Family offices have long been a powerful, if understated, force in the world of wealth management.

However in recent years, these privately owned companies have grown increasingly popular among UHNWs. This rise is driven by a number of factors including a greater desire for wealth concentration, a push towards more personalised and direct investment strategies, and the impact of the Great Wealth Transfer.

[See also: Family office executives reveal the 10 biggest trends shaping the industry]

Tracing their origins back to 19th-century America, family offices (FOs) are now well established in Europe and are growing increasingly popular in emerging markets where first-generation wealth creators find themselves in need of support. Originally designed to help titans of industry protect their wealth and create a legacy, today the role of the family office has diversified to include everything from management of luxury assets to legal issues.

The growing prevalence means it is more important than ever that UHNWs and private client service providers fully understand what FOs are, what they offer, and who they benefit.

Jump to:

- How are family offices structured?

- What are the different types of FOs?

- How much money do you need?

- Global growth

- Family office vs wealth management

- History of family offices

What is a family office?

Put simply, a family office is a private wealth management company that provides a comprehensive suite of services to a high-net-worth family, individual, or a group of UHNWs.

A single-family office (SFO) manages the money of an ultra-high-net-worth-individual and their family, while a multi-family office (MFO) is responsible for the wealth of several families.

[See also: The best family office service advisers in 2024]

These offices are trusted to support families with complex financial needs, including investments, accounting and regulatory reporting, governance, succession planning, the management of luxury and lifestyle assets, and philanthropy. Advisers are trusted to build and protect wealth, while creating a long-term legacy and smooth transfer between generations.

How are they structured?

The way in which an FO operates can be adapted to suit the needs of the family it serves. It can be based in one jurisdiction, or it can operate out of multiple cities. In most cases, advisers will either be in-house, outsourced, or a combination of the two. The configuration depends on the requirements of the HNW families and the amount of money involved, as well as other factors.

[See also: Family offices place more value in outsourcing]

‘Some families outsource a lot of their activities, which the family office just coordinates. It can almost be just a secretariat service,’ says Annamaria Koerling, founding partner of Delfin Private Office. ‘Alternatively, it can be a fully fledged family business enterprise, where they do everything in house.’

In the second instance, the FO can take care of governance, trusts, corporate services, tax planning, wealth management, philanthropy, operating businesses and any number of other services all under one roof.

Single vs multi-family: the different types of FO

The total number of family offices worldwide grew from 1,285 in 2019 to 4,592 in 2023, according to Fundraising from Family Offices: A guide to raising capital by London-based investment data company Preqin. SFOs account for 59 per cent of the total.

Single family office

An SFO focuses, as the name suggests, on the assets and desires of a single family, with the primary goal of centralising business management. There is direct authority over the employees and a close relationship with the family. The advantages of having an SFO include heightened confidentiality, cohesiveness and personalisation.

Multi-family office

An MFO manages the wealth of multiple families. This structure means expenditures are pooled, making management more cost-effective. The advantages of having a MFO include a wide range of expertise, shared overhead costs, and simple management.

Virtual family office

‘Virtual family offices (VFOs) are simply family office services that are outsourced to an external firm, rather than having an in-house team,’ explains Jodie Barwick-Bell, partner at Evelyn Partners, who has extensive experience in setting up and running FOs. 'It just means you haven't got someone in-house, who’s employed by you, running your family office.'

Increasingly complex international regulation, cross-jurisdiction interests and a generational wealth transfer are among the factors driving the shift from traditional family offices to the more dynamic services offered by VFOs.

Daniel Channing, director of Jersey-based Crestbridge Family Office Services, explains in a helpful online post on the topic: 'The VFO has become a very viable option for families at all levels. Getting the very best expertise and support is what families ultimately want – and actually it can be far more accessible, more flexible and more cost effective to be able to tap into that expertise remotely or virtually.'

However, there are also limitations: communication between siloed teams and the family can be more fragmented; a cohesive approach to long-term future planning might be lost; and VFOs might not be as secure as traditional family offices.

How much money do you need for a family office?

The cost of establishing and maintaining an FO is guided by the nature of the firm (single, multi or otherwise), size of AuM, as well as factors like the type of investments. Portfolio size, complexity, and the mix of active versus passive investments all affect the costs of running a family office.

SFOs typically start at around USD300 million in assets under management (AuM), but can exceed USD1 billion, according to HSBC Global Private Banking.

An office can employ anywhere from a handful to over 100 professionals, including portfolio managers, accountants and lawyers.

Running costs of a family office

The costs of running a family office can broadly be split into four categories, notes Citi Private Bank:

- Internal operating costs: Employee salaries and benefits, as well as overheads, technology, and telecoms

- Direct family expenses: Taxes, administration fees, travel costs, property and luxury investments like art and other collections

- External professional service fees: Cost of outsourcing services including security, insurance, tax, legal and accounting

- Investment advisory fees: Management, custody, research/data, and aggregated reporting

The way fees are decided can be done either on a flat-rate basis, or dependent on the value of AuM.

