children sometimes don’t listen closely!’

Office parties

With prices ranging from £4 million to £30 million, the 85 Raffles-branded flats at the £1 billion Old War Office development in Westminster are being snapped up by the great and the greater.

According to press reports, former New York City mayor Mike Bloomberg, president of Goldman Sachs International Todd Leland, Australian actress Rebel Wilson and King Caesar Augustus Mulenga of Uganda are among those believed to have acquired boltholes in the Hindujas’ sumptuous residential and hotel development.

It’s going to be one hell of a moving-in party.

This article first appeared in issue 89 of Spear’s, available now. Click here to buy a copy and subscribe

This article has been updated to reflect the fact that Ayesha Vardag was not born in Pakistan.