The next generation of high-net-worth philanthropists is being let down by financial advisers who lack experience in the field, research suggests.

The majority of HNWs aged 18-34 years old say giving to charity is an ‘important part of their life’, according to a survey conducted on behalf of the Charities Aid Foundation.

[See also: Who won at the Spear’s Awards 2023? The complete list of winners revealed]

Yet just 5 per cent of independent financial advisers, wealth managers and estate planners claim to be ‘very confident’ about advising clients on philanthropy, creating a knowledge gap that could lead to less money being donated – or less money being donated in an effective way.

The Charities Aid Foundation (CAF), which was recently honoured with the Private Client Services Award at the Spear’s Awards 2023, is calling on the wealth management industry to increase awareness and training of UK professionals ‘to ensure some of the £5.5 trillion set to pass between generations within the next 30 years finds its way to charities’.

[See also: Why the Great Wealth Transfer will be a dangerous time for global capitalism]

A generation of donors but few advisers to help

The survey of 500 young HNWs (investable assets of £1 million-plus) found one in three consider themselves a philanthropist. But these young donors need help. More than half (57 per cent) of respondents said they believe a financial adviser could help with their philanthropy. The figure is only slightly lower between the 35-54 age group (49 per cent).

A separate survey of 215 advisers conducted on behalf of CAF found almost three-quarters (72 per cent) do not include philanthropy as part of their initial fact-finding meeting with clients.

This is detrimental to business. Those who regularly give philanthropic advice said it helped them build on existing relationships with clients. Around 56 per cent of advisers said they saw it as an opportunity to get to know their clients better, and nearly half said it makes them feel closer to their clients. Meanwhile 21 per cent said they see a direct link between providing philanthropic advice and winning new business.

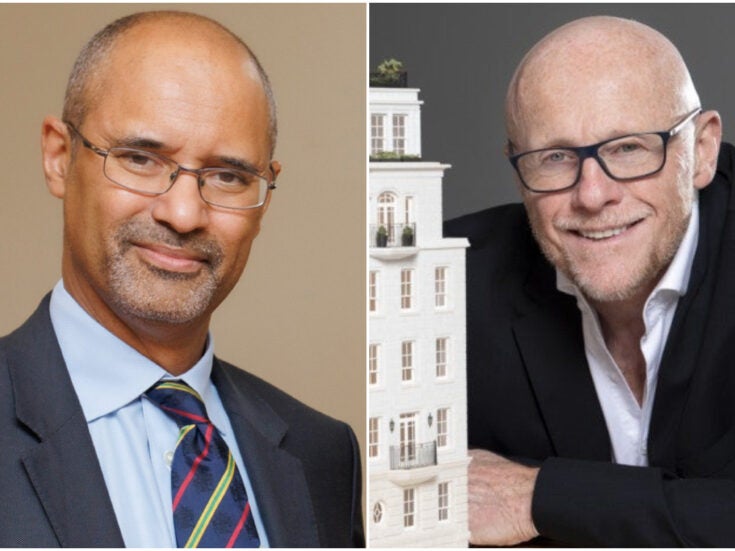

‘The next generation are expected to be the most significant donors in history,’ says Mark Greer, managing director of giving & Impact at Charities Aid Foundation, which helped more than 3,000 private clients donate nearly £200 million to charities last year.

‘But it is how they approach their giving that makes them different from previous generations. As philanthropy advisers, we know it is essential to understand the motivations, values and attitudes of clients, as well as the mechanisms available to them, to ensure philanthropy is as effective as it can be.

‘We would like to see philanthropy added to CPD and industry qualifications for financial advisers to ensure that private client advisers are able to better meet the needs of their clients. Forward-thinking advisers looking to provide a holistic service to the next generation would be amiss to ignore this rich topic of engagement.’