Bayswater window

For decades it has been among zone 1’s least-loved districts, but could this be the year Bayswater is reborn as a super-prime hotspot to rival Knightsbridge and Mayfair?

Already, on the corner of Bayswater Road and Queensway overlooking Hyde Park, we’ve seen the arrival of Park Modern – a £450 million, 57-apartment block from Fenton Whelan, beneath which sits a new Jeremy King restaurant, the Park, opening in May.

[See also: Jeremy King is back to reclaim his crown]

Now the former Whiteleys shopping centre on Queensway is reopening after a £1.2 billion Foster + Partners makeover. The first apartments were handed over to buyers in March, and I’m told that already 90 of its 139 residences – worth a tidy £600 million – have been sold. All will be finished by the end of September, says the man behind the development, Marcus Meijer, CEO of real estate investment firm MARK, which bought the ailing shopping centre from insurer Standard Life in 2013 (before going 50:50 on the deal with CC Land in 2019). In 2018, Finchatton was appointed development manager.

Meijer is convinced that by the end of the year – when the barefoot luxury Six Senses hotel is open at the Whiteley, with spa and wellness facilities for residents – Bayswater will be back.

[See also: Neighbourhood watch: where the super-rich really live in London]

‘In the next six to 12 months you will really see the transformation,’ he says. ‘Our dream is not to make it into Mayfair or Knightsbridge, but to make it into more an extension of Westbourne Grove. That has a charm that more and more people are looking for.’ Meijer, a long-time resident of Notting Hill, which he compares to New York’s West Village, adds: ‘It doesn’t matter how wealthy you are or where you come from, but everybody walks around Notting Hill in sweatpants and sneakers. It’s a more lifestyle-orientated luxury, rather than luxury for luxury’s sake.’

Lucky number seven?

With a combined stock valuation of around $13 trillion, the ‘Magnificent Seven’ – Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and Tesla – now account for 30 per cent of the S&P 500. Unsurprisingly, many wonder how long the good times can last. Don’t forget that in the 1960 film only three of the gunslingers survive.

AJ Bell’s Russ Mould notes that similar stock bubbles in 1967-68, 1972-73 and 1998-2000 all ended in tears. ‘No one rang a bell when it was time to get out, and anyone who just held on finally had to give way to the market’s Cassandras,’ warns Mould. Hedgehog Investment Partners would tell its clients – if it had any – to stick their accrued winnings in their hat and walk briskly away.

Grey times

For all that the UAE will be celebrating its removal from the anti-money-laundering Financial Action Task Force’s ‘grey list’ – Amer Malik, head of Middle East International at Lombard Odier, tells me it’s a ‘strategic win’ for the country – don’t expect the floodgates to open just yet.

‘Remember the UAE is a tale of two extremes – Captain Mainwaring in Abu Dhabi and the younger Del Boy brother in Dubai, who they periodically have to bail out,’ one seasoned money watcher tells me.

‘Dubai is already a major hub – especially for China and Russia. The interesting thing will be if the calmer elder statesman of Abu Dhabi becomes more significant.’

Brassing off

‘I am never one to blow my own trumpet,’ wrote self-declared ‘#MrSuperPrime’ Daniel Daggers in the Times in February. Really? Actually, Daggers had written the word ‘wink’ in brackets but it fell foul of an editor’s delete key.

When asked about trumpet-blowing, Daggers tells Hedgehog: ‘We don’t seem to flinch when corporates do it. What’s 30 offices around the world with countless shop windows and weekly press adverts headlining achievements if it’s not blowing a trumpet? That’s half a brass band!’

Pepping up Sale e Pepe

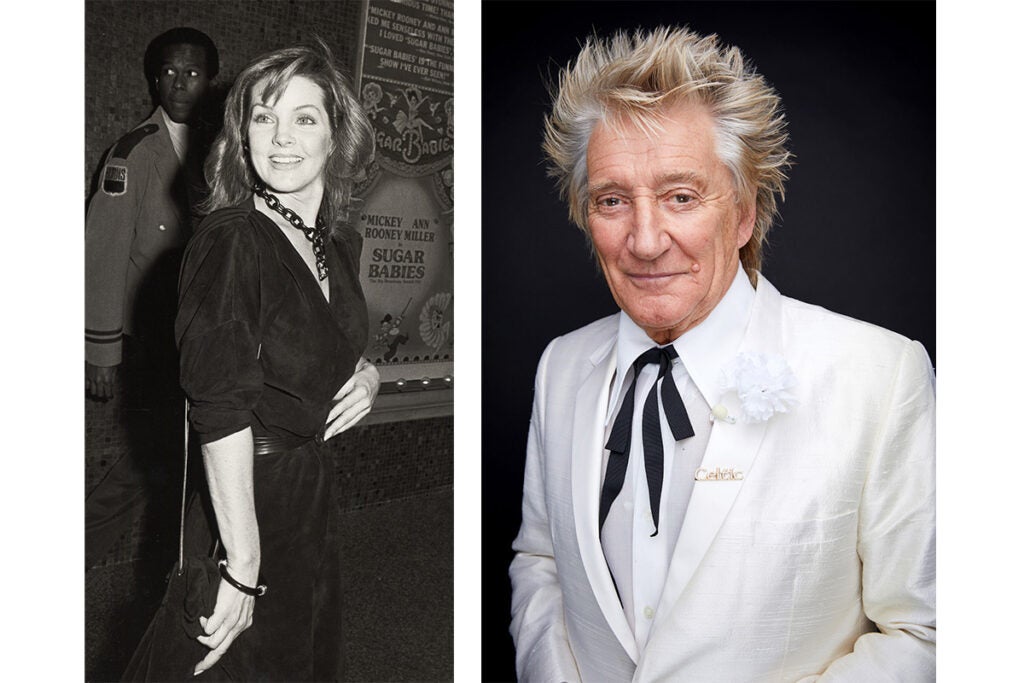

Celebrating its 50th birthday this year with a massive refurbishment under new ownership is Sale e Pepe, the Italian restaurant on Pavilion Road in Knightsbridge which has fed the likes of Ringo Starr, Rod Stewart, Sir Roger Moore and Priscilla Presley. Now part of Markus Thesleff’s dining and bar empire – his concerns include Notting Hill’s Los Mochis and cocktail bar Viajante87 – it has reopened.

‘The vision really was to take this old dame and bring her back to her former glory,’ says Thesleff. ‘As we got into the site