Great family wealth has its benefits, of course. But keeping a fortune within a family is often a process fraught with difficulties – and conflicts.

There are questions of inheritance, legacy, fairness, equality and entitlement, as well as practical considerations surrounding tax, asset management, and wealth preservation.

Typically grouped under the umbrella of ‘succession planning‘, this is an area of increasing focus for family offices, lawyers and wealth managers as they anticipate the seismic impact of what has been dubbed ‘The Great Wealth Transfer‘.

Without the correct processes in place, the difficulty of passing wealth from one generation to the next can cause irrevocable damage. Just ask Logan Roy and co. of HBO’s Succession.

[See also: Succession at the House of Arnault: who will wear the crown?]

Or, indeed, these high-profile, ultra-high-net-worth families whose disputes have played out on the public stage – and in the courts.

These are the biggest billionaire family feuds.

What are the biggest billionaire family feuds?

Agnelli family

The dispute in the Agnelli family stems from the estate of Gianni Agnelli, the Italian industrialist, senator, and principal owner of Fiat. The car manufacturer was at one point responsible for 4.4 per cent of Italy’s GDP.

However, his death in 2003 threw his family into turmoil. Over the last two decades, his family has been divided by legal and financial disputes.

The clashes revolve around the Italian businessman’s only surviving child, Margherita, and her children, particularly the three eldest, John, Lapo and Ginevra, whom she shares with her first husband, the writer Alain Elkann.

John Elkann was the chosen heir of his grandfather Gianni and has been leading the family business since 2004.

[See also: Super troupe: Ferrari fever takes Tuscany]

The Agnelli legacy is worth billions of euros, and the empire not only includes Fiat but also shares in Ferrari, Philips and The Economist newspaper – among a number of other businesses.

Margherita inherited part of this estate when her father died, but decided to sell her shares to her mother, Marella, in 2004 during a time of financial difficulty at Fiat. A settlement was reached in Switzerland (known as the ‘Geneva Pact’) but following Marella’s death in 2019, Margherita’s shares of the Agnelli empire were split between John, Lapo and Ginevra.

Margherita, a mother-of-eight, is now fighting to be re-included in the family business for the sake of her five youngest children by her second husband. Her claims have not only continued the family drama but have escalated it.

Goldman family

Dubbed ‘the most secretive family in American real estate’, the Goldmans have been fighting among themselves since patriarch Sol Goldman died in 1987.

An investor and philanthropist, Sol Goldman was the co-founder of Solil Management, a real estate investment firm which, at its peak, oversaw a portfolio that consisted of nearly 1,900 commercial and residential properties across New York City, including the Chrysler Building.

At the time of his death in 1987, Goldman owned more than 600 properties, worth over $1 billion, making his the largest real estate portfolio in the Big Apple.

[See also: Meeting Harry Macklowe: the man who shaped New York]

After his death, Sol’s four children began a legal battle with their mother Lillian, claiming she was not entitled to her share of inheritance based on divorce proceedings and marital issues with their father. It took five years of proceedings for Lillian to receive her percentage of shares (33 per cent), which was then divided among the four children when she died in 2002.

However, this was not enough to put the billionaire family feud to one side. In December 2023, one of the Goldman children, Jane – who took over as head of the family company – was sued by other family members over her power grab of the family fortune.

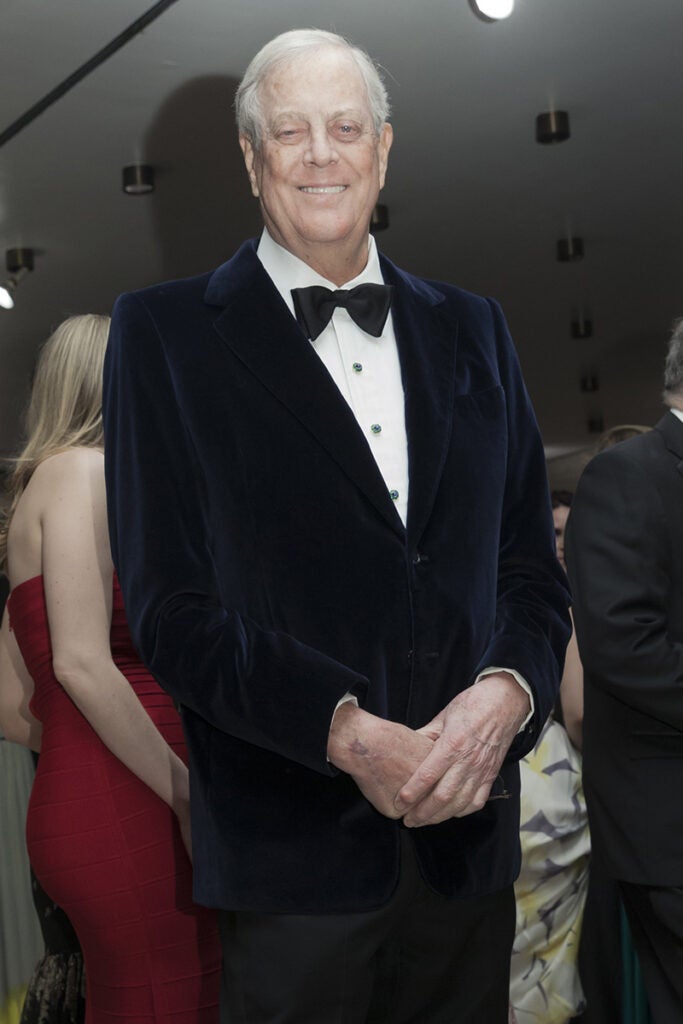

Koch family

The Koch family maintain control of Koch Industries, the second largest privately owned company in the US, with revenues of $115 billion in 2019.

The business traces its fortunes to its founder, the late Fred C. Koch, who developed a new method for refining crude oil into gasoline. Together with his wife, Mary, Koch had four sons: Frederick, Charles, David and Bill.

Fred C. Koch died in 1967, and, as is common in billionaire family feuds, his death prompted disputes among his heirs. After Bill attempted to take control of the business in 1980, he was fired. He and Frederick decided to sell their shares to the other two siblings, Charles and David, for more than $700 million in 1983.

But Bill and Frederick soon felt shortchanged by the deal and sued their brothers Charles and David for more money. The lawsuits lasted 18 years, eventually settling in 2001 for an undisclosed amount.

David Koch died in 2019 and Frederick Koch in 2020.

Rinehart family

Gina Rinehart is the richest person in Australia, with a fortune estimated at $30 billion which she made from iron ore, after turning around her father’s Lang Hancock business.

The firm was crumbling before she took over as executive chairwoman in 1992, transforming Lang Hancock into a billion-dollar concern.

Her father’s death sparked an 11-year legal battle between Gina and her stepmother, from whom she eventually inherited the family business. But that was not the end of her legal disputes.

[See also: Billionaires should pay 2% wealth tax, say G20 ministers]

Gina is involved in several inheritance disputes, including with the daughter of Lang’s business partner, but perhaps the most notable is her feud with two of her own children, John and Bianca.

The two sued their mother over stakes in an iron ore mining complex which they claim their grandfather left them in a family trust. John and Bianca believe their mother owes them billions of dollars that she took from the family fund into her company.

The case is still ongoing and is being heard by the Supreme Court of Western Australia.

Gore family

Bill Gore, the American engineer and businessman co-founded W. L. Gore and Associates, the company behind Gore-Tex fabric, with his wife, Genevieve. The couple shared four children.

Genevieve died in 2005, 18 years after her husband.

The couple had set in motion a succession plan in 1972. They decided that each of their four children would share in an equal share of the family trust. When the wealth passed to the next generation, the proportion of assets passed on would depend on the size of the family branch. Ie. a family branch with two grandchildren would be entitled to twice as much as one with just one grandchild.

The Gore-Tex heirs all had four children, except one, Susan, who had three. Based on the family trust system, Susan’s children would therefore receive fewer shares than their cousins. To remedy the situation, Susan decided to adopt her 65-year-old ex-husband as a fourth child, to even out the size of her family branch.

However, this impromptu adoption caused two major problems. First, Susan’s ex-husband decided that he wanted to hold on to the shares of the trust that he could now inherit, although that was not part of the initial agreement.

Then, Susan’s siblings fought her in court so that her newly adopted son wouldn’t be recognised under the family trust. The court ruled in favour of the rest of the family, and Susan’s plan failed.

Barclay brothers

Amongst the impressive portfolio of assets – including newspapers and a private island – owned by Frederick and David Barclay, better known as the Barclay twins, was the Ritz Hotel.

And the iconic London hotel on Piccadilly was the stage for the infamous legal dispute at the heart of the billionaire family feud.

[See also: The billionaire class of 2023: who are the biggest winners and losers?]

In 2020, only months before David’s death, Frederick and his daughter Amanda sued part of the family (David’s three sons and one of his grandchildren) as they claimed to have been recorded during private conversations at the Ritz Hotel. Frederick and Amanda accused their relatives of misusing their private information and breaching confidence and data protection laws.

Although denying the bugging had anything to do with business, the four confessed in court and apologised, thereby also settling the issue legally.

Pritzker family

One of the wealthiest families in the US, the Pritzker fortune was founded in the 20th century, particularly through the founding and expansion of the Hyatt Hotels Corporation.

Previously, the group’s holdings have also included the Superior Bank of Chicago, the TransUnion credit bureau, Braniff airlines and the Royal Caribbean cruise line.

Today, their fortune is estimated by Forbes at more than $41 billion.

However, the Chicago family spent years in legal fights over their billions and assets – including Hyatt hotels – and had to divide its fortune among family members.

When she was 18 years old, one of the family heiresses, Liesel, filed a lawsuit worth $6 billion against her father Robert and her 11 cousins, claiming they had stolen hers and her brother Matthew’s rightful trust fund shares.

The allegations were based on the fact that Robert had donated part of his children’s trust funds to the family foundation and that six years later, Liesel and Matthew were left out of their cousin’s plan for dividing the fortune.

According to Forbes, Liesel’s lawsuit led to a division of the family fortune that created ‘nearly a dozen billionaire Pritzkers’, and saw her walk away with $500 million.