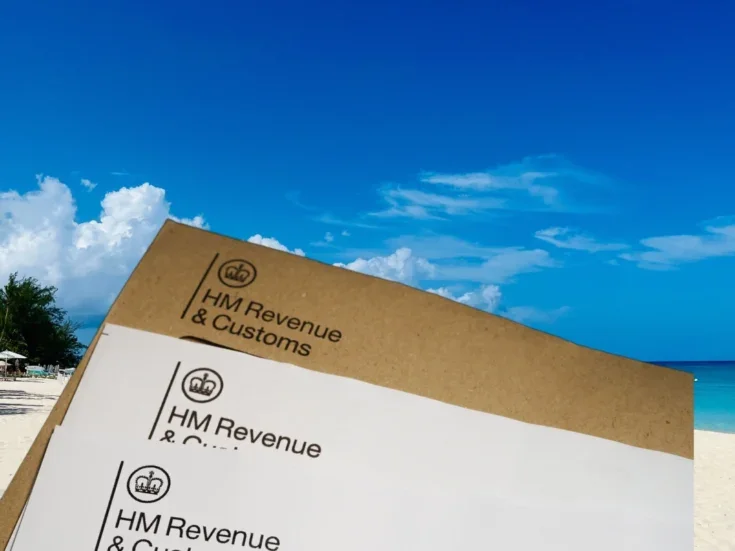

The latest Spear’s Breakfast Briefing makes the case for investment in the Caribbean country’s booming hospitality industry. Rasika Sittamparam reports

‘The Turks and Caicos Islands are the tourism Mecca of the Caribbean.’ So said Angela Musgrove, the senior vice president of Invest Turks and Caicos in her address to up to 50 HNW guests gathered for the most recent Spear’s Breakfast Briefing this week at The Savoy.

‘We brag about the fact that we are one of the fastest growing economies in the Caribbean,’ Musgrove told guests. ‘We brag about the fact that we have a very strong legal system, and a very strong political system. We are acknowledged to be one of the most beautiful places on earth – and we brag about that as well,’ she added. ‘We refer to it as a better place in the sun for investors.’

Turks and Caicos is a collection of 40 islands, islets and cays covering 193 square miles of the Atlantic – located just 75 minutes from Miami. Home to 41,000, the TCI as they’re known welcome around 1.3 million visitors each year, many of whom have a high-net-worth. With temperatures averaging 30-32C from June to October, and several ‘best beach in the world’ awards included in over 40 travel accolades in recent years, its tourism industry is burgeoning with untapped and largely ‘undeveloped’ potential, said Musgrove.

And with a GDP of about $1 billion, Turks and Caicos has ‘a quite reasonable’ gross national income per capita north of $28,000, Spear’s editor Alec Marsh pointed out, adding that The Economist has recently projected that it will maintain steady growth through to 2021.

In addition, the islands are ‘strategically located’, Musgrove said, with 13 direct flight connections to London, US and Canadian cities.

She noted that the Ritz Carlton is due to open in the Turks and Caicos, in 2022. This project will add over 500 beds to the islands’ room count, an area where the government encourages direct investment. ‘The opportunities include the fact that our tourism infrastructure is relatively underdeveloped,’ she said. ‘Currently, we have a real need for more beds in the tourism industry – we constantly see the fact that our demand is well above the supply of rooms that we have.’

Other major developments are waiting for developers: from hotels to marinas where yacht tourism can develop. The country lacks a convention centre, which could be an attractive project for global investors looking to capture the investment value of the islands’ close proximity with the Americas.

There are formidable perks available too. Projects in Providenciales, Turks and Caicos’ commercial and populous hub, are eligible for a 50 per cent import duty reduction for the entire development process. Projects planned elsewhere will be eligible for a 75 per cent reduction in import duty. Investors can also access Crown land, as well as a number of pristine, undeveloped spots within the archipelago.

‘We want to offer you more of a red carpet treatment rather than a red tape treatment,’ Musgrove told the audience. ‘Through our development agreement process, we can provide you with an immigration protocol document that allows you to streamline your project even further, in terms of processing labour and human capital needed for your development.

‘We have seen a steady growth in UK business over the past number of years – and we hope to see continued growth as we strive to maintain our reputation as the top location for high-net-worth individuals,’ Musgrove concluded.

James Bursey, CEO of Invest Turks and Caicos, painted an even wider picture of the islands’ investment landscape. The ‘ex-Canadian’ national drew from his experience as a private equity investor himself, as well as from his expertise in global corporate affairs.

‘Direct investors, come and see me afterwards – I’ve got a deal for you,’ declared Bursey. ‘But,’ he cautioned. ‘We are not Panama. Dodgy investors are not welcome. Our primary goal in Turks and Caicos is to attract quality investments, by quality investment. We definitely have to be sustainable; sustainable in both economic and ecological terms. We will look at investors very carefully.’

He told attendees that there were two things that the TCI didn’t have: ‘Traffic jams. And the other thing we don’t have is income taxes, we don’t have inheritance taxes for the moment, and we don’t have property taxes.

‘So, if any of those things that we don’t have appeal to you, then this is a place to come for don’t haves. But one of the things that we also want to point out is that in that environment, we are also in the middle of the Americas… we are halfway between South America and North America, and as you know, those economies are all growing.’

There is also a real opportunity in the marine market, Bursey noted, which is under-developed and of huge commercial value – not least with the islands’ world renowned diving waters. ‘Take a look at the British Virgin Islands, slightly over 55 per cent of their quays are actually floating and they run 440 charter yachts a year. We run eight – but there is room for growth.’

Bursey revealed that four billionaires, and numerous HNWs, have not only invested in Turks and Caicos, but had also made the Caribbean archipelago a second home.

‘Our economy has grown over the last 30 years, primarily with Canadian and US investment, with sporadic investment from the UK and Europe. But we are here today to encourage you to take a look at why we think this is a much better destination, especially for those interested in putting money for high-net-worth individuals and family offices,’ he said. ‘We are a very nice location to hold and grow multi-generational wealth.’

Spear’s found afterwards that many of the audience members were in fact sold on the idea.

The Turks and Caicos Islands: A Better Place in the Sun for Investors took place at The Savoy on the 10th of March in association with Invest Turks and Caicos.

Read more…

Spear’s briefing: Investing in the Turks and Caicos

World exclusive interview: Prince Albert II of Monaco

Busting the private equity myths