Sean Hagerty’s accent marks him as unmistakably American. But the roots of the softly spoken head of one of Britain’s fastest-growing investment companies are British: Hagerty’s mother was born in London, and his great-grandfather Sir Ninian Comper designed some of the stained-glass windows in Westminster Abbey and the Houses of Parliament.

Today, Sir Ninian’s descendant runs the London-based European arm of the Vanguard Group, the second-biggest investment group in the world, with nearly $8 trillion of assets under management. That is roughly the equivalent of the GDP of the UK and Germany combined, and makes Vanguard one of the biggest owners of virtually every major listed company on the planet.

It has also become an increasingly large and disruptive presence in the UK’s own investment industry. Vanguard has been quietly present on the isles since 2009 – selling its funds to big pension plans and ordinary British investors through a smattering of platforms – but in 2017 it announced it would be mimicking its US approach by offering its wares directly to Brits as well.

The news that the US investment behemoth was setting up its stall in the country helped send a shiver of fear through swathes of the UK financial industry. The shares of investment managers such as Schroders, Jumper and Ashmore quivered markedly on the day it was announced, but worst affected were wealth manager platforms Hargreaves Lansdown and St James’s Place, which suddenly faced a formidable new competitor in their domestic market.

[See also: The UK’s best private banks: the exclusive institutions UHNWs trust with their money]

‘We don’t pay attention to other people’s stock prices,’ deadpans Hagerty, an avuncular Pennsylvanian with square black glasses and side-parted salt-and-pepper hair. ‘We always just think about what we do.’

For fans of the ‘passive’ investment style that Vanguard is best known for – so-called index funds that do nothing but track a broad financial market benchmark such as the FTSE 100 or the S&P 500, as cheaply as possible – its arrival was as thrilling as it was unnerving for its rivals.

‘For years there were very few of us in the UK advocating the use of index funds. So I remember being really excited about Vanguard’s decision to come here,’ says Robin Powell, the founder and editor of the Evidence-Based Investor. ‘The UK fund industry was even more powerful in those days than it is now, and active managers like Neil Woodford were being heavily promoted in the media, so we were crying out for disruption.’

A move into financial advice was quickly aborted, but Vanguard’s UK business remains healthy and growing. It has now amassed about $168 billion of assets from UK investors and $21 billion on its personal advice platform, also making it one of the fastest-growing wealth managers in the country. In the process it has also helped bring down the cost of investment funds across the industry – a phenomenon that some have dubbed the ‘Vanguard effect’.

Vanguard: a success story born of a fateful mistake

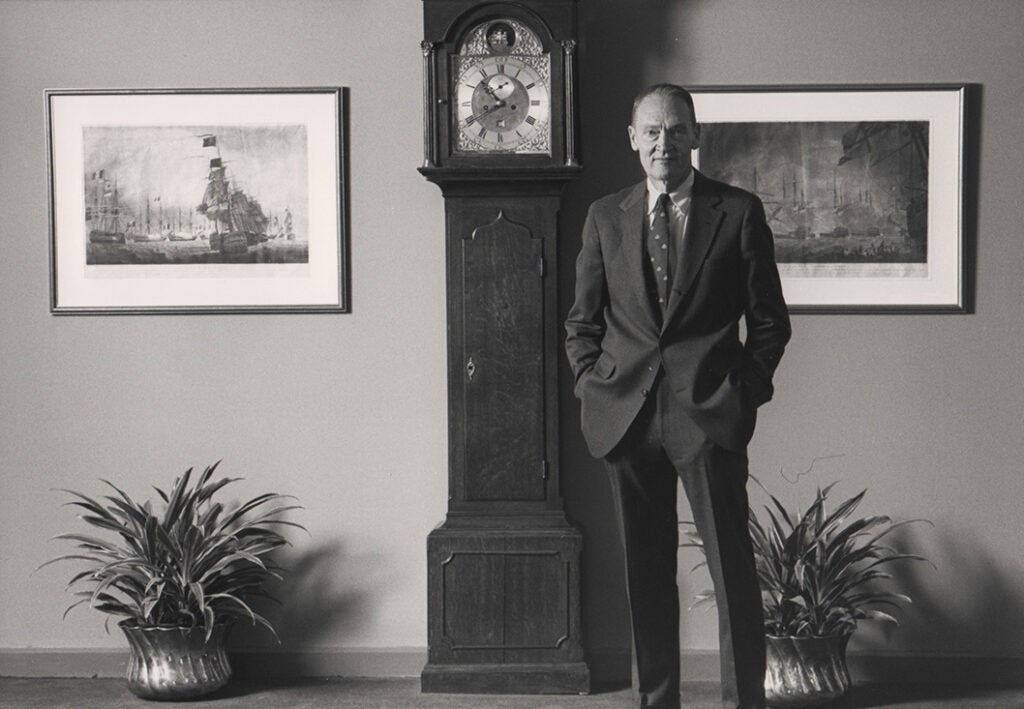

Vanguard founder Jack Bogle stands in front of a picture featuring the ship that gave the company its name / Image: Vanguard

But to understand how Vanguard has become one of the planet’s biggest investment managers, why its presence has become so keenly felt in the UK, and the backlash that has begun to gather against it, we need to turn the clock back almost 50 years, to a fateful mistake made by its founder, Jack Bogle. For Vanguard was born not out of corporate derring-do and strategic vision, but out of calamity, chaos and necessity.

