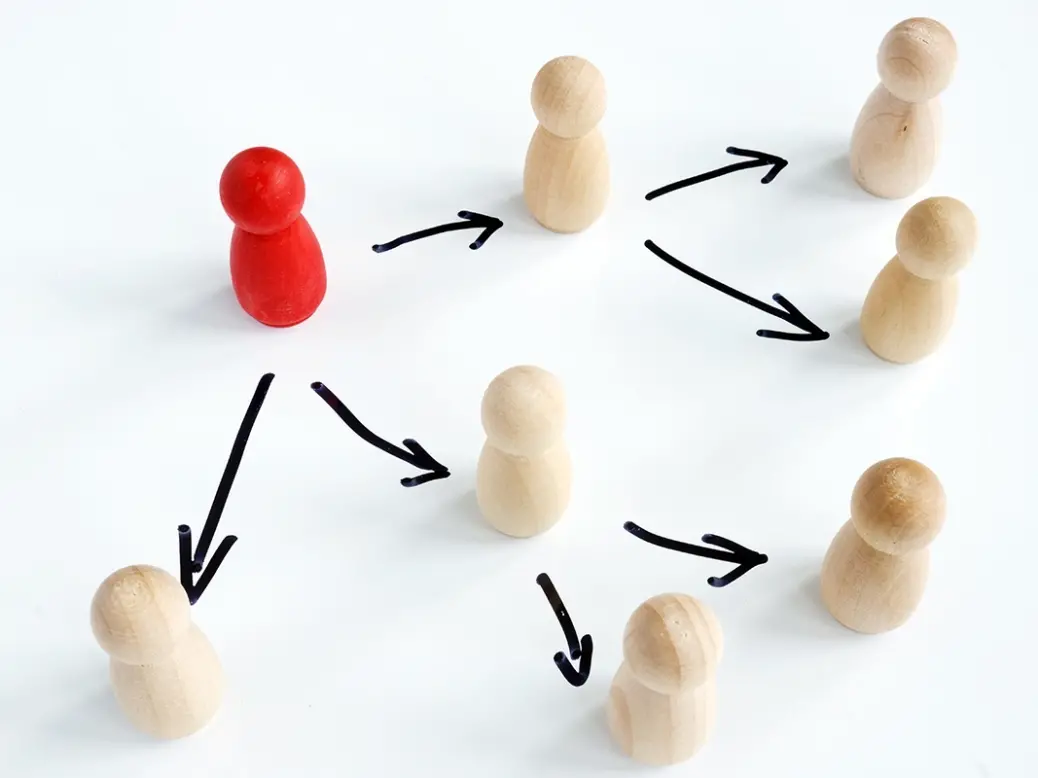

Family offices are shifting towards outsourcing to overcome challenges facing the industry, according to a recent survey.

Over the past 12 months, 96 per cent of family offices have outsourced non-core functions to deliver maximum efficiency and effectiveness, an RSM survey of 100 family offices based in the US and Canada revealed.

[See also: Saudi Arabia brings ‘Davos in the Desert’ to Miami]

Popular services to outsource include IT, bill paying and tax services, according to the report.

Outsourcing can go some way to mitigate issues created by evolving tax laws, rapid advancements in technology, cybersecurity threats, the looming great wealth transfer, and the ongoing talent shortage. By outsourcing, firms can instead concentrate resources and attention on their core competences, such as wealth preservation and strategic planning.

A generational divide

More than one-third of respondents (35 per cent) agree outsourcing select services can allow a family office to focus on delivering value. And more than half (55 per cent) agree outsourcing is important to mitigate risk for complex estate, legal and tax issues.

[See also: Family offices poised for buying spree]

There is a more favourable attitude towards outsourcing among smaller and newer family offices than their larger and more established peers.

Seventy per cent of respondents from firms established since 2015 agreed that outsourcing can allow an organisation to focus on delivering value. This compares with just 33 per cent of respondents from family offices established before 1990.

The report adds: 'Perhaps this shows a greater understanding among younger generations about the value of strategic outsourcing, which is a newer concept that is gaining popularity in business circles.'

This trend looks set to continue. Among family office respondents who use third-party providers for services related to bill pay, IT, tax planning and tax compliance, the overwhelming majority say they will continue to outsource these services in the next 24 months.

'They find themselves at an inflection point'

'Family offices are facing a time of great challenge and change,' said Tony Wood, national leader for the global family office practice at RSM US LLP.

'They find themselves at an inflection point where they will need to address a variety of pressing concerns related to their people, processes, data and technology to strengthen their operating model, focus on long-term growth and maintain resilience across their entire enterprise, including their operating businesses and investment structures.

'Furthermore, with $84 trillion of intergenerational wealth transfer projected through 2045 as a part of the ongoing great wealth transfer—$16 trillion of which is expected over the next decade—the backdrop for operational optimisation and resilience is as compelling as ever.'

The 2024 RSM Family Office Operational Excellence Report surveyed family offices in the US and Canada and they varied across size, generations, and operating business sector, as well as years in operation and expenses. The firm works with more than 600 family offices in the US and Canada and more than 1,000 globally.