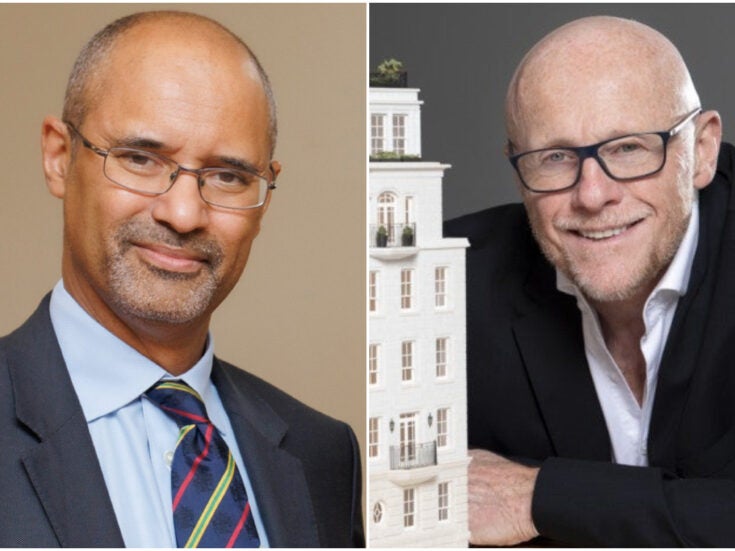

Read the transcript from the Spear’s/Speechly Bircham/Cazenove Capital seminar on philanthropy in the 21st century, featuring John Studzinski CBE and Ian Watson

The Auditorium, Moorgate

21 February 2012

Host: Josh Spero, Spear’s, assuming the role of the CEO of a family office

Panel: Nigel Kershaw, CEO, Big Issue Invest; Dominic Lawrence, solicitor, Speechly Bircham; John Studzinski CBE, philanthropist, Genesis Foundation; Ian Watson, philanthropist, Watson Family Foundation; Alexia Zavos, Socially Responsible Investment, Cazenove Capital

My boss has made £300 million and knows nothing about philanthropy but wants to get involved. What are the first steps?

Ian Watson: He should start by looking at a full universe of options, organisations that would like to have additional funds that are doing good work. But he should start where some passion is.

John Studzinski: I started working in a soup kitchen when I was six years old, so I was told I had to have passions and I quickly learned that a lot to do with life was volunteering one’s time, because time came before one had money to give away. … You’re making an assumption early on that he’s comfortable with philanthropy and one of the things that I’ve seen quite often is many people who have a lot of money don’t necessarily – there’s a lot of people who are not necessarily interested in philanthropy and therefore there’s a way that you have from a risk management point of view to make them comfortable with knowing that it’s okay to give money away.

Then it gets into the whole question of how you give money away. Don’t make the assumption that on day one someone’s going to associate philanthropy with an aspiration. I actually know some very rich people who refuse to give any money away because they’re hoping to move higher in the league tables of wealth, and by giving too much away that moves them down instead of up.

Nigel Kershaw: Sometimes if people are following their passion, maybe they’re following the wrong thing. A lot of people say, “I want to help the poor homeless person on the streets,” and actually it’s an iceberg – underneath that are things about parenting, about anger, about education, about training, about housing, and so part of what we’re trying to look at is to think about what are the causes and how you prevent them, instead of picking off the little things, because there’s often more.

John Studzinski: I think he has to be warned early on that he’ll have lots of people getting at him. He’s going to have lots of requests, lots of wonderful emotional requests, desperate requests, illogical requests, and he’s going to have to figure out a way. He’s going to have to develop his own confidence level and decide how he’s going to go about this and he’s going to have to spend time with other people he feels comfortable. … Hearing about other people’s experiences in philanthropy is an important thing, hearing case studies is an important thing.

Ian Watson: He’ll find that if he tells people he bumps into that he’s interested in giving away money to charity that he’ll have any number of people after him.

How can you remain anonymous?

Dominic Lawrence: It’s one of the uses of a foundation – you can set up your own charitable vehicle and if you want to, you can make it a vehicle to allow you to make grants on an anonymous basis. You can sever yourself and keep yourself behind the screen of the foundation. It’s difficult or impossible for the charities receiving the money to track it back to you. There are loads of others who want to use their foundation for promoting their own name and promoting the fact that they are giving large sums to charity, whether it’s for personal glory or for encouraging the others, maybe a mixture of the two.

John Studzinski: All foundations generally have a set of goals and objectives and if he’s just starting out and doesn’t know his goals and objectives, what does he do? If we were to list him in the Foundation Directory, what would it say?