Jim Riepe paced anxiously around the billiard room of the Union League Club on the corner of Park Avenue and 37th Street in New York City, a venerable gentleman’s club once frequented by the likes of John Pierpont Morgan and Teddy Roosevelt. It was too early for a drink, so Riepe settled his nerves by playing a few solo racks, while awaiting the verdict from the board meeting taking place next door.

In it, his boss Bogle was fighting for his professional life. In 1966 Bogle had engineered the merger of Wellington, the respected but stolid US investment group he ran, with a group of hot-shot fund managers in Boston. The tense corporate marriage broke down completely in the early-1970s bear market – the worst since the Great Depression – and at the January 1974 board meeting Bogle was finally ousted as CEO of Wellington by the Boston partners.

When Bogle, ashen-faced, walked out of the board meeting, he strode over to Riepe and dictated what the press release of his defenestration should say. Their afternoon train ride back to Wellington’s headquarters in Valley Forge was sombre, quiet and tense. ‘He was devastated,’ Riepe told me for my book Trillions, the history of index funds on which this account is based.

Yet Bogle, determined as ever, decided to launch an audacious countercoup. US mutual funds have their own boards of directors that are in theory independent from the investment managers who actually control the money. This created an opportunity for Bogle to exploit. ‘I was determined to win at the craps table what I had lost at the roulette table,’ he later recalled.

The very next day, Bogle took the 6am train back to New York to make his case directly to the funds’ board. ‘You don’t have to fire me,’ he told them. ‘This is your corporation. You oversee these mutual funds on behalf of their shareholders. Wellington Management Company doesn’t own the mutual funds. This is a great opportunity for us. The funds ought to have their own voice.’ He then presented a radical idea: mutualising Wellington. Its own funds would acquire Wellington, which would become a subsidiary that operated on an ‘at-cost’ basis.

This proved far too much for the directors of Wellington’s mutual funds. But in a sop to Bogle they did eventually decide to set up a subsidiary that the funds would own that would handle all their administrative work, which Bogle could lead as CEO.

In later years, Bogle would often recount how he left Wellington the same way he was hired: ‘Fired with enthusiasm!’ In truth, his closest colleagues said Bogle long felt humiliated, angry and bitter about ‘the Great Bifurcation’, as it became known internally. It gnawed at him.

[From the magazine: The most important super-prime property company you’ve never heard of]

Until the split, he had been the head of one of the biggest and oldest money managers in America, after suffering nary a setback in a remarkable career. Now he was a glorified clerk – albeit a well-paid one.

The profound sense of injustice poured rocket fuel on the already raging bonfire of Bogle’s determination, driving him to transform what could have been a monument to his biggest humiliation into something special. He named the new company Vanguard – inspired by a print depicting Admiral Horatio Nelson’s flagship – and set about making it worthy of such a grandiose name.

The problem was that the divorce agreement with Wellington precluded Vanguard from engaging in any investment management. Bogle’s sly solution was to set up an unmanaged fund that simply tracked the S&P 500. At the time there were a handful of such index funds around, but all were aimed at pension plans, not the ordinary individual investors that Wellington and Vanguard catered to.

Initially, the First Index Investment Trust (FIIT) was an utter flop. When it launched in August 1976 it had only managed to raise $11 million, after Bogle had publicly predicted $150 million. FIIT was such a humiliating failure that the press gleefully labelled it ‘Bogle’s Folly’.

Rivals were not above some sniping. Fidelity’s chairman, Edward ‘Ned’ Johnson, snootily told The Boston Globe his investment group would certainly not be dabbling in the field. ‘I can’t believe that the great mass of investors are going to be satisfied with just receiving average returns. The name of the game is to be the best,’ he said.

However, from tiny acorns mighty oaks grow. FIIT was later renamed the Vanguard 500 Index Fund, and today it manages a colossal $866 billion. That alone is almost as much as all of Schroders. And even that is dwarfed by Vanguard Total Stock Market Index Fund, which tracks the entire US equity market and manages $1.3 trillion, making it one of the single biggest pools of capital on the planet. The world’s largest bond fund is also a passive vehicle managed by Vanguard, the $292 billion Vanguard Total Bond Market Index Fund.

