Wine has been toasted as a profitable asset class for years now, and a new report from the Wine Investment Fund suggests that, with patience, investing in grapes can still bear fruit. Not everyone agrees, however.

The report, ‘Have the Prospects for Fine Wine Changed?’, noted that although the Liv-Ex Investables wine index had fallen by 27 per cent in a year by mid-2012, it has since reclaimed some of the loss and steadied. The authors see the fall as an adjustment and consolidation of a market that had grown at an average rate of 11.9 percent since 1988. They are upbeat (as indeed those running a wine investment fund might well be). ‘The long-run returns can be expected to remain around 10-12 per cent.’

Read more in wine investment from Spear’s

Others in the profession are not convinced: ‘You’d be doing very well to get half that,’ Richard Harvey, senior international director of fine and rare wines at Bonhams, told Spear’s: ‘They probably have an interest in bulling it up. I would say things will remain pretty static over the next three to five years.’

The report points to significant long term growth potential aided by globalisation of fine wine-buying in North American, Japanese and Chinese markets; by investment, with major fund creation; and by the creation of accepted standards to assist trades. Such shifts in the landscape have contributed to the seventeen-fold increase in the market over the last 25 years.

However, those who sell wine for a living, like Richard Harvey, are not convinced that this growth will come: ‘China was the area that gave the growth between 2009-11. It’s difficult to see where else is going to do that. India has huge tax issues. Brazil – I don’t think that’s going to have any significant impact. I don’t see anywhere else that can drive it given that the economic outlook for most of the Western world looks fairly slow.’

Read more on wine tasting from Spear’s

China in particular is a worry: ‘There’s pressure in China, obviously from the new government, on less banquets, less conspicuous consumption, so the market in China is really slowing down and that’s what drove the market up in the last two to three years.’

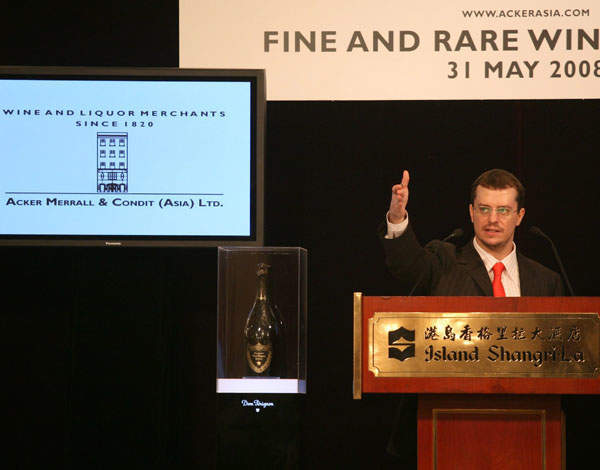

Pictured above: Wine auction, Acker Merrall & Condit (Asia)

Away from investment funds, there’s clear profit to be made for those heading straight to established market channels. Bonhams recently sold a bottle of Château d’Yquem 1933 for £1292.50 and a case of Château Lafite-Rothschild 1982 for £22,325, and has put an estimate of £70-80,000 on a dozen bottles of Romanée-Conti 1988 scheduled for auction on 5 December.

Meanwhile, last week Sotheby’s had a record-breaking sale of fine wine, raising £2.3 million. Lots included a selection from the private collections of the late Madame Lacoste-Loubat, owner of Château Pétrus and Chateau Latour à Pomerol.

Stephen Mould, Sotheby’s head of European wine, said: ‘I was delighted with the success of the private cellar of Madame Lacoste-Loubat which proves that a perfect provenance attracts global interest. Prices soared above our expectations for all three châteaux.’

Sotheby’s has made $238,200,125 from wine sales over the last three years and in the purple years of the late Noughties sold a 50-case lot for over $1 million and a single Jeroboam for $310,700.

Recent news has not necessarily made investors more partial to wine funds: one racket stole £3 million from a hapless bunch earlier this month.

And if you’re uncertain about the money wine may make you, the best way to profit from it is to drink it.