There have been many watershed moments for Saudi Arabia since Mohammed bin Salman (MBS), the seventh son of King Salman, emerged as the country’s de facto ruler. Appointed crown prince by his father in 2017, the ambitious young royal soon became recognised as a potential moderniser of his oil-rich nation and, therefore, a figure of significant interest in Western capitals and beyond.

[See also: The new face of Saudi Arabia]

Perhaps the most significant step in the emergence of MBS as a power player on the global stage came on 24 October 2017, when 3,500 financiers, central bankers and political figures arrived at the Ritz-Carlton in Riyadh for the inaugural summit of the Future Investment Initiative (FII) – or, as it was dubbed by the media, ‘Davos in the Desert’.

In a country where cinema was still illegal, women were not able to drive and people were routinely sentenced to public stoning for something as trifling as adultery, the likes of Larry Fink, Jamie Dimon, Christine Lagarde, Tony Blair and Richard Branson came to be part of the conversation and to hear MBS pledge to open up his country’s economy, ramp up investment in new technology and move forward with the sale of shares in Aramco, Saudi Arabia’s trillion-dollar state oil company.

‘Changing Saudi Arabia for the better means helping the region and changing the world,’ said the crown prince in a speech promising a new Saudi Arabia, turning its back on extremism and embracing modernity. ‘This is what we are trying to do here. And we hope we get support from everyone.’

Rocky short history of the FII

The short history of the conference has not always run smoothly, however. There was more than a slight hiccup in 2018, when the fate of journalist Jamal Khashoggi became clear. The Saudi-born dissident, who was a contributor to the Washington Post, had entered the country’s consulate in Istanbul on 2 October but had not been seen since. A few days later, his death was confirmed by Turkey, leading to a flurry of reports that the Saudi state might be responsible (this would effectively be confirmed the following month, when the CIA concluded that MBS had ordered Khashoggi’s assassination).

The shock at the Khashoggi killing, and the widespread belief that Saudi Arabia was culpable, prompted several big names to pull out of that year’s event, including the chief executives of BlackRock, Blackstone and Credit Suisse. Yet predictions that Saudi Arabia’s clout would be permanently damaged proved to be wrong.

Within a year, all three of those same chief executives were back for the third FII meeting. That it took place in the Riyadh Ritz-Carlton – which, just days after that first conference in 2017, had been used as an impromptu detention centre for government officials suspected by MBS of stealing from the Saudi state – was not enough to keep them away either.

Indeed, since its inaugural outing FII has become a regular fixture in the calendar of the world’s power brokers and financiers. At the most recent edition, in October 2023, Citigroup’s Jane Fraser, JP Morgan’s Jamie Dimon and Goldman Sachs’ David Solomon were in attendance. Following the meeting, $17.9 billion of deals were announced. Those made public included a joint venture between the Saudi sovereign wealth fund and Italian company Pirelli, as well as a large Saudi investment into a wind energy project in Azerbaijan.

[See also: Saudi Arabia brings ‘Davos in the Desert’ to Miami]

Buoyed by its success, the FII is now taking its show on the road, with satellite events in Miami, Hong Kong, London and elsewhere, combining roundtable discussions on AI and ESG with more private opportunities for high-level hobnobbing. ‘You can probably count on one hand the number of times that this many CEOs turn up in the same place in the average year,’

says one senior adviser, speaking of the FII’s flagship event in Riyadh. Needless to say, they’re not there just for the hospitality.

In short, the FII is, very visibly, going from strength to strength – even as the man who is the driving force behind it has largely stayed out of the spotlight. Because, while Saudi Arabia’s all-powerful crown prince is universally regarded as the public face of the FII summits, it is the lesser-known figure of Richard Attias who has been trusted by the House of Saud to make it all happen. In his own, relatively quiet way, Attias has become one of the most trusted advisers to one of the world’s most powerful ruling families, as well as a connector and convenor of the most influential figures in finance, politics and business. But how?

