If there were 68,800 non-doms in Britain in 2021-22, how many, Hedgehog wonders, will there be on 7 April 2025, when the new residency-based tax system comes into force? ‘I wouldn’t be surprised if it was half that number,’ declares Camilla Wallace, senior partner of Wedlake Bell.

But where are our non-doms going? To Italy (which, despite doubling its flat fee for non-doms, is holding up), Spain with its ‘Beckham’s law’, as well as Switzerland, Monaco, Miami and the Channel Islands. However, Wallace confides: ‘Dubai is super popular… I would say it’s Italy for the financiers and Dubai for the entrepreneurs.’

[See also: Flight risk: Britain’s super-rich are on the run]

Ayesha Vardag, president of law firm Vardags, who bases her business in Dubai and has a spectacular home in Florence, coos that UHNWs are attracted to the ‘glitz and glamour’ of Dubai, the culture and romance of Italy and the golden village-to-beach existence of Monaco. She adds: ‘Paying over half one’s income or capital gain on [a] corporate sale for the privilege of living among England’s dark Satanic mills – why would anyone want that?’

Presumably that’s a question that chancellor Rachel Reeves will answer when she delivers her Autumn Budget on 30 October.

[See also: New regime, new taxes?]

AI threat

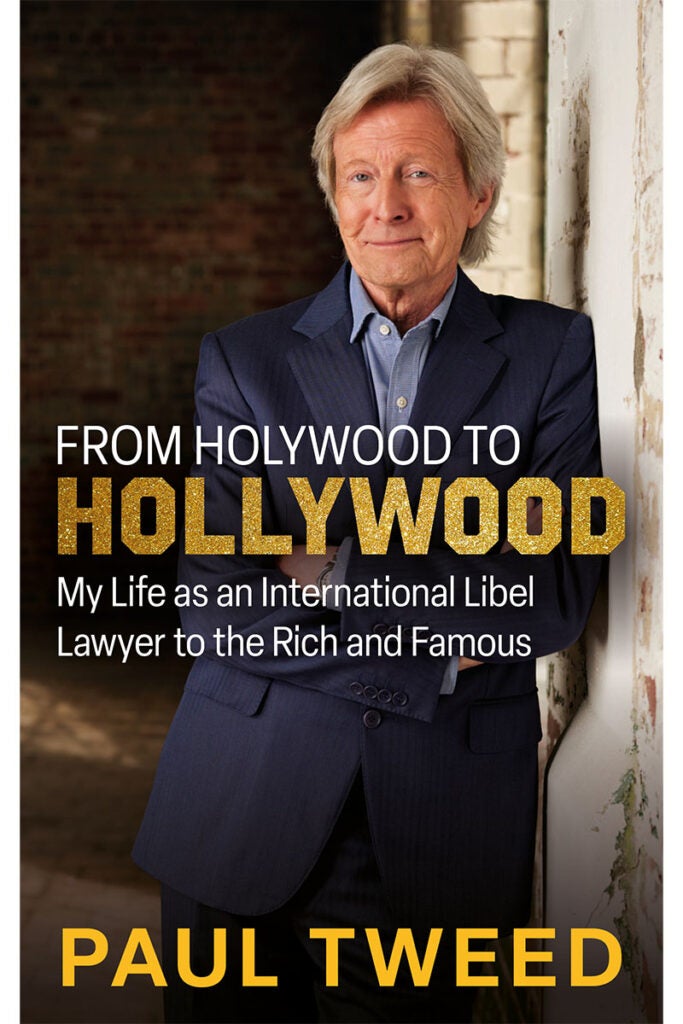

From Holywood to Hollywood, privacy and media lawyer Paul Tweed’s new memoir, is also a rallying cry over the dangers of AI.

The Ulsterman in LA tells Hedgehog that ‘the whole modus operandi of the family office, no matter where in the world, is privacy, confidentiality and low profile. When AI comes into play, it is going to be exceptionally difficult to maintain that position. I see big challenges facing HNWs and their family offices.’

[See also: Family offices bet big on AI – but fail to adopt the technology in-house]

Chiefly there’s the danger of AI cloning of the principal and the distribution of fake footage of them on social media, says Tweed, whose clients have included Britney Spears and Liam Neeson. ‘The riots that have taken place in the UK are a prime example of how disinformation spreading on social media can cause mayhem.’ HNWs, take note.