[The Charity Commission’s Register of Charities] is a fascinating read. It’s a real interested read just to see who’s focused – some charities are very focused on their mission statement and their criteria and others are totally clueless. It looks to see who’s on the board and what they’re doing.

Do you have to have specific aims?

Dominic Lawrence: You need to have thought about what you actually want to achieve. A lot of donors setting out on the path of philanthropy make the mistake of being over-specific about what their foundation is there to do. Once you’ve set the objects of the charitable foundation in the governing documents, they’re effectively set in stone – it’s very difficult to change them, in some cases impossible.

What’s involved in a foundation? Do you have to hire an expensive CEO?

Dominic Lawrence: No, and the Charity Commission would rather you didn’t. It’s set up to receive funds from one individual or a family, normally – it’s a private grant-making vehicle. In this country it’s a company or a trust.

Alexia Zavos: If the foundation will hold funds in excess of the funds needed to meet short term grant commitments you might want to consider hiring an investment manager. There are lots of issues to consider such as the obvious questions around performance consistency, fees, investment process, charity expertise & reputation as well as other areas which you may not immediately think of such as whether the manager offers a flexible SRI approach and to what extent it is embedded within the investment process or do they provide trustee education and can they bring with them useful experience from other similar clients?

What are the tax benefits?

Dominic Lawrence: A foundation gives you the benefits of direct charitable giving but with some added bells and whistles. A particular bell in this context is the ability to make grants to organisations outside the UK because, at least historically, you were only able to get a tax break on charitable gifts to a UK charity. The tax rules in this respect are very parochial.

Alexia Zavos: I read a statistic that only 5 per cent of foundation money is donated internationally, versus 13 per cent of public giving, which I was surprised about, given a foundation’s tax breaks.

How do you – and should you – involve your family? Ian has the Watson Family Foundation.

Ian Watson: We were not seeking to be anonymous!

Why not?

Ian Watson: We felt the charities that we worked with – and we tried to take a limited number where we get hands-on involved – my background is an entrepreneur so I try to apply that same kind of thinking to the charities I work with, so there’s an added value that comes to that charity beyond just the money. From having it as the family foundation, we have a 21-year old daughter, we wanted her to be involved with it. We hadn’t set up the foundation up to go on in perpetuity – we’re set up as a wind-down foundation.

We wanted her to learn about the process of giving money, and giving money with the proper consideration, and giving it so that it’s of benefit to the person receiving it. So having a family foundation is exactly the way to do that, and at 21 she’ll be a trustee. We have Maya Prabhu from Coutts as a trustee, and my wife and I, so she’ll be working with us and over the next few years she’ll be able to learn, hopefully, how to properly and wisely give funds, and then at the time that she’s 35, hopefully she can come in as the managing director of the foundation.

Does it give her more financial sense?

Ian Watson: Yes, because those will be responsibilities that she’ll have and to give her that period of training will benefit her.

Dominic Lawrence: That’s something we’re seeing more and more – charity as a side benefit, as a financial training ground for the next generation.

Why would philanthropists seek publicity?

John Studzinski: My general framework is human dignity, and whether I work with young artists, nurturing them through the Genesis Foundation, or the work I do as vice-chair of Human Rights Watch, or my work with the homeless since I was six years old and helped found The Passage in Westminster in 1980 with Basil Hume, or the work I do with youth unemployment, it’s all relating to dignity and so much of fundraising – I prefer a different term, I call it “outreach” – so much of trust is built on networks of people who understand issues.

I had a dinner at my house two months ago and I got all the people in the British film industry together – they had never sat together – we all sat down and talked about how do we nurture young filmmakers, young directors, young screenplay-writers for the next generation in Britain, and the first reaction was we’ve never got this group of people together and the second point is, What projects can come out of this? What needs addressing and funding?

A lot of philanthropy has nothing to do with money but with leadership and management, and a lot to do with getting the right people in the right place and getting the right cocktail. That’s the most interesting kind of philanthropy, and I do it publicly because I think it’s important because it’s not just about the symbolism of giving money or the symbolism of having a foundation – it’s about bringing people together who know that as a group they can solve problems.

How do you measure impact?

Nigel Kershaw: One of the things that is changing is measuring the impact of what you’re doing. That’s really key, because all of us can tell great stories of people’s lives that have been transformed, and without putting a kind of a matrix over everything where you stifle innovation, there are some very simple things that you can do, that we do – we have a social impact index for any investment that we make, and it could be very simple like how many jobs created. There are things you can’t measure, like human dignity, or forgiveness, in your film [Ian Watson has produced a film called Forgiveness].

