‘It’s like becoming fluent in another language,’ says Charles Stewart of his immersion in the art world in the five years since he was appointed CEO of Sotheby’s. ‘I’m still a novice.’ That might be true within the hallowed halls of the auction house, where specialists oversee more than 70 departments ranging from ‘Aboriginal art’ to ‘objects of vertu’, yet as our conversation unfolds, it is difficult to imagine the affable former financier as anything other than a native speaker.

[See also: Confidant’s trick: What happens when a trusted UHNW adviser goes rogue?]

‘Look at the Renoir still-life in the gallery over there and you can see how the pattern on the vase is influenced by the artist’s interest in the art of Meiji Japan in the late 19th century,’ explains Stewart during an interlude on ‘the interconnectedness of art’, as we speak in the Damien Hirst-adorned boardroom of the company’s New Bond Street HQ.

The Morgan Stanley veteran spent almost 20 years at the bank in various roles across the US, Europe and Latin America, including as deputy head of investment banking for EMEA and head of Latin America investment banking. In 2013 Stewart left for London to become CEO of Itaú BBA International, the international arm of the largest bank in Latin America.

‘The client base between Sotheby’s and investment banking is very similar,’ he observes. ‘It’s just in one, you’re spending time on their commercial endeavours and financial interests, and here you’re spending time on their passions, personal interests, and collections.’

[See also: Introducing Spear’s Magazine: Issue 93]

Stewart, known to colleagues as Charlie, returned to the US following a meeting with the French-Israeli billionaire Patrick Drahi, the founder and controlling shareholder of telecom group Altice. Stewart served as co-president and CFO of Altice USA, helping to deliver the company’s successful $2.1 billion initial public offering on the New York Stock Exchange in 2017. ‘Then, when Patrick acquired Sotheby’s in 2019, I moved across to take my current role,’ he says.

That $3.7 billion deal, through a private holding company, was described at the time as a ‘jolt to the art world’, ending more than 30 years of public ownership. Stewart immediately replaced fellow American Tad Smith as CEO, while Jean-Luc Berrebi, the head of Drahi’s family office, was installed as Sotheby’s CFO.

A new era at Sotheby’s

The impact was swiftly felt, with reports of significant job cuts across junior and senior levels of the organisation as Stewart turned his attention towards bringing the now 280-year-old auction house into the 21st century.

[See also: Outstanding art advisers 2024]

‘One of the great strengths of Sotheby’s is its heritage, but sometimes it feels like a several-hundred-year-old company,’ says Stewart, who is based in New York with his family but travels regularly to Sotheby’s international outposts. ‘When I got here, there was a notable absence, or underinvestment, in a lot of the digital tools that you would have thought would have been basic practices.’

The most visible outcome is the explosion in the number of online auctions. In 2019, digital accounted for ‘about 40 per cent’ of bidding. Today, that number is around 93 per cent. But there has also been significant investment in back-end services, including improving the analysis and utilisation of client and object data, ‘which are a huge competitive advantage’, and investment in implementing blockchain technology to authenticate certain works.

[See also: The generational divide shaping the global art market]

Digital technology not only allows the auction house to reach a greater geographical spread of buyers – in 2023 there were bidders from 125 countries, more than three times the number in which Sotheby’s has a physical presence – but it also provides data that can be shared with clients. Stewart continues: ‘If you’re selling something, what you want to know is: “Was every possible person who might be interested in my [lot] exposed to it? How can you show me that?” Digital is beyond mission-critical to convene a global audience around these important works.’

Giants of the global art market

This reflects a wider shift in the global art market. Online sales reached an estimated $11.8 billion in 2023, according to the Art Basel and UBS Global Art Market report, a rise of 7 per cent year-on-year and accounting for 18 per cent of the art market’s total turnover. This is despite the fact that overall sales slowed by 4 per cent to $65 billion.

[See also: UK art market falls behind China amid global dip in sales]

‘There are plenty of reasons why the world is softer,’ says Stewart between sips of coffee. ‘The fast, easy, free money has been flushed out of the system all over the world. There’s regional pressure in Asia, there’s geopolitical uncertainty in the Middle East, war in Russia, there’s the high cost of money, there’s election uncertainty – all of these things create uncertainty, which is not usually the friend of any economic activity. The art market isn’t immune to any of that.’

Sotheby’s recorded consolidated sales (taking in auction, private and inventory) of $7.9 billion in 2023, slightly down on the $8 billion it achieved in 2022. Auction sales accounted for $6.5 billion, down from $6.6 billion the previous year. The biggest lots of the year were Pablo Picasso’s $139.4 million Femme à la montre (1932) in New York and Gustav Klimt’s £85.3 million ($108.5 million) Dame mit Fächer (1917–18) in London. ‘There is a flight to quality at the moment,’ Stewart notes. ‘In a world of some uncertainty we’re seeing a retreat to the established and known artists. It’s less of a market where people are throwing huge prices against relatively young, unestablished artists.’