Points make prizes

First the FTSE 100 blasted through the 8,000-point barrier in April. Then in August AstraZeneca became the first UK-listed company to hit a £200 billion valuation. Days later, London shrugged off market volatility starting in the US that wiped $1 trillion off New York’s seven biggest stocks. So what’s going on? Is London’s lacklustre capital market finally getting its act together?

[See also: The untold history of women on Wall Street]

‘The fact that it showed less volatility during that summer squall than the US helped to restate its value claims and certainly made people wonder whether some of the vices it’s being accused of – a bit stodgy, a bit lacking in tech – were actually potential virtues,’ notes Russ Mould of AJ Bell.

So what next for the Footsie? Consider London’s price-to-earnings ratio of 12 versus 22 in the States, says the market-watcher: ‘There will be a lot of people who will be looking for the US multiple to come down and for the UK multiple to creep up.’ On current forecasts, if that earnings ratio reached 14 the FTSE would hit 10,000.

Going for the privates

With two schools already closing because of Labour’s imposition of VAT on the sector, education consultant Matthew Goldie-Scot is clear that the tax grab is nothing short of a naked attempt to destroy the sector by pricing out the British middle classes.

[See also: Privately furious: Top independent schools braced for Labour’s VAT grab on fees]

‘If you’re an international family looking at Institut auf dem Rosenberg and Le Rosey alongside Hurtwood House, Eton or Winchester, the money’s probably not the issue,’ confides Goldie-Scot. But, he adds, international parents won’t want to send their scions to a British school without any British children in it. ‘If the British middle classes are squeezed out to the extent that the institutional memory and the British nature of the schools is eroded, you will see a disincentive to enrol your children there.’ Maybe that’s the plan.

Towering bills

Having paid royally for HSBC’s iconic tower at 8 Canada Square in Canary Wharf in 2014 – £1.1 billion changed hands for the building in the halcyon days before Brexit, Covid and hybrid working – the Qatari Investment Authority is facing a bill of up to £800 million to convert it from a single-occupancy 42-storey office block into an attractive place for mixed residential, leisure, retail and commercial use after the bank leaves in 2027.

With the Wharf’s occupancy rates plummeting to 85 per cent, one real estate expert whispers: ‘Even if they pull it off, it’s hard to see how the Qataris will ever get their money back.’

Saving the seas

Serbian conceptual artist Marina Abramović – the so-called ‘grandmother of performance art’ – has donated a photograph of her Performance for the Oceans (2024), which was filmed on a beach at Fire Island in New York in May, for auction at Christie’s in October. Proceeds are going to nautical conservation foundation Blue Marine, which is working towards protecting 30 per cent of the world’s oceans by 2030 (8 per cent is protected so far).

‘We have seen increasing numbers of artists grappling with the issue of climate change and the biodiversity crisis – the loss of nature through human abomination, greed, and stupidity,’ says Blue Marine’s CEO Clare Brook. As well as Abramović, the charity’s backers include yacht mogul Peter Lürssen and CVC co-founder Rolly Van Rappard – but the question remains, how much money do they need to achieve ‘30 by 30’?

‘Our turnover is £11 million and we’re hoping to grow that in order to deploy as many leading experts in this field to secure 30 by 30,’ says Brook. ‘If we get close to £20 million turnover, then we can be really effective in achieving this target in the run-up to 2030.’

Dig deep now.

Nammos on manoeuvres

Mykonos hotspot Nammos – the beach club of choice for boldface names such as Kendall Jenner, Bella Hadid, Leonardo DiCaprio and, er, Philip Green – is not content with having spawned the highest-earning restaurant in the world, Nammos Dubai. The brand has branched out into hotels, opening its first this summer on the Greek island where it all began in 2003.

[See also: Nammos Dubai was a turning point: Petros Stathis on his philanthropic journey]

Alfredo Longo, CEO of Monterock International, the firm that co-owns the Nammos business as well as assets including the Aman Venice hotel, tells me that the new 29-key Nammos Hotel Mykonos is just the start. Resorts will be added in the Maldives and Saudi Arabia in 2026 – both already under construction – with a third landing in Abu Dhabi in 2027. But, insists Longo: ‘Most of all, we don’t want to dilute the brand through over-expansion. We want to keep it in a level that is not overdone.’

So how many more hotels will there be? ‘I would say we will have these three resorts for sure, most probably another two, maximum – three from the other side of the globe. Maybe we will look at something in the Seychelles, America, South America, and then we will be done.’

This feature first appeared in Spear’s Magazine Issue 93. Click here to subscribe.