Welcome to Miami

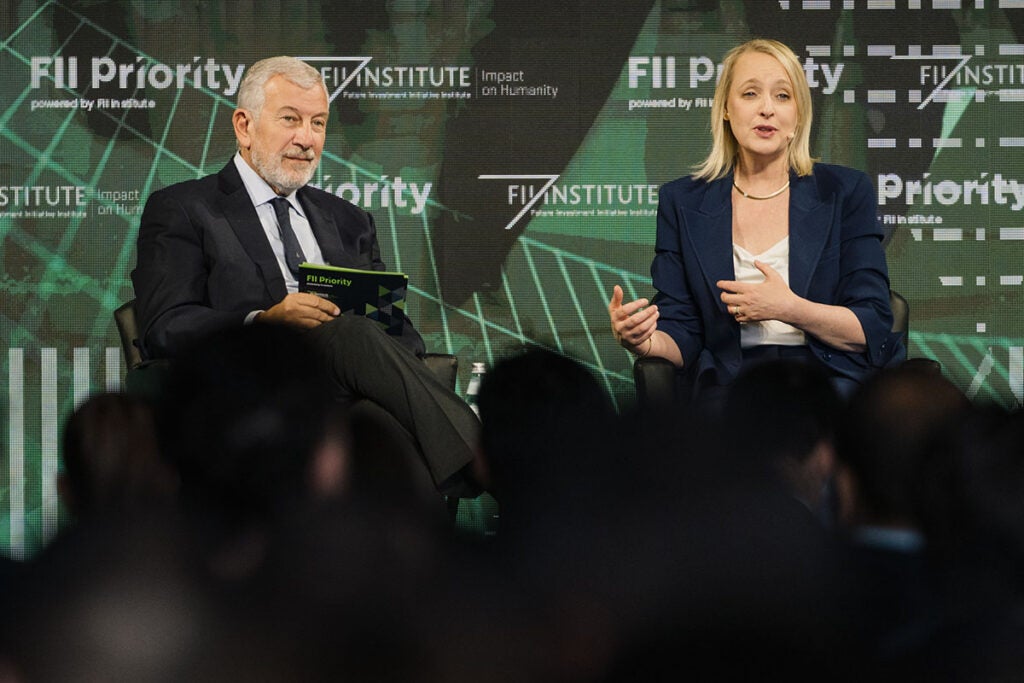

On a beautiful February morning in Miami Beach, Richard Attias is indoors. But inside the large ‘multidisciplinary event space’ at the hyper-fashionable Faena Hotel, he seems to be enjoying his moment in the spotlight as he comes on stage to open proceedings at FII Priority, one of the organisation’s so-called ‘satellite’ events that take part in global hubs for capital and power. During his curtain-raising speech, Attias welcomes Yasir al-Rumayyan, the governor of Saudi Arabia’s $700 billion sovereign wealth fund, with a warm handshake. The 54-year-old financier is responsible for some of the kingdom’s most ambitious and high-profile investments – from its takeover of Newcastle United to its sensational disruption of the PGA Tour with LIV Golf and its $2.3 billion investment in Uber.

Once off stage, Attias is constantly in demand. During the two-day event I spot him several times moving from one part of the forum to the next, as well as back and forth across the wider hotel estate and into the areas reserved for private meetings. When he does venture through the atrium, he occasionally stops to greet VIP guests (including Stephen Ross, the billionaire owner of the Miami Dolphins) in gregarious fashion – even occasionally with a hearty embrace or a continental-style kiss on the cheek.

[See also: Best Middle East wealth managers 2024]

The FII press team declines to reveal details of Attias’s diary or whom he is meeting. But on a journalistic recce into the depths of the hotel before our scheduled interview, I catch a glimpse of him disappearing behind a large wooden door. As I creep closer, I notice that the man outside in a dark suit appears to have an earpiece running alongside his neatly clipped hair. I decide to return to the main foyer.

