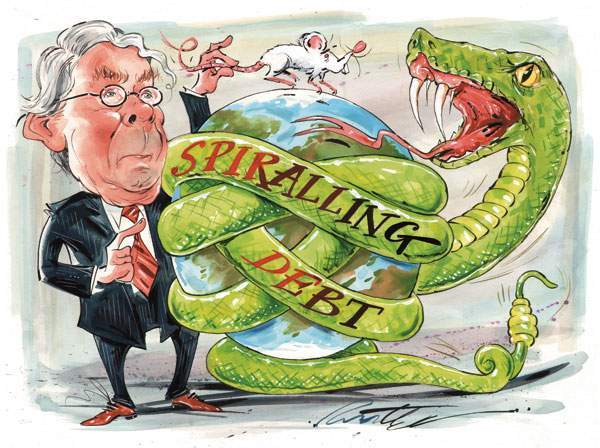

Mervyn King’s ghost is walking the crumbling ramparts of the world economy, thanks to his new book, The End of Alchemy, writes Stephen Hill.

No sooner have we digested Ben Bernanke’s crisis memoirs than we have Mervyn King’s excellent new book, The End of Alchemy, covering the same momentous time. King goes further than Bernanke’s strictly descriptive account of the crisis, however, as he tackles the issues raised by it and looks to an uncertain future.

He signals the end of the easy times of high leverage and QE, and warns instead of the ridiculously high level of debt on just about everything everywhere: on paper, plastic, swipe cards, tag screens, balance sheets, off-balance sheets, mortgage charge sheets, debentures, IOUs, CDSs, ABSs, CFDs, and especially on the ledgers of central banks and national treasuries. Oh, and on bank balance sheets, especially on EU bank balance sheets.

The alchemy has all been used up: global debt now stands at over 200 per cent of global GDP, 265 per cent in the OECD countries, 35 per cent higher than in 2007, according to the Bank for International Settlements (BIS). King goes further than Bernanke as he predicts that a global crash is inevitable in this debt-fuelled world. His prediction immediately begs the question of ‘When exactly?’

On The Andrew Marr Show back in March, however, he decided not to frighten the horses just yet, saying it might be in twenty years’ time. How about three years’ time, or sooner? The world is facing a major write-off situation, within the next one or at most three years. Why do I say this with such confidence? Because a study of the economic cycles, particularly the 19th-century cycle chroniclers, namely Clément Juglar (French — the series of short cycles of nine years, give or take a year or two), and Nikolai Kondratieff (Russian — the long 45/90-year cycle, give or take five years or so) bears it out.

In fact, no sooner had King sent his book to the printers than the shadow of his prediction fell across global markets. When 2015 ended, just about everyone everywhere was expecting the recovery to go on slowly in 2016, but after the global shocks of Q1 nobody seems able to articulate what on earth is going on, let alone what is coming next.

Q1 delivered some unexpected tremors. There was the collapse of the BRICS and emerging markets, who had gone on a $3.3 trillion debt binge after the crisis, following just a minor tightening of the Fed’s monetary policy by 0.25 per cent. The ongoing problems in the eurozone were compounded by rumours (not denied specifically) that Deutsche Bank’s swaps and derivatives book was out of control by enough to wipe out (or swipe out) the bank’s capital. There was the negative interest rate on gilts and other nations’ debt instruments. The migration crisis in Europe has shattered the Schengen Agreement. The threat of Brexit loomed. There were problems in China, as it makes a major gear-change, downgrading growth. And above all, there was the lack of a robust recovery in the US. These shocks have been amplified because we are battling strong headwinds of outlandish debt.

The big trouble with debt is it has to be repaid, and interest paid on it — or, if it’s a bad debt, written off or restructured, which amounts to much the same thing: national debts are continually being restructured by just being inflated away into the future, as it was assumed that a little bit of inflation does the economy good. Unfortunately, it’s now deflation that has replaced inflation, however, and no one seems to know how to get back to just 2 per cent so-called ‘core inflation’. So discreet national debt restructuring has come to a squeaky full stop: repayment looms, as interest rates edge up in 2017.

Banks that get into a bad debt situation may be ordered, like the Cyprus banks were ordered by Germany, to administer haircuts to their shareholders or (wait for it) blameless depositors, who have no choice in this over-borrowed world other than to forfeit assets, or they’ll have to declare bankruptcy. Individuals, likewise, can go for a voluntary arrangement with their creditors in most Western countries or declare bankruptcy, whichever is best for them.

If Mervyn King has a favourite word to sum all this up, it is disequilibrium: between those countries who claim that they’d be all right if everyone else’s GDP were normal; between unsustainably high and low government and consumer expenditures, between high and low exchange rates, ditto taxes, debt levels, and interest rates and productivity levels between different countries. King is hinting at the need for managing the whole global economy — of actually giving the G7 and 20 something to do! In recent years, short-term measures by individual countries to bolster economic performance and market confidence in their own economies have only perpetuated the underlying disequilibria. So now we have underlying and overlaying disequilibria to heighten the disparate crisis points.

King draws a distinction between central banks dealing with liquidity issues (which is their key function) and insolvency issues (which should be beyond their capability, and require restructuring and reform). Bernanke came to a similar conclusion, which he labelled as the distinction between the financial crisis which gave way to the economic crisis, as he tacitly admitted that US QE I fell into the former category; QE II was financed internally within the Fed’s own balance sheet and was therefore valid and neutral; but the much bigger, open-ended QE III was to deal with the economic crisis, as Congress failed to take any complementary fiscal action. So the hidden cost for QE III is in the post. It seems that King can see a need for formal restructuring here, but he doesn’t put it into words.

King concludes that the central bankers now find themselves ‘in a prisoner’s dilemma’ — unable to raise rates for fear of slowing what little growth is left, and causing another downturn. This dilemma, in the Mervyn King script, ‘has only perpetuated the underlying disequilibrium’. Yes, that disequilibrium has been ‘underlying’ the economy since the liberated and leveraged madness of the Eighties, Nineties and Noughties ended in the global credit crunch. Governments had joined in the debt game as well, aided by the central bankers’ ability to create endless money, as the politicos leveraged up on the tax-take of whole nations — none more so than the US with Obamacare. Then governments didn’t listen to central bankers’ calls for fiscal measures to match their monetary policies, to balance out their economies.

‘Only a fundamental rethink of how we… organise our system of money and banking will prevent a repetition of the crisis. Without reform of the financial system, another crisis is certain, and the failure… to tackle the disequilibrium in the world economy makes it likely that it will come sooner rather than later,’ King concludes. He sets out on his fundamental rethink on money, banking and the future of the global economy by looking for new tech to drive the future, but when he can only see stem cells and biotech on the horizon, he rather dejectedly leaves this major task to the next generation of economists.

The problem with ‘fundamental rethinks’, however, is that they are based on the latest experience and rarely work. Rodin’s sculpture Le Penseur is seated, contemplating the middle distance of his fundamental rethink — but when his fundamental rethink is over, he stands up and his own fundament falls off! The trouble for King’s final call is that it is often events that seem to cause new economic reactions and thinking, born of dire necessity, not fundamental rethinks driven by the last crisis. As Mark Twain observed: ‘History does not repeat itself, but it rhymes.’