Spear’s readers offer their opinions on a new members-only club for centimillionaires, the movement of Russian wealth from London and the modern perils facing independent booksellers

Money Worries

SIR – As a psychiatrist who has been told (by the representatives of the rich) that I possibly see more billionaires in my practice in Harley Street than any other therapist in Europe, I found your article ‘Join the Club’ (Spear’s 83) of particular interest. It highlighted some of the common issues I see myself, clinically.

In the article you comment: ‘To some people, it may seem strange that someone worth more than $100 million could have “problems’’’; so, yes, the common mistake here is the delusional belief that money can solve all problems in life. Wealth can resolve many difficulties, but, for example, just because you can afford an expensive doctor in private practice, it doesn’t mean you have found a great physician.

Indeed, precisely because money can often give you more options, it also requires more thoughtfulness, not less. Financial clout is no replacement for the exercise of intelligence and even wisdom.

The best therapy often means seeing a psychologist willing to tell you the brutal truth about yourself, as opposed to what you want to hear. The problem with great wealth is even therapists sometimes don’t dare endanger a good income stream by going after brutal honesty in a session, as opposed to the much more commercially viable ‘tea and sympathy’. Yes, I have been told I see more billionaires than anyone else, but no one can understand why, as my reputation is that I don’t shy away from treating them the same as everyone else. But that is the greatest compliment you can pay a wealthy person.

Russian wealth

SIR – I read your previous cover feature, ‘The Fall of Londongrad’, with interest. It touched on a number of important points that were relevant to legal practitioners in the UK, including the movement of Russian wealth. However, several months later a new trend is emerging.

Since Russia and its legal market have been cut off from the international arena, demand for Russian legal services and expertise outside the country is growing. As managing partner of a foreign law firm headquartered in London, my team and I have been dealing with an unprecedented volume of queries coming from the US and Europe, ranging from how to wind down Russian operations to sanctions compliance, end-user checks and expert reports for litigation and arbitration cases in the UK.

While Londongrad may have fallen, the city’s legal industry is standing stronger than ever. This is a testament to the flexibility and sophistication of the UK’s legal market, as it allows foreign law firms to work in the UK and cater for international clients under the vigilance and guidance of the Legal Services Act. Svetlana London, CIS London

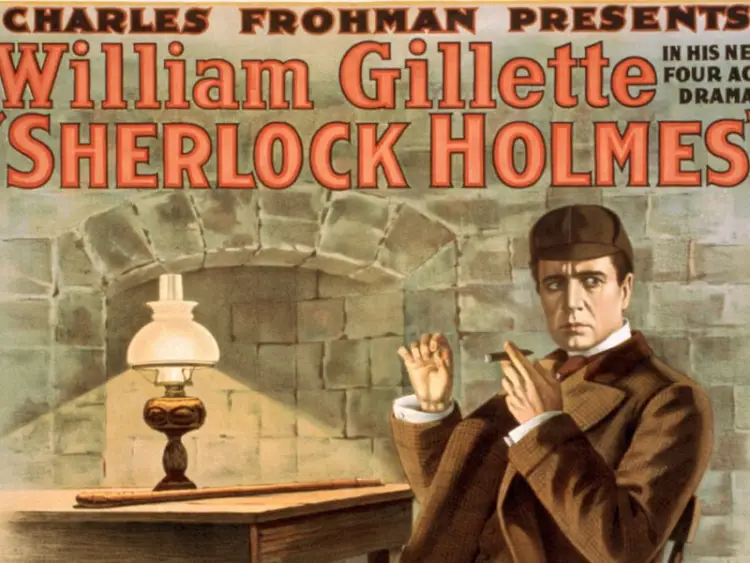

Intellectual pursuits

SIR – I read with interest Sam Leith’s article on the value of intellectual property estates (Spear’s 83). As a law firm with expertise in intellectual property, we often work with individuals looking to protect and bolster the value of their reputation. The article led me to think further about the current tendency towards ‘cancel culture’ and how events which can damage an individual’s reputation might also diminish a portfolio’s value.

The recent Johnny Depp libel litigation is a prime case of just that. Depp’s Hollywood royalty status was indisputable until allegations of domestic violence were levelled against him by Amber Heard and The Sun. Depp alleged that Heard’s statements about domestic violence resulted in film producers and directors refusing to work with him and his body of work being devalued. And yet, with Depp now having received vindication from a US court, he has turned the tide of public opinion in his favour.

Those who are looking to invest in or capitalise on a copyright estate should also consider the reputations of those involved very carefully, and be aware of the social, political and geopolitical developments which might affect them.

Balancing the bookshops

SIR – In response to Rory Sachs’ article regarding Livraria Lello celebrating its 116th anniversary (Spear’s 83), we at Stanfords would like to raise a glass to them as a fellow veteran (albeit slightly more mature at 169 years) bookshop. We understand only too well the challenges that arise operating an analogue business in a digital age.

It’s been a rough time for independent bookshops. As bricks-and-mortar shops with rent, taxes and expert staff , we have expenses that web-only businesses do not have. Stanfords had the added blow of specialising in maps and travel books, so with travel halted and the drop in footfall in central London, we lost a lot of sales.

It is wholly down to our loyal customers that Stanfords is still here today. They helped save us from closing down by raising £150,000 in a crowdfunder. It’s so important that when authors promote their books they offer links to actual bookshops instead of online giants so this global community of bookshops can survive and thrive.

Vivien Godfrey, CEO, Stanfords

To have your say, email our letters team here. All correspondence will be considered for publication unless otherwise stated.

Image Credit: Wikimedia Commons

More from Spear’s

Inside R360, the member’s club you have to be a centimillionaire to join

What less Russian money and oligarchs leaving would mean for London