Having spoken to those familiar with the workings of Saudi Arabian organisations, I am aware that schedules are not always adhered to. So when I finally reach a roped-off meeting room (a precious resource at an FII summit) on the upper floor of the backstage area for my meeting with Attias – which has been delayed several times already – there is still doubt as to whether I will get to meet the man himself at all. After a while sitting and pawing at my phone, it is suddenly apparent from the reaction of the FII team members in the room around me who has just entered the room. By the time I have stood up, Attias is already bounding across the room with an athletic stride, his hand outstretched to clasp mine.

The rise of Richard Attias

Attias may have a strong relationship with the kingdom and its top brass, but he is neither a Saudi national nor a resident of the country. He was born in the late 1950s in Fez, Morocco, to a Jewish Moroccan family that, it turns out, has a strong pedigree when it comes to royal relations. ‘My late grandfather was a tailor to Mohammed V [the first king of the newly independent Morocco], so he was in the royal palace most days,’ Attias tells me. His father was also close to Morocco’s rulers, serving as a senior civil servant in the king’s government.

Raised by his mother along with four siblings, Attias was educated at the Institut National des Sciences Appliquées de Toulouse (one of France’s grandes écoles) before going on to found his first company, a business that organised corporate conferences, in his thirties. In 1995 he attended a meeting of the World Economic Forum in Casablanca and ended up meeting Klaus Schwab, the WEF’s founder, in what would prove to be a pivotal moment in his career.

[See also: Is this the death of Davos?]

By 1998, Attias had sold his company to the Paris-based advertising group Publicis and joined the board of the French giant to head up an international events division. Through his pre-existing relationship with Schwab, he was tasked with organising events for the WEF, including its marquee annual conference, ubiquitously known by the name of the Swiss ski town in which it takes place. ‘I produced Davos for 14 years and started many of the WEF’s regional summits, including the first such events in China and South Africa,’ Attias tells me with a hint of pride.

Coinciding with the irresistible wave of globalisation that defined the early 2000s, Attias’s tenure with the WEF is regarded as a significant period of transformation for the organisation – with its meetings evolving from scholarly economics conferences to international gatherings of the great and good. One sketch of the event for a current affairs magazine mused how the phrase ‘see you in Davos’ had been elevated to a ‘secret handshake’ between ‘the world’s elite and those who aspired to join it’.

By the mid-2000s, the number of chief executives attending Davos had topped 500, with the likes of Sergey Brin, Richard Branson and Bill Gates making an appearance, as well as world leaders from Bill Clinton to Tony Blair and A-listers from Angelina Jolie to Matt Damon. How did Attias manage to get so many power brokers in the same room? ‘You can never take credit individually for anything you do in the events business,’ he says. ‘I was part of many strategic meetings at the WEF, when we were brainstorming about how to improve our programmes. But it was always a collaborative approach. Of course, as a leader, you are bringing your inspiration, your ideas and your energy, but you still need the right team around you.’

[See also: Millionaires call to be taxed more in open letter to Davos leaders]

What do others say about him? ‘I see [Richard Attias] as a kind of 21st-century Napoleon Bonaparte,’ says a Saudi-based Westerner who has worked closely with him. ‘He’s got that massive vision, strategic nous and a good feel for the issues that really matter. He creates shows where every aspect reveals an obsessive perfection, and which tackle genuinely on-point issues.’ Attendees at the FII summit in Miami are similarly enthusiastic in their praise. They’re putting their money where their mouth is, too; the advertised cost of membership of the FII network is $15,000.

Attias is not afraid to take risks. In 2008, amid the worst days of the financial crisis, he parted ways with both Publicis and the WEF to found his own eponymous consultancy – Richard Attias & Associates (RA&A) – which would focus on helping governments boost their nation’s profile and put on showcases designed to attract foreign investment at high-end conferences.

Events on the company’s résumé include something called the Egypt Economic Development Conference (a 2015 summit in Sharm El-Sheikh described as a ‘comprehensive country-branding strategy’ for post-turmoil Egypt) and the Doha Goals (a series of flashy sports conferences launched following Qatar’s successful bid to host the FIFA 2022 World Cup).

