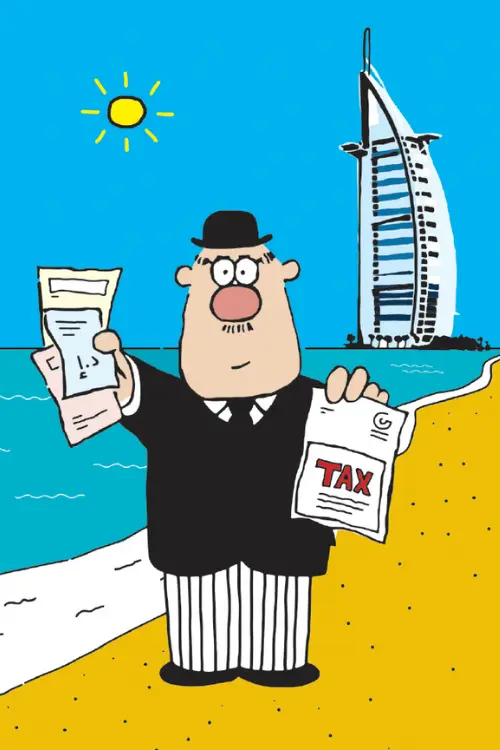

In 2017, the United Arab Emirates found itself on the EU’s blacklist for states deemed to be non-cooperative to creating and strengthening fair and transparent tax systems. It was a blow to the small Gulf country that, for the last five decades, had endeavoured to be seen as a legitimate player in the global economic system.

Soon after the news broke, senior ministers released an official statement affirming the UAE’s commitment ‘to its long-standing policy of meeting the highest international standards on taxation’.

Prior to the EU’s announcement, the most significant form of taxation in the UAE – and one which often went unnoticed – was excise tax, a charge imposed on products such as energy drinks and tobacco products, which have a 100 per cent tax levied against them. Today, the tax landscape in the UAE is somewhat different.

[See also: The 2023 Spear’s Tax & Trust Indices]

What forms of taxes are there in the UAE?

In January 2018 (one month after being placed on the EU’s blacklist), the government introduced VAT on most goods and services, with exceptions for certain sectors such as healthcare and education. Although the tax was levied at just 5 per cent, its introduction was a symbolic and significant shift for a nation that had become notorious for being ‘tax-free’.

(The UAE’s efforts in strengthening and transparently reporting on its tax systems were rewarded in October 2019 when it was removed from the EU blacklist. However, critics will note that the country is still under the microscope as it remains on the EU’s anti-money-laundering list and the Financial Action Task Force’s ‘grey list’.)

In June the UAE government introduced corporate tax, the first form of direct tax to be implemented as part of the country’s new economic strategy.

The evolution of attitudes to tax in the UAE and other Gulf nations makes sense, according to James Heathcote, the Dubai-based founder of family office and tax advisory Sanctoras, who says there’s ‘a general realisation’ among GCC states that they cannot rely for ever on oil income: ‘They need to look at alternative ways to raise revenue. Introducing a limited form of taxation is one way to do that.’

For the moment, corporate tax in the UAE stands at 9 per cent, below that of fellow GCC states Saudi Arabia (20 per cent), Oman, Kuwait (both 15 per cent) and Qatar (10 per cent, with a 35 per cent tax rate for petroleum companies). Across the board, corporate tax rates in the GCC fall short of the global average of 23.4 per cent.

Will the UAE increase its tax rate?

It’s unlikely, at least in the near future, that the UAE’s tax rates will increase to meet the global average or even the OECD’S 15 per cent minimum global corporate tax mandate, Heathcote tells Spear’s.

One reason for this is that the UAE is vying for foreign investment and faces competition with other GCC states to attract multinational businesses, entrepreneurs and high-value workers. In recent times it has been successful.

A UN World Investment Report revealed that in 2022 the UAE attracted FDI totalling more than $22 billion – the highest in the Arab world. Saudi Arabia attracted FDI of less than $8 billion. Heathcote adds that while Saudi Arabia has made significant overtures to international businesses, the UAE’s tax regime is a crucial point of difference.

The country must also consider that its resident entrepreneurs – both Emiratis and expats – are accustomed to a low-tax way of life. ‘For them, going from zero to 9 per cent is already quite a big jump,’ says Heathcote.

How will corporate tax affect wealthy UAE residents?

But according to some observers, the introduction of new taxes may have consequences that are not yet clear.

Jerry Parks, a partner at law firm Taylor Wessing, says he’s urging clients to prepare for the possible impact of corporate tax on real estate portfolios. In the UAE it’s common practice for real estate to be held in holding companies (as opposed to keeping property under one’s name) in order to bypass Sharia inheritance law, which can dictate how and to whom assets are passed on.

‘Those corporations [holding companies] are caught by corporation tax and therefore will have to pay tax, which they’ve never had to do before,’ says Parks.

The tax would only apply if rental income exceeding AED 375,000 (£82,000) was being derived from the properties under the holding company, but Parks notes this threshold is not difficult to reach, given ‘the average rental price for a villa on the Palm is anywhere from AED 500,000 to a million’ per year (£109,000-£218,000).

However, there is not widespread agreement about the precise implications of corporate tax on real estate portfolios. ‘If you have a rental property or even a portfolio, the question is whether that’s a business or just passive investment,’ says Heathcote. ‘If it’s just passive investment, it’s unlikely that those profits will be subject to corporate tax.’

Will the UAE introduce income tax?

Income tax is unlikely to be brought in any time soon, notes Tim Searle, a tax adviser to Middle Eastern UHNW families. ‘Even if it were at a low rate, it would make people pause,’ he says.

But Searle, who is also based in Dubai, is sanguine about the introduction of other levies and points out that tax, in and of itself, is nothing new: ‘We’ve had indirect taxes for a long time: [tolls] on roads, in hotels, paying for our visas.’

He adds that as the UAE attempts to balance the twin aims of raising money for the public purse and remaining internationally competitive, the thing that matters most is not whether the UAE introduces more taxes, but whether its tax system remains favourable compared to elsewhere in the world.

Find out more about Spear's top recommended experts in the Middle East:

- James Heathcote - tax adviser and CEO at Sanctoras

- Jerry Parks - property lawyer and partner at Taylor Wessing