Private sales have apparently been unaffected by the long-running ‘Bouvier Affair’ – the farrago that seemed to culminate in a New York courtroom in January, when allegations of fraud made against Sotheby’s by Russian oligarch and art collector Dmitry Rybolovlev were dismissed by a judge. As a category, private sales rose from $1.1 billion in 2022 to $1.2 billion in 2023, as clients seek out ‘speed, security and discretion’.

By comparison, Christie’s, Sotheby’s biggest rival, recorded $6.2 billion in global sales in 2023, significantly less than the $8.4 billion of the previous year (although that 2022 number was inflated by a blockbuster $1.6 billion Paul Allen sale). Private sales at Christie’s rose by 5 per cent between 2022 and 2023. (As both businesses are privately owned, they do not need to report annual profits and losses).

[See also: The dark art of the deal: the oligarch who lost a billion in the art market]

Yet the really big-ticket items don’t account for anywhere near the majority of sales. ‘What’s funny about the art market, and Sotheby’s in particular, is that we’re most associated with the really high-value things we sell because it gets the press and the attention,’ explains Stewart. ‘But the truth is that objects over $1 million only represent about 1 per cent of the objects that we sell. They’re more significant as a percentage of value, of course. But objects under $25,000 account for roughly two-thirds to 70-plus per cent of sales. That’s not well known.’

Power of next-gen collectors

To ‘grow the pie’, he says, Sotheby’s must juggle the democratisation of art with the UHNW collectors and sellers who buoy the upper end of the market. ‘It’s this barbell,’ says Stewart. ‘We specialise in things that have provenance, that are rare, that are valuable, that attract interest, but we’re not just where the billionaires buy and sell from one another… We want more people to collect art.’

[See also: Sotheby’s stages inaugural pop culture auction as collectibles sector grows]

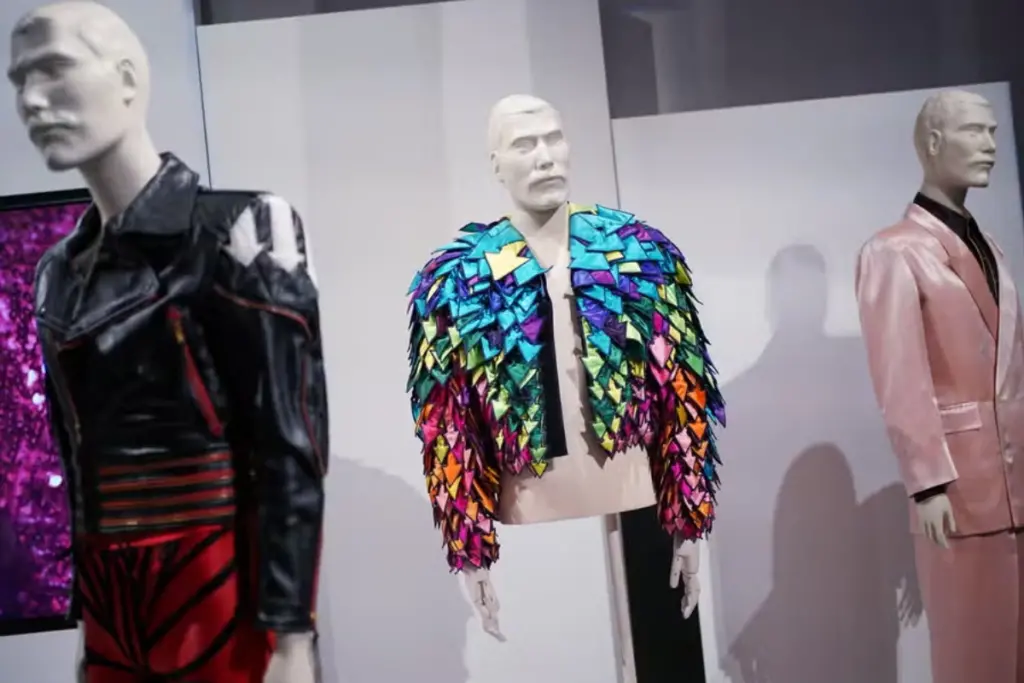

Digital – with its online brochures and app-based bidding – is one way the barrier to entry can be lowered. There has also been a greater focus on ‘accessible’ categories such as sports memorabilia, pop culture collectibles and handbags. The strategy is bearing fruit: Sotheby’s recorded a 35 per cent year-on-year increase in the number of buyers aged 20 and under in 2023.

Successfully wooing these next-gen art collectors is important. The ‘Great Wealth Transfer’ will see Baby Boomers transfer their wealth and assets, including art, to their descendants. In 2023 Gen X overtook Boomers as the most active bidders in Sotheby’s $1 million-plus market.