MBS’ bold vision

So when did Saudi Arabia enter the picture? ‘I have actually been working with the Saudis for more than 20 years now, going back to when I was at Publicis,’ Attias says when we speak over the phone some weeks after our meeting in Miami. ‘Originally I was asked to create an investment forum for a body called Sagia, which was the predecessor of the PIF, the sovereign wealth fund.’ At the time, the forum served as a useful conduit for Western multinationals interested in the kingdom’s notoriously closed economy.

Then, 10 years ago, Attias began working with MBS. ‘When I met His Royal Highness for the first time, he was 27 years old,’ Attias recalls. ‘Even then, he already had such a bold vision.’ The connection came through bin Salman’s non-profit vehicle, the Misk Foundation. ‘They knew of my work with Davos and wanted to know if I could put together a new forum focused on youth issues.’

[See also: Saudi 2.0: Can the kingdom really be remade?]

By 2017, bin Salman had bigger ideas. Having just unveiled Vision 2030 – his flashy roadmap for a revamped Saudi economy – he was looking to take the message to the world that his country was changing. ‘We first started talking about a major event in February 2017,’ says Attias. ‘At that time, His Royal Highness was keen to do something by the summer. I had to say that we would need more time than that. We eventually settled on October, which still left us with less than seven months to organise it.’ (‘In this part of the world, that’s considered a generous timescale,’ one Gulf insider later remarks to Spear’s.)

The initial vision was to bring 1,000 potential investors, largely representatives from major asset managers and big banks, to Riyadh. They ended up with three times that number. It helped, of course, that the kingdom was gearing up to press ahead with the Aramco IPO, which – depending on the volume of shares offered – was set to rank among the largest in the world.

Yet Attias attributes the success of the first FII to the excitement around Saudi Arabia’s upcoming ‘gigaprojects’ – a series of ambitious developments championed by MBS as symbols of his country’s reinvention. Even for a region where governments have deep coffers to draw from, the projects have been a bonanza for consultancy and construction firms. By some estimates, the value of contracts awarded runs into the hundreds of billions.

[See also: Desert dream: the story behind Dubai’s prime property surge]

As a close ally of the Saudi leadership, Attias has a less mercantile assessment. ‘The reason that the global business community wanted to be part of these projects is that they’re so ambitious. Whether you’re an economist or engineer, it’s extremely rewarding to be part of the most ambitious project related to your industry, whether that’s in terms of sustainability or technology.’ He cites the example of the Neom development project investing $175 million in flying cars.

Anyway, Attias says, FII’s main motivation is not to bring money to Saudi Arabia, but to lead a global conversation on investment themes, hence Miami and a June event in Rio de Janeiro. ‘We realised that if we want to be inclusive and talk to the world economy, we cannot just be in Saudi Arabia. Riyadh might be a global hub, but we still need to go to other continents and cities.’

A citizen of the world

For Attias, this geographic reach is one of the things that distinguishes the FII from its rivals, including Davos itself. ‘From day one, we have had delegates from China, from Africa, from other parts of Asia, from Europe and the United States.’ The FII’s other selling point, he adds, is its emphasis on attracting a younger audience. ‘We are obsessed with having as many youth attendees as possible,’ he says, pointing to the FII’s outreach programmes focusing on entrepreneurship. It’s a natural fit for Saudi, he says, given its relatively young population (63 per cent of Saudi nationals are under 30).

With his earnest tone and gregarious manner, Attias comes across as every inch the natural politician – a useful trait in a region where cultural sensitivity and a deft touch can go a long way when it comes to negotiating with, and on behalf of, ruling families. Indeed, as he gives me the elevator pitch for the FII as a catalyst for dialogue, a Saudi princess, Princess Reema Al Saud (who works with Attias on communications), nods approvingly and scribbles notes.

[See also: How the rich and famous fell for Miami]

For all the worthiness and talk of global dialogues, it’s notable that many of the VIP names at the Miami summit already have significant business links with Saudi Arabia. Some are the chief executives of multi- nationals – such as Accenture – who have won large government contracts there. Others are the direct recipients of Saudi capital – such as Jared Kushner, the former White House staffer (and son-in-law of Donald Trump) whose private equity fund has been tasked with investing $2 billion of PIF money.

