Charles Saumarez Smith paints a frightening picture about the health of philanthropy in Britain. As I was interviewing the head of the Royal Academy for a film on philanthropy in the 21st century, we got on to talking about what its defining features were – and his answer was worrying.

Instead of talking about private-public partnerships or technology, like most of the other interviewees, he spoke about how the government’s use of the taxation system was helping or hurting – mainly hurting – philanthropy and the cultural sector.

Gordon Brown, he said, liked philanthropy but only ‘as a way of manipulating the financial rules in order to give philanthropists financial benefits through the system of taxation’. The Tory government was avoiding this with a more appropriate response of moral and social ‘encouragement and incentivisation of donors’.

But it was Brown’s £30,000 levy on non-doms in 2007 – which shadow chancellor George Osborne also supported and as chancellor increased to £50,000 – which was doing most harm to the Royal Academy, other museums and galleries, and the charitable sector as a whole. (The Royal Academy is not publicly funded, so it needs philanthropists more than most institutions.)

‘When the new legislation about non-doms came in it appeared not to have an immediate effect, but the reality is it’s quite obvious that a lot of very wealthy people are relocating to Geneva. The reality is it’s very hard to ask someone who’s located in Geneva to give money to a London institution.

‘You could say it’s only 15, 20 people, but if those 15, 20 people are the richest hedge fund people and they’re no longer resident in London that’s going to have an effect – it’s inescapable.’

According to the Financial Times, Saumarez Smith is right that non-doms are being driven away. In the first year when the levy was due (2008/9), 16,000 non-doms left the UK – over 10 per cent of the total. Only 5,400 people paid the levy in the first year.

Saumarez Smith’s tone was even, almost quizzical. ‘The reality is it’s such a small number of people who are hugely wealthy, so wealthy they can give money away without really noticing, if you’re talking about a pool of 35 people and ten of them suddenly decide that for financial reasons that it’s better to live in Geneva, you’re in trouble.’

Most corporate sponsors have vanished – Saumarez Smith named notable exceptions BNP Paribas and BNY Mellon – and government support is draining away from the arts sector: ‘The first decade of the 21st century was a phoney period in which we were still able to live on economic largesse. I don’t think that the current climate, where there’s an inexorable reduction in public expenditure, is going to change.’ It is thus ‘hugely in arts institutions’ and everybody’s interest’ for the government to continue encouraging philanthropy.

The £30,000 levy was created in 2007 so that non-doms resident in the UK for over seven years could continue to take advantage of the favourable arrangement whereby foreign income or capital gains were untaxed as long as they remained outside of the UK. It was increased to £50,000 in the Budget of 2011 and made applicable to those resident in the UK for over 12 years.

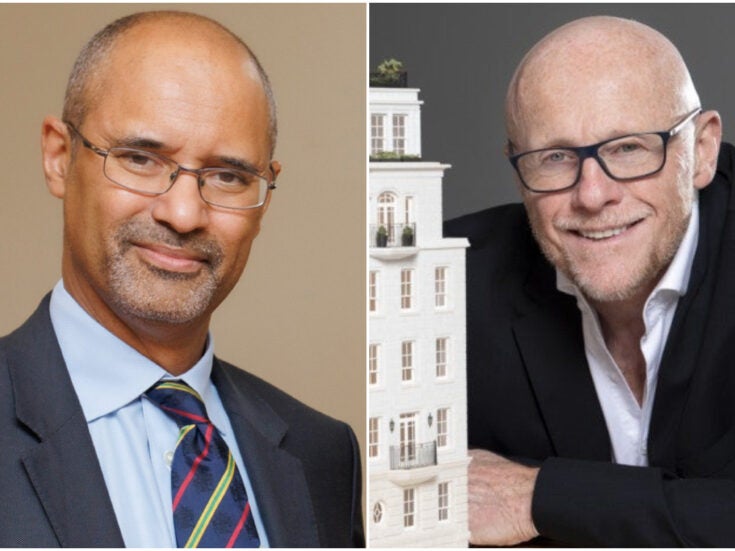

Spear’s is co-producing the film Philanthropy in the 21st Century with Red Sky Vision; it will be premiered online in late Spring. Interviewed for it so far are Culture minister Ed Vaizey, author Michael Green, philanthropist Dame Stephanie Shirley, Stephen Dawson, founder of venture philanthropy charity Impetus Trust, and Salvatore Laspada of the Institute for Philanthropy.

The government is encouraging philanthropy through schemes like Catalyst, which provides matching funds for private donations, and Ed Vaizey told an audience at the Spear’s Talk at the Conservative Party Conference last October that charities could do more to form stronger relationships with donors, but if donors are being driven away, what need for matching or relationship building?