[See also: Why the Great Wealth Transfer will be a dangerous time for global capitalism]

‘The interesting thing will be to see how much the next generation value and want the same thing as their parents,’ says Stewart, who observes there has already been a rise in the number of blockbuster single-owner estates coming to auction. ‘In 2014 the $218 million Bunny Mellon collection became the largest collection to sell at auction – in the last few years alone we’ve had several collections go for $500 million and higher – over $1 billion.’

But Sotheby’s doesn’t just want to meet clients online. ‘Because we deal in objects, there has to be this fully hybrid digital/physical experience,’ explains Stewart. ‘Most people don’t know that we’re open to the public every day. But we are. We want people to come in. We want them to ask questions, and to learn.’

A global footprint

Sotheby’s has 80 locations in 40 countries – and more on the way. A 24,000 sq ft space launched in Hong Kong in the summer; Paris will have a new site by the end of the year. In 2025 the New York headquarters will relocate to the Breuer Building, once home to the Whitney Museum of American Art. Together with London and Geneva, these three cities make up the group’s biggest selling centres.

Outside the auction rooms and galleries, one-off, exclusive events provide a forum to foster relationships with UHNW buyers. ‘Going to a big luxury brand event and seeing the same handbags that you would see in Shanghai, New York, Paris or London is not enough,’ says Stewart. Instead, he says, clients seek money-can’t-buy experiences such as a private dinner where ‘food, music and art’ are matched in a ‘unique environment’, or a day driving rare supercars that ends with a ‘night at a private home or a museum with a collection of works on display’. ‘We at Sotheby’s are right in the middle of that space,’ he adds.

[See also: New kids on the block: inside Sotheby’s UK property arm as it makes a move on London]

The firm provides 22 art-related services, including valuations, storage, art financing and tax advice. The wider business umbrella incorporates classic car dealership RM Sotheby’s; the Sotheby’s Institute of Art, which offers accredited educational programmes; and Sotheby’s International Realty, a brand established by the auction house in 1976 that operates as a franchise. The property agency made a splash in London last year when the UK franchise was relaunched by Dubai-based businessman George Azar, who was already at the helm of the Sotheby’s real estate businesses in Dubai and Saudi Arabia. He announced his arrival by poaching big-name agents such as Becky Fatemi and Marcus O’Brien from rival firms and catapulting the brand to the heart of the competitive super-prime property market.

Middle East calling

My meeting with Stewart came just weeks before it was announced that ADQ, an Abu Dhabi sovereign wealth fund, had acquired a minority stake in Sotheby’s. In its reporting Reuters notes that Drahi had been ‘struggling with soaring debt costs because of a $60 billion debt pile that allowed him to build his media-to-telecoms empire in an era of low interest rates’. (The deal itself followed months of speculation – later denied – that Drahi wanted to take the business public.)

Together, ADQ and Drahi, who remains Sotheby’s majority shareholder, will invest approximately $1 billion and drive further expansion into the Middle East market.

Sotheby's launched in the region with Sotheby’s Dubai in 2017, the same year the Louvre opened in Abu Dhabi, and has since more than tripled the number of permanent staff on the ground. They run a year-round programme of events in the Middle East and there could soon be more to come.

‘We haven’t closed the deal yet so we haven’t announced, and don’t have specific plans,’ says Stewart when we catch up on a call after news of the deal emerges. However, he does acknowledge the growing cultural might of the Middle East.

‘Middle Eastern collectors are already among the largest collectors across many categories – art, but also jewellery, watches and cars,’ he notes. The interest is reflected in the establishment of world-class museums which have ‘some of the most significant cultural agendas of any institution in the world. That’s true particularly in Abu Dhabi but also in Qatar and Saudi Arabia.’

ADQ will be represented on the board, but Stewart insists there is ‘great alignment’ between Drahi and the new shareholders. ‘I think that’s one of the very exciting things about this partnership,’ he says on the line from the Hamptons. ‘There will be some governance adjustments, but I think those are all healthy and constructive. We are still running the business.’

There are early signs from the spring and summer season that the 2024 figures might not reach the bumper highs of recent years. In addition to macro forces, Stewart partly puts this down to the absence of single-owner collections coming to market. ‘If we’d had a $500 million estate, we would have sold it and everyone would have written the market is up,’ he insists. (Christie’s used the same reasoning to explain its deflated 2023 sales.)

Yet Stewart remains optimistic on the house’s ability to win over UHNW clients when they are ready to bring their estates to market. ‘We think we have opportunities with all these people,’ he says. ‘We auction homes and furniture and cars and wines and jewels… So for a discerning UHNW audience, Sotheby’s should be engaging with people in those collecting journeys.’

This feature was first published in Spear's Magazine Issue 93. Click here to subscribe.