A Pablo Picasso masterpiece of his golden muse that fetched $139 million at auction last year helped propel Sotheby’s to near-record $7.9 billion in consolidated sales in 2023, a year-end report reveals.

[See also: The generational divide shaping the global art market]

Against a challenging backdrop, auction sales dropped from $8 billion in 2022 to $6.5 billion in 2023. However, this still represents a 40 per cent increase from pre-pandemic figures. Private sales rose from $1.1 billion in 2022 to $1.2 billion.

Landmark single-owner auctions drive Sotheby’s sales

Several high profile sales at the top end of the market, including the collection of Emily Fisher Landau, one of the greatest art collectors of the 20th century, made 2023 a ‘landmark’ year for single owner auctions, with 143 sales of this kind totalling $1.3 billion, up 24 per cent from 2022.

In a blockbuster auction of Fisher Landau’s collection, Picasso’s Femme à la montre (1932) sold at Sotheby’s New York in November for $139 million while in July 2023, Gustav Klimt’s Dame mit Fächer (Lady with a Fan) set a new auction record of $108.4 million in London. Fisher Landau’s collection made $427 million in total while other noteworthy single owner sales include, Mo Ostin ($130 million), Clara Schreyer ($118 million), and Long Museum owners Liu Yiqian and Wang Wei ($109 million).

Sotheby’s CEO, Charles Stewart, said increased generational wealth transfer and healthy auction sell-through rates had enabled the company to navigate the challenging market.

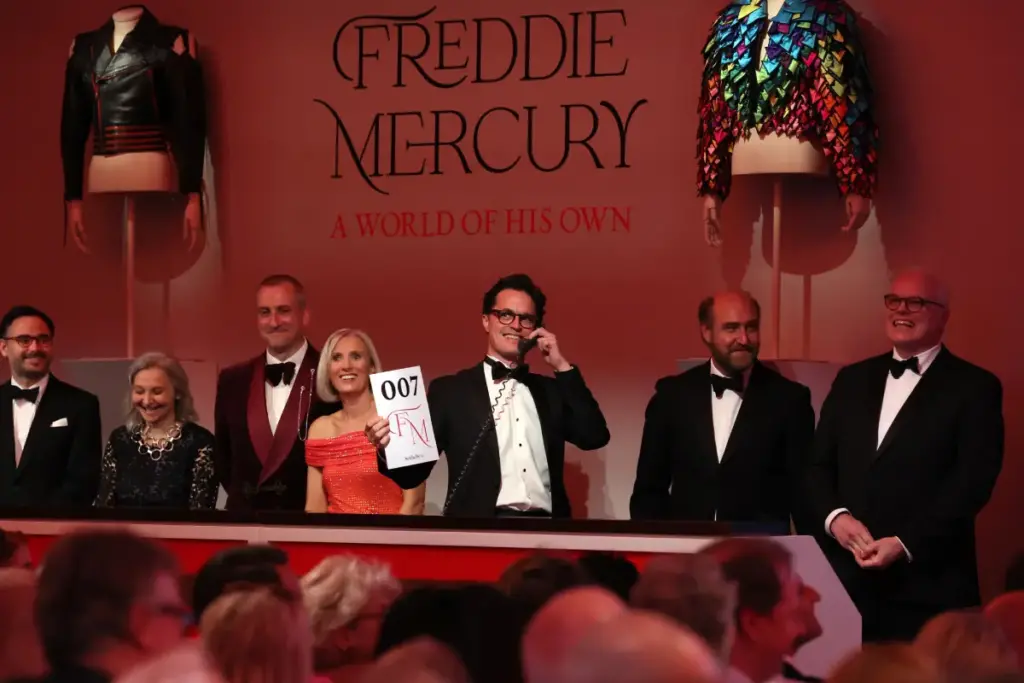

Brooke Lampley, Global Chairman & Head of Global Fine Art at Sotheby’s said the year had been ‘anchored by standout results in all regions, and by extraordinary collections – from Emily Fisher Landau in New York to Freddie Mercury in London, and Hubert Guerrand-Hermès in Paris.’

‘These collections are not just accumulations of objects, but true stories and legacies, testament to the remarkable spirit and vision of each collector,’ she said. ‘The lion’s share of these great single-owner sales are coming to the market as they pass from one generation to another. This next generation are embarking on their own collecting careers – making for exciting conversations as we look to support their journey, now and in the future.’

Memorabilia and luxury break records

Away from art, new benchmarks were established across luxury, culture and sports. Luxury auction sales totalled $2.2 billion, a slight 4 per cent increase on 2022 with handbags, wine & spirits, science & popular culture and sports memorabilia departments achieved record auction totals.

[See also: China’s insatiable appetite for luxury should reassure investors]

Items owned by the former Queen frontman raised $50 million in September’s Freddie Mercury: A World of His Own, while a rare 41962 Ferrari 330 LM / 250 GTO by Scaglietti sold for $51.7 million, becoming the most valuable Ferrari ever sold at auction.

Sotheby’s sold a pair of Nike Air Jordan 13, worn and signed by Michael Jordan, for $2.2 million in April 2023, making them the most expensive sneakers and one the most valuable Michael Jordan items sold at auctions to date.

A bottle of The Macallan 1926 single malt whisky broke the world auction record for any bottle of wine or spirits when it sold for nearly £2.2m (US$2.7m) at Sotheby’s in London in November.

Changing face of art collectors

Sotheby’s noted a significant shift in the generational profile of clients with Gen X collectors overtaking Baby Boomers as the most active bidders in the $1 million-plus market, with this age bracket (people born between 1965 and 1980) accounting for 40 per cent of bidders, up from 36 per cent in 2022.

There was a record number of bidders and buyers in the Middle East, with sales increasing by 80 per cent, reflecting Sotheby’s expanding global offerings. The influence of Gen Z bidders was also growing, with record numbers of buyers off luxury goods in their 20s.

In recent years, Sotheby’s has expanded its global footprint and the scope and frequency of its offerings, having opened new spaces in eight locations, while introducing new selling categories such as classic cars (RM Sotheby’s) and real estate (UK Sotheby’s International Realty). Luxury sales platform Sotheby’s Sealed was launched last year, that combines the discretion of a private sale with auction bidding.

Josh Pullan, global head of high-end luxury for Sotheby’s added: ‘Over the past three years, Sotheby’s has embarked on a transformative journey to grow our presence in the high-end luxury market. The launch of new collecting categories, combined with digital and on-the-ground experiences have dramatically expanded Sotheby’s audience to a new and younger demographic of collectors.’