The power of passive investing

Vanguard’s success is largely down to two quirky facts that stem from its troubled genesis. Firstly, because it is still owned by its own funds, its dividends in practice come in the form of lower fees on its funds. The more profits, the lower fees can be. That means it is the dominant low-price provider in a high-cost industry. Weighted by assets, the average cost of a Vanguard fund is just 0.08 per cent, compared to the 0.54 per cent it estimates the broader industry charges on average.

Secondly, although Vanguard still sells plenty of traditional, actively managed funds (including much of the original Wellington line-up), it has helped both swell and surf the gargantuan wave of money that has flowed into passive investment funds such as the Vanguard 500 over the past two decades. Bogle only launched an index fund because it was the only thing he could do in 1976, and for a long time its passive funds languished unloved and denigrated, but it eventually proved stunningly serendipitous.

Just in 2023, index funds – whether they invest in bonds or equities – have attracted almost $600 billion, according to data provider EPFR Global. In contrast, traditional active funds have seen net outflows of $245 billion. All told, Morningstar estimates that there is now about $7 trillion in passive index funds such as the Vanguard 500, and another $10 trillion in exchange-traded funds (ETFs) – next-generation index funds that trade like a stock on bourses around the world.

Even this $17 trillion understates the overall heft of passive investing. Many big pension plans and sovereign wealth funds don’t invest in public investment vehicles such as ETFs. They either hand bespoke index-tracking mandates to the likes of BlackRock and State Street or simply do it in-house. Five years ago BlackRock estimated that this amounted to another $5.4 trillion just in equities. Assuming a similar growth rate to what we have seen on the public fund side, this could amount to another $10 trillion today, on top of the $17 trillion known universe of index funds.

Index funds have not yet become as popular in the UK as they are in the US, but Vanguard’s Hagerty argues it is only a matter of time. ‘We don’t have the same adoption here yet, but we’re on our way,’ he says. ‘The secular shi is there. Indexing will grow and costs will come down in the UK. We’re just trailing the US a little, but it’s coming, we can see it.’

Vanguard is a good example of this. The average age of its UK clients is just 40, and a third are under 30. ‘And those aren’t people who are buying meme stocks or Bitcoin,’ Hagerty stresses. ‘They’re buying broad-based, sensible Vanguard portfolios.’

Cost is obviously a major reason for the shift. Lower fees can amount to significantly greater returns over a long investment horizon, and few have done more to flatten the cost of investment management in the US than Vanguard. That is beginning to happen in the UK as well, some financial advisers say. ‘Vanguard has been a huge force for good in the UK market and has helped drive down costs for investors,’ says Alan Smith, CEO of Capital Asset Management, a financial adviser that specialises in entrepreneurs.

To make just one comparison, the all-in average ‘ongoing charges figure’ for a ready-made Vanguard portfolio – including the funds and platform – is 0.37 per cent. For a typical Hargreaves Lansdown balanced portfolio it is 1.37 per cent.

But the primary reason why flows into passive funds remain torrential boils down to performance. Despite countless confident promises by active investment managers that they can and will beat the market in the longer run, the actual data is grim for the industry. The few that can walk the walk usually end up eroding any precious market-beating ‘alpha’ through high fees.

S&P Dow Jones Indices, the biggest provider of financial benchmarks, has for more than 20 years tallied the after-fee performance of investment funds. If you adjust for survivorship bias (excluding funds that were so bad that they closed would obviously make the remainder look a little better), then less than 10 per cent of all US stock-pickers have beaten the market over the past decade. In the UK things are a little better, but not much: less than 23 per cent of stock-pickers here have managed to outperform the market.

Some investors reckon they can find those stock-picking starlets that beat the market in the long run. The reality is that this is very hard, if not impossible. The ‘persistence’ of investment returns – the likelihood that someone who beat the market in any given period will do so in the next one – is very low. In fact, they are so low that even if someone outperforms over a decade, the odds are that they will fail miserably in the next one. Things are a little better in less ‘efficient’ markets, such as bonds. But even a significant majority of fund managers don’t beat their benchmarks over a 10-year period. In its latest ‘scorecard’ on investment performance, S&P Dow Jones noted that not a single category of investment manager could, on average, beat the market over 15 years.

Disappointment is therefore one of the most powerful drivers of money gushing into index funds. Hagerty recalls how every turn of the market cycle is accompanied by predictions that the coming era will finally turn people off passive investing and restore the lustre of active management, most recently the higher-inflation-higher-rates era. ‘Over and over and over again we hear it, and then it doesn’t happen... We know it doesn’t make a difference what the cycle is,’ he says. ‘And I think people are coming to that realisation.’

