Downing Street’s claim that some philanthropists were using tax relief on charitable donations as a tax dodge has been described as ‘an outrage,’ ‘mind boggling’ and ‘almost frightening’ by philanthropists and their advisers.

The row between government and the charitable sector, which followed the cap on personal tax relief announced in last month’s budget, intensified yesterday when Downing Street claimed that some wealthy individuals were giving to charitable causes as a way of dodging tax.

On Tuesday a Downing Street spokesperson suggested that HNWs ‘may in some cases be giving that money to charities that do not do a great deal of charitable work,’ adding that ‘the system as it stands can be and is being abused’.

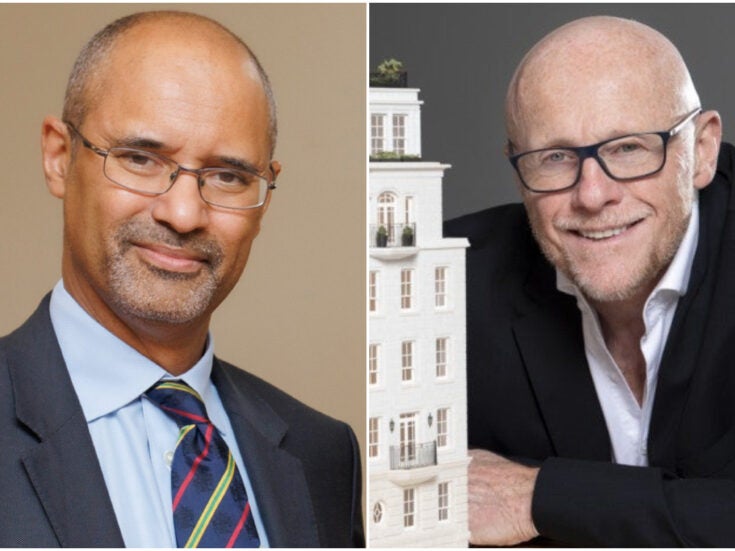

Mike Betesh, founder of family office Generation Three Family Partners, told Spear’s that Government was ‘in effect punishing charities’ and described its attitude towards philanthropy as a ‘disaster’ and ‘almost frightening’.

‘In a country that is so dependent on the private sector’s contribution to welfare, and where there is such a road ahead to reach demand, to put a limit on such demand is absurd,’ he added.

While acknowledging that any tax relief can be open to abuse, he said the government was taking the wrong approach to tackling this, arguing that ‘Yes, for every tax incentive there will be a select number of people who dodge the bullet, who use it for their own benefit alone, but it would be a disaster to limit incentives in this way. Instead the government needs to adopt a tougher stance on regulation, and to be more watchful.’

Richard Ross, who was awarded Spear’s Philanthropist of the Year for his funding of medical research through family foundation Rosetrees Trust, agreed that the government’s response was disproportionate, telling The Independent that ‘they are using a sledgehammer to crack a nut.’

‘There are not enough wealthy people giving to charity and this is giving out completely the wrong message. It is saying if you give away too much we are going to penalise you,’ Ross added.

John Timpson, the founder of Timpson Shoes and also a Spear’s Philanthropist of the Year, offered Spear’s a more moderate response. Some people ‘probably are’ using charitable tax relief as a means of avoiding tax ‘if they are giving money to something that is not a proper charitable cause but nevertheless has charitable status,’ he said. However he believes that the government response is misguided, saying that ‘the government should be tackling the charitable status of these organisations, and not the tax regime.’

The current government response risks ‘catching people who are doing good’, Timpson said, although he added that ‘In difficult times people in the habit of giving might use it as an excuse to stop, but I don’t think it will make a huge difference.’

John Low, chief executive of the Charities Aid Foundation echoed Ross’s fear that the government’s stance appeared to penalise rather than reward philanthropy, saying that ‘we should recognise and celebrate today’s great philanthropists, not brand them as wealthy tax dodgers.’

‘Whoever is advising the Chancellor is quite wrong to equate tax relief on major donations to charity with tax avoidance. This is not a ploy to save tax. Philanthropists who make large donations give away far far more than they could ever claim in tax relief,’ he added.

Those most likely to be affected by the government’s stance on charitable tax relief are not established long-term philanthropists with their own foundations, said Betesh, but the next generation of philanthropists — precisely the individuals that the government should be encouraging to donate.

His concern lies with ‘the next generations of givers, people who are earning £5million or £7million who want to give £1million away, these are the people we really need to encourage, not the seasoned givers who already donate through foundations.’

As of next year, the total tax relief (including tax relief on donations) an individual can claim will be capped at £50,000 or 25 per cent of income, whichever is greater.