Ian Watson: But you can measure how many people are watching.

Nigel Kershaw: And I think you’re seeing that younger generation coming in who are looking at that. If you look at and you then say, “I deliver a hundred million pounds worth of jobs, could I pay my CEO a million pounds to do that?” I think people get fixated on cost and not on what you’re actually achieving, which for me is the key: how you dismantle poverty is the key, and if that costs, it costs.

John Studzinski: We just celebrated our tenth anniversary last January and I could teach a course in great triumphs and great mistakes and where I flushed money down the toilet. I learned that I measure it on the basis of, “Is the right expert leading the project?” We create projects and the output of it is how many people are affected but also the benefits of it. We create what we call the Genesis Network, so someone that we gave money to ten years ago, they’re still part of our network.

We’ve had eight students who’ve got to RADA and to LAMDA who’ve won Olivier Awards who would not have gone to school at all because they got in with no financial sponsorship. We not only track them but we keep them as part of the family because they become philanthropists – they may not have money because they’re young actors but they give time and actually mentor other people. We keep a network of people and projects involved and we don’t let go of it.

Ian Watson: In the most recent project we got involved in, it’s called Partners for Youth Empowerment Global, we discovered it through my daughter, who went on the programme that they have, a week-long camp, that has a very powerful effect, that transforms the lives of the 14-18 year old that do it. The programme was running on the West Coast of the US and the West Coast of Canada, and after hearing about it, I was able to get involved and say, “This shouldn’t be just here, reaching tens of thousands – this should be reaching millions of people because it’s so powerful.”

So we were able to put in money and make a three-year commitment on that money and also go out to raise money, because that’s something a philanthropist can do. We put in funds, I became the chairman, we moved into the UK then into Uganda, Brazil, India, South Africa. We can measure the number of people that go through the programme and they train youth leaders in turn to give the programme so we try to keep track of that too so we can see how far out and what the numbers are from the ripple effect are.

John Studzinski: There’s a parable in the Bible that we know about, about giving someone a fish versus teaching them to fish. I think that’s something relevant in philanthropy – lots of philanthropy can give lots of people one fish, and they can have a lovely meal and that number looks great, it’s a million, but you can also teach very few people to fish and they actually do a great job.

Nigel Kershaw: I think there’s a third bit of that story now. Give them a rod and charge them 10p and then you can afford to make millions of rods to give away – and you’ve got social business.

Dominic Lawrence: How do you measure your impact, how do you get maximum bang for your buck? A lot of it misses the point – a lot of the benefit which can be obtained from philanthropy is intrinsically impossible to measure and ultimately you have to go on your gut feeling – am I doing the right thing here? You just have to accept that sometimes the pseudo-scientific measurement of benefit doesn’t really work.

Nigel Kershaw: Last year our vendors earned £8 million, in terms of the self-help and the dignity they have, because they were earning, not begging, not prostituting. We saw this potential investor and he said, “I don’t want to invest, I want to invest in a hostel, because what I really like doing is going and having tea with the homeless people and relating to them.”

Nigel Kershaw: I said, “I understand that human feeling, but actually your investment could create a Big Issue, then you have to weigh your gut feeling of ‘actually I’ve given and I want to have a direct relationship with somebody’ to what you might be able to create in terms of if you did a Gordon Roddick and seeded a Big Issue. They’re not mutually exclusive but you have to come away from the gut sometimes and say I can be of real value with my money and my skill and expertise.

John Studzinski: You have to be selfish about philanthropy too. We all have to get something out of it personally. This notion – and I’m not talking about public recognition or honours – I’m talking about what do you get out of – I’ve learned a lot from spending 30 years with homeless people, I’ve learned a lot from dealing with human rights, I’ve learned a lot from young artists. I’ve reflected back on myself and what I’ve learned. One has to be selfish in philanthropy and say, “What do I want to get out of this personally?” A lot of people often don’t ask themselves that question.

What do you get out of it?

Ian Watson: I don’t see it as an obligation or a requirement to give, I see it just it’s suggested as human beings that we naturally want to aid others. Philanthropic activity is our nature. I see it not as an obligation but as a gift that I should be acting upon.

Should you support the charity with the lowest overheads?

Nigel Kershaw: A lovely expression was said, “You need your business to be lean, but not so lean it’s anorexic.”