As a result, rivals who initially laughed off Vanguard and index funds have either grudgingly embraced them – offering them alongside their active wares – or suffered the consequences and faded away. That even includes Fidelity, a stalwart of traditional stock-picking and one of Bogle’s nemeses after Ned Johnson had dismissed Vanguard’s inauspicious launch.

[See also: What does 2024 hold for family wealth?]

Soon after Vanguard opened its current headquarters in Malvern, Pennsylvania, in 1992, Bogle commissioned an artist to paint a 25ft x 5ft five-panel mural of the Battle of the Nile, the scene that had inspired the company’s name. Cheekily, he asked the name of the French ship La Spartiate being bombarded by HMS Vanguard in the central panel to be changed to La Fidelité, a none- too-subtle barb at Johnson’s Boston investment group.

However, under Johnson’s daughter Abigail Johnson, Fidelity has belatedly managed to become an index fund force. Today, index funds make up almost a quarter of its $4.5 trillion of assets under management. That still leaves ‘Fido’ in the shadow of its old upstart rival, but at least it is thriving, unlike many once mighty asset managers that have refused to embrace the growing demand for cheap passive funds and stagnated.

Nonetheless, success of this scale does not come without raising hackles. Some prominent investors argue that index funds have become a dangerous ‘blob’ that wrecks the efficiency of markets, somehow fuelling both bubbles and sell-offs. And while Vanguard has been able to hide a little behind BlackRock – which as the world’s single biggest asset manager attracts outsized opprobrium – it cannot forever dodge some of the thorny questions that even its founder raised before passing away in 2019.

Choppy waters on the horizon for Vanguard?

The origin of Vanguard’s name has meant that nautical terms suffuse its corporate culture, and maritime paraphernalia dots its offices. Employees are ‘crew’, cafeterias are ‘galleys’ and buildings at its American HQ are named after ships from Nelson’s fleet. And in November 2018, its crew members woke up to a broadside from their former admiral.

The ailing Bogle had been forced to step down as CEO in 1996, when a congenital heart problem – which had led to a series of heart attacks, the first one when he was just 31 – finally hospitalised him and put him on a transplant waiting list. His able deputy Jack Brennan stepped up with aplomb. But after Bogle made a stunning recovery after the transplant, he was infuriated when the board wanted to keep his former protégé as CEO. Eventually their conflict became so destructive that the board felt it needed to force him out as chairman as well, starting a testy relationship between the company and its founder. That became even more apparent in his latter years.

Shortly before Bogle passed away, he wrote a new book on Vanguard and an excerpt made its way into the Wall Street Journal. While he praised index funds and the immense benefits they had brought to investors, he warned that their natural economies of scale meant the big would only get bigger, and this concentration was dangerous to ‘the national interest’.

‘If historical trends continue, a handful of giant institutional investors will one day hold voting control of virtually every large US corporation,’ he wrote. ‘Public policy cannot ignore this growing dominance, and consider its impact on the financial markets, corporate governance, and regulation. These will be major issues in the coming era.’ A few months later, in January 2019, he passed away at his home.

[See also: Why the ultra-rich are changing how they invest]

There are myriad criticisms of passive investing, most of it ill-founded or made in bad faith. Active investors have gone from mocking the idea to shrilly denouncing a growing threat to their well-remunerated livelihoods, arguing with scant evidence that index funds somehow ruin markets. If this were true, surely they would start to perform less lamentably.

But Bogle homed in on the thorniest challenge of all – the real possibility that just a handful of index fund giants will own most of the global stock market within our lifetimes.

BlackRock is the world’s biggest asset manager thanks to its own suite of index funds and ETFs, which it acquired from Barclays Global Investors in the wake of the financial crisis. But Vanguard is not far behind in terms of assets, and is bigger in the US. That means that if you look at the shareholder registry of most of the world’s largest companies, Vanguard will be at the top or very near it.

For example, Apple’s biggest shareholder by far is Vanguard, with an 8.3 per cent stake. Combined with BlackRock, State Street and Fidelity’s index fund arm, passive funds combined control almost a fifth of the world’s most valuable company. Index funds now even own more of Tesla than its index fund-sceptic CEO Elon Musk. Given the current trends of index fund growth, within the next generation their influence could morph into dominance.

John Coates, a professor at Harvard Law School, has argued in a recent book that the mounting ‘concentration of wealth and power in a small number of hands threatens the political system’, but given the societal value of index funds it is ‘better thought of not as a problem to be solved, but as a dilemma to be managed’.

After a troubled launch, the good ship Vanguard has enjoyed a remarkably tranquil journey over the past three decades. However, the sociopolitical tempests on the horizon means the next decade could be far choppier.

Robin Wigglesworth is the editor of FT Alphaville. Trillions, his book about the history of passive investing, is published by Penguin Business

This feature was first published in Spear's Magazine Issue 90. Click here to subscribe