A disappointing half-year at the auction house signals to the intensity of competition at the top, particularly with its biggest rival, writes Arun Kakar

Sotheby’s announced their half-year results last week, curiously reporting a 23 per cent rise in consolidated sales alongside a 26 per cent dip in net income compared with 2017. While it might not signal trouble for the world’s second largest auction house, it does reveal the state of 2018’s auction market.

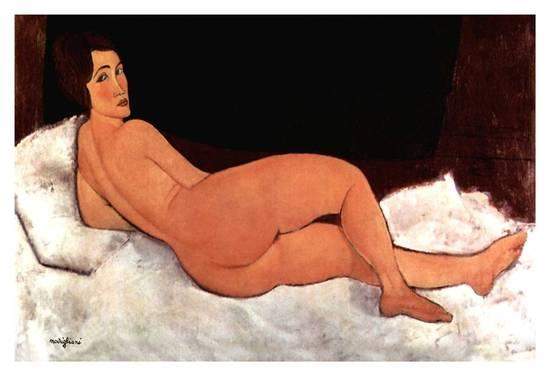

Much of the slump was attributed to the sale of two artworks that were unidentified by the house, but are widely believed to be Modigliani’s Nu couche (sur le cote gauche) and Picasso’s Buste de Femme de Profil (Femme Ecrivant).

The Modigliani, which went under the hammer for $139 million, was guaranteed for $150 million – the highest ever figure to be placed on a painting. It was only the buyer’s premium – the additional percentage charge on the hammer price paid by the winner – that lifted it over the mark to $157 million, a new record for the house. Sotheby’s said that premiums like these ‘negatively impacted’ its results, as they were used to ‘offset’ the shortfall from guarantees and fees.

The Picasso was a more obvious misfire for Sotheby’s. A guarantee of around $45 million was placed on the painting with an estimate at roughly the same price. The painting sold for $36 million, resulting in a loss of around $6-7 million.

Both of these cases point to the intensity at the top of the market to secure the best works for auction. ‘The art market was driven by competitive high-value consignments from fiduciary sources such as estates, foundations, and charities,’ the house said in a statement. ‘Accordingly, when compared to the prior year periods, our auction commission margin was reduced by a higher level of auction commission shared with consignors in these situations.’

Its auction commission margin slipped from 16.3 per cent a year ago to 14.1 per cent in the first half of 2018. ‘Risky auction guarantees and declining commissions are a reflection of how competitive the auction world is with Christie’s and Sotheby’s both vying for the high-value lots that will set them apart,’ Ariane Belisle of AIB art advisory tells Spear’s. ‘Here, Sotheby’s sacrificed profits to secure these consignments. Perhaps, in this instance, it didn’t quite pay off as they had hoped.’

The Sotheby’s results also fall against the backdrop for the best ever half-year figures for rival Christies. This was largely helped by the $835 million Rockefeller ‘sale of the century’, which propelled the firm to a record $4 billion in sales, a 35 per cent rise on the same period last year. The sale generated new buyers and also created new opportunities for engagement: more than 85,000 people viewed the collection when it went on display. Eight in ten of the highest selling artworks sold around the world went under a Christie’s hammer, news which rings in sharp contrast must be difficult when heard against the ‘lower than expected’ quarter at Sotheby’s, which fought its rival for what looks to be the year’s most remarkable sale.

However, there is a silver lining, as within the same report, the auction house describes an influx of clients from the far east. Over a quarter of Asian buyers from the first half of the year were new, accounting for 28 per cent of auction sales, compared to 24 per cent at Christie’s. Sales under in the region amassed $488 million over the same period, up 15 per cent on the year before, with eight of the 20 top lots sold at the Sotheby’s purchased by Asian clients.

With competition looking to further intensify in the top end of art, it looks like Sotheby’s road to redemption lies eastwards, where it also reports a notable uptick of interest in western art.

Arun Kakar writes for Spear’s

Photo credit: Wikimedia Commons

Related

Why change is the only constant for online art

Is it fine wine’s time to shine?