Alexia Zavos: There’s definitely far too much focus on a charity’s admin costs. The general rule is that a charity shouldn’t spend more than 25% of their income on admin yet as there is no official standard about whether to categorise costs as either fundraising or charitable program expenditures it is difficult to draw comparisons. If a fundraiser is paid a large salary but they raise four times that a year, surely it is justified?

John Studzinski: I think it’s less important to focus on costs. One of the great things about philanthropy is that you get access to a lot of experts. If you’re not clear on who are the experts, who are the people that drive that institution, who are the leaders, who are the managers, then you shouldn’t be giving any money to that institution. Normally there’s one or two people that are the visionaries, that are the innovators, that are the change-agents.

I always tie my grants to those people being there, and if they leave I have the right to modify or withhold the grant. So much of it is not about the organisation or the charity but about the leadership or the character embedded in charities.

Does it require you to hire someone to meet all the charities?

John Studzinski: If it’s important to you, you should do it yourself.

Ian Watson: No-one is going to be able to use the judgment and the experience that you have and apply that to the charity you’re considering getting involved with. I usually go as chairman, but there’s a CEO who’s running it full time.

Nigel Kershaw: I have the 6.30 Club. You have, for example, a very successful investment banker, seven to seven o’clock makes a lot of money, a lot of experience and knowledge. Then at 7.01 they come out of work mode and they can go into philanthropy mode. I want people in investment at 6.30, when you can take their expertise and their knowledge and their skills, and perhaps their money, and their heart, in that time at 6.30 when they can push the two together, and that’s when something becomes for me very special. You see people in that middle space that really understand and get it and think they can make a difference because you’re taking all the parts of their life into a wholeness.

What is social investing?

Nigel Kershaw: It goes back to something we said at the beginning about sustainability. If you just go back to Gordon Roddick, he seeded the Big Issue, and we haven’t gone back to him in the second year to ask for more. What we’ve gone back and said is, “This is what we’ve delivered, this is how many vendors we’ve got, this is how much they’ve earned.” So year after year for that one-off investment, we’re going to give you that social return, plus, because we’re a profitable company, albeit we give the profits to our foundation, we’re able to give the capital and a financial return back to the investor.

Isn’t it wrong to make money out of charity?

Nigel Kershaw: From a charitable point of view, it seems counterintuitive. Take the Big Issue again: the greater our turnover, the more social value we’re creating. For us, if you invest in us and we’re able to give you your principal back and a dividend, then that person can decide what to do – reinvest it to create more value, give it out as grant. We can reinvest our money over and over and over to try and convey that the reasons why there are some people on the streets.

Alexia Zavos: Social Impact is part of a key trend in philanthropy which is the shift from purely making grants to using investment strategies to create systemic change. Aligning financial investments with values and leveraging assets has become increasingly possible as the field of SRI has evolved. Do you all remember the scandal about the Gates Foundation in 2007 following an LA Times article which stated that 41 per cent of their assets were invested counter to the foundation’s charitable goals?

John Studzinski: I spent six months of my life working with Mother Teresa. She was fabulous, a bossy formidable woman who got everything she wanted, including once a building from Margaret Thatcher. But she always took the view that the dirtier the money, the better because once it was in her hands, God would bless it and it would be put to good use. She would never ever decline money – she would take money from drug dealers, from all sorts of people who in some respects felt redemption from actually giving her money. This holier-than-thou attitude of not taking money from a prostitute or a drug dealer or a tobacco company or an arms dealer or a defence manufacturer or a politician or whatever, one has to be a bit careful.

Alexia Zavos: The SRI space has developed hugely and now offers a range of investment approaches, some darker green then others. It is now possible to apply SRI solutions to all asset classes without limiting performance. At the very least a foundation should consider the extent to which social, environmental and ethical research is integrated into the investment process. It is not only about protecting the reputation of the foundation but also a way to help identify risk and opportunity.

Nigel Kershaw: If you look at JP Morgan or Carnegie, it’s not just about saying, “Here’s part of my life where I do all sorts of things that could be pretty bad, and I’m going to make up for it in another part of my life and do all sorts of good things.” I think maybe there is somewhere – we’ve just invested in a film company, Sweet Chocolate Films, homeless people making films, and it’s giving us a financial return and it’s giving us a lot of social value. My thing would be let’s have a look at that middle space. You lay a social P&L on all that you do, and it’s not like offsetting.

Questions

Paul Hensby: Should you give to existing foundations? Charitable sector ripe for rationalisation and mergers.

John Studzinski: Sometimes egos prevent rationalisation, and it’s where philanthropists can force, in certain spaces, this consolidation or even within foundations they can force it by making a big grant subject to that condition. There are far too many inefficient NGOs in the homeless space, certainly in North London.