Koerling continues: 'Some families do that on a flat charge basis - £10,000 per portfolio, or whatever - but the majority do it based on the value of the assets in each portfolio. So they charge a certain percentage fee applied to the assets, which covers the costs of running that family office.’

Global growth

The number of FOs has more than tripled over the last four years, according to a recent report.

The total number of firms worldwide grew from 1,285 in 2019 to 4,592 in 2023, according to Fundraising from Family Offices: A guide to raising capital by London-based investment data company Preqin. Single-family offices account for 59 per cent of the total.

Regional trends

North America remains the region with the greatest proportion of family offices (37 per cent) and the majority of assets under management (54 per cent). It is followed by Europe, which accounts for 32 per cent of firms and 30 per cent of AuM; and Asia, which is home to 15 per cent of offices and 8 per cent of AuM. The remaining regions are grouped as ‘rest of the world’ for the purpose of the research.

[See also: Millennials set to be richest generation ever as number of UHNW rises]

‘There is the potential for greater growth in both the number of family offices and their capital across the world, but particularly in some of the emerging markets,’ the report authors note.

‘While the number of family offices grew year on year to 2023 by 20 per cent in North America, 17 per cent in Europe and 22 per cent in Asia, the figure for "Rest of world" surged 31 per cent. Although managers may tend to look towards developed markets for family office capital, the upward trend in emerging markets is noteworthy.’

What is the difference between a family office and a wealth manager?

FOs can, of course, manage wealth. So, in this sense, they are a wealth manager to the family that they serve. A wealth manager, however, has lots of different clients, whereas a family office works for just one family.

‘The main difference is the number of clients that they have, rather than the type of service that they provide. A very big FO will typically have its own investment teams,’ says Koerling.

Another difference is the ‘relatively limited investment and advice’ that wealth managers provide. They only manage investments, whereas an array of duties that can fall under the remit of a family office. Also, a family office is fully bespoke, whereas wealth managers are suppliers of an investment product that they already have.

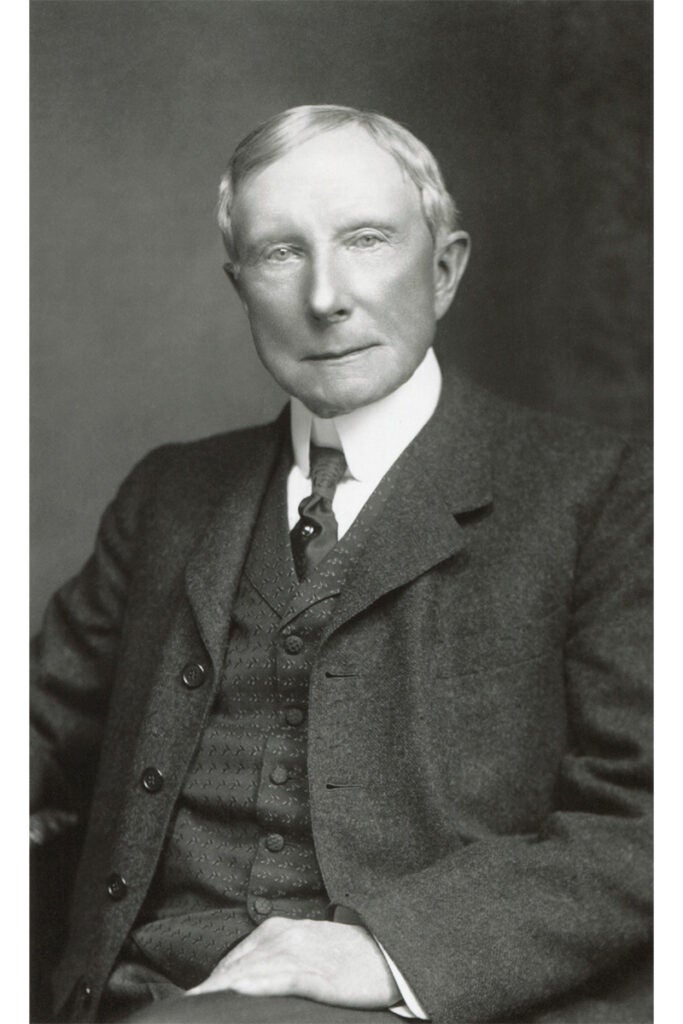

The history of the family office

Family offices have their roots in the industrial revolution which created the first 'titans of industry' in the United States.

In the 1930s, the family of J.P. Morgan founded the House of Morgan to manage family assets gained from their banking empire. The first full-service single-family office is credited to J.D. Rockerfeller in 1882. At the time of his death in 1937, his fortune stood at $1.4 billion (or the equivalent of approximately $255 billion today).

The power-players of New York's Gilded Age followed suit, with the Carnegies and Vanderbilts founding their own family offices to manage their interests and protect their wealth. As with today's dynasties, a key motivator was the desire to keep the wealth within the family as it passed down through the generations.