As for those speakers who don’t have publicly reported links to the kingdom, who range from former Google chief executive Eric Schmidt to actor Rob Lowe, one FII insider gives a candid insight into how their participation might have been secured. Asked how the organisation has been able to attract the various luminaries due to speak at the event, they say nothing but rub their fingers together in the universal gesture that signifies money.

How lucrative is the enterprise for Attias himself? While Saudi Arabia has been a long-standing client of his consultancy, the success of FII opened up a new avenue. In 2019 the PIF took a 49 per cent stake in Attias’s business, later increasing its ownership to 75 per cent. It also announced funding for a permanent vehicle known as the FII Institute, an international think tank charged with utilising the summits to pursue an ‘impact on humanity’. Attias has been appointed chief executive.

[See also: The ‘masters of the universe’ are back in business]

When asked about his financial interests, Attias says: ‘Let me put it this way: you don’t work for a non-profit foundation if you want to make money.’ Perhaps. But you don’t build up and sell a business for fun either. ‘When I sold my company to Publicis Group, it was to get my freedom back,’ he answers. ‘He’s obviously done very well commercially,’ says one Gulf expert within the Spear’s network, an adviser to UHNW families. ‘In this part of the world, he’s basically Mr Events.’

While the Gulf economies have made big strides in terms of their maturity, personal relationships remain imperative for business – something on which Attias has been able to capitalise. ‘His company organised the Abu Dhabi Sustainability Week last year and it was clear he had the trust of Sultan Al Jaber.’ (Al Jaber is the head of Abu Dhabi’s state oil company and was

the host of COP 28.) On stage in Miami, Attias referred to the PIF’s governor, Yasir al-Rumayyan, as his ‘dear friend’. But he explains during our phone conversation that there is also a professional element to the relationship. ‘The PIF is my majority shareholder and he is, of course, the chairman of that. So I am quite often dealing with His Excellency,’ Attias says. ‘But we also deal with multiple Saudi officials and private-sector leaders. The FII has 20 strategic partners who are Saudi companies, so we are privileged to be in touch with multiple stakeholders.’

[See also: The best wealth managers for ultra-high-net-worth clients in 2024]

Despite his close relationships with Saudi’s power brokers, Attias has lived for more than 20 years in Manhattan with his wife Cécilia Ciganer-Albéniz (who was previously married to former French president Nicolas Sarkozy). Attias remains a Moroccan citizen and has a house in Marrakech too. ‘I tend to spend my time between Marrakech, Riyadh and New York,’ he says.

Richard Attias: politician or diplomat?

I ask the question that no self-respecting mover and shaker can resist: how do you define yourself? ‘I’m a citizen of the world,’ he says without missing a beat. ‘I want to be a peacemaker, and the best way to do that is to help grow economies.’

To what does he attribute his success? ‘I think my education and my roots [in Morocco] have played a big role. They made it possible to do what I do: which is creating great platforms, influential dialogues, and bringing people together. I’m trying to convince leaders to invest in those countries which have a vision. That’s what we do at FII and why I am extremely happy to be heading this amazing institution – because our mandate is genuine.’

As for how he sees his legacy, the great convenor of power brokers, CEOs and billionaires is uncharacteristically ambivalent. ‘I just want my family to be proud of what I’m doing,’ he says with a shrug. ‘I’m not a politician. I’m not looking for anything special. I just want my grandkids to say that I did something nice with my time.’ It all feels a million miles away from the beaming, self-styled visionary who had shared the stage with al-Rumayyan and former Treasury chief Larry Summers in Miami.

Perhaps, then, the politician label isn’t the best one after all. After two days observing Richard Attias do his thing, and having spoken with him at length, I find myself leaning towards another comparison: a diplomat. Like most good ambassadors, he’s a man who can turn on the charm like the best of them. But he also knows when discretion is the order of the day. It’s the combination of these two things, you suspect, which has served him – not to mention his dear friends in Riyadh – so very well indeed.

This feature first appeared in Issue 92 of Spear’s Magazine. Click here to subscribe.