Ian Watson: The biggest example is Warren Buffett deciding not to manage his $35 billion but to give it to the Gates Foundation for them to manage.

Rupert Phelps: Can children be resentful about giving money away?

John Studzinski: I have 43 godchildren, so I’ve had this in spades and several buckets. The smartest thing parents can do is never let their children know how much money they have until at least they’re 30 or 40. The big mistake a lot of parents make is they’re too transparent with a lot of money. The way I’ve seen that dealt with really effectively is the child be given a lump sum of money that they can have as their own private foundation at the age of eighteen or 21, where they can take the income from that and learn to make decisions about what to donate to, how to get engaged, and it’s almost a bit like a laboratory for them to understand philanthropy. I saw this with some children, and by the time they got to 25 or 30, when their inheritance became more of an issue, they had a sense of giving.

Ian Watson: One thing to try and keep any wealth we had a secret until the age of 35 would have been a tough job, I can tell you.

Gina Miller: How do you deal with the disconnect between young people and those who made the money?

Ian Watson: I think that young people, not just if they’re coming from wealth, are much more aware of charitable giving now than was the case in the past. They’re much more open to and it’s easier to encourage it. In our case, the reason we got involved in the PYE charity is because of my daughter – she was the one who brought it to us and now we’re going forward with it. Her involvement in our foundation – it’s not going to be easy for me to give up control – but by having her involved, she’s now wanting the foundation to get involved in the environment more. That’s a cause I have sympathy with but it’s not something we’d contributed to, but as a result of her, that’s something we’re now taking a serious look at.

Alexia Zavos: This is something we are definitely seeing within family trusts as well. Younger beneficiaries have often travelled extensively early on and combined their travel with some sort of charitable work or have seen first-hand the impacts of deforestation for example. This is increasingly translating into questions for the trustees about how these principles and concerns can be incorporated within their family wealth management.

Dominic Lawrence: I would say there were three trends which you could draw out of the involvement in the next generation. One of those is looking at new areas to benefit, like the environment, which traditionally hasn’t been something that has interested the older generation very much. Another is investments and the tendency towards social or impact investment, the double-bottom line.

The last trend is the tendency of charities or foundations to be set up for very short-term objective, an intention to “spend out” within a pretty short period, maybe five or ten years, to achieve the maximum possible impact for current problems rather than this drip-drip-drip approach to philanthropy which previous generations favoured. The next generation of philanthropists are much more keen to expend that capital quickly to achieve the maximum benefit now.

Nigel Kershaw: We’re seeing a number of changes here. We have somebody who chairs their own family office, who works in a private equity office, got the bug about social investment and has come to work for us because she felt that “I could use all the skills that I’ve got and I can do this in a different way than my traditional charity,” although she still does both.

The most interesting thing that happened to me in January is that a guy who’s the executive chair of a multinational electronics company who’s thinking of coming into the fund and said, “I can’t meet you at the moment because my son’s away, he’s at Cambridge, and I want him to come and meet with you because he really wants to learn more about entrepreneurship.” There really is a thing now where you’re seeing a lot of entrepreneurs who are thinking in an entrepreneurial way and aren’t concerned with revolving family wealth generation after generation and teaching their kids about entrepreneurship rather than trusteeship.

John Studzinski: You have to be careful not to mix up good and bad parenting with philanthropy because there are some disasters where people are raising Mommie Dearest, in terms of Joan Crawford and the standpoint of entitlement, where children at the age of sixteen are looking at their mother’s chequebook and hoping she’s dead. That is a different set of issues. It depends on the wealth level, it depends on the parents’ conviction, and how old or new the money is. If it’s new money, then you have to work very hard to incorporate the children into your new set of values that link to philanthropy, and if you haven’t done that then you may well pay the price.

I don’t agree with Ian’s point: I know several people who have done a good job of being very discreet about not changing their lifestyle and kept their asset in the bank so their children didn’t realise that they actually were worth £200 million. I can name one person in particular who until the age of 35 didn’t have a clue how much money he was worth.

Nigel Kershaw: The next gens bring a lot of knowledge and new ways of doing things and that cross-pollination which is going to be immensely important in how we start to dismantle poverty in all the areas we work in.

John Studzinski: If you’re trying to develop a movement, not just entirely for fundraising but for outreach, social media is an untapped tool and you’ve seen the impact of social media on the human rights movement in the form of the Arab Spring and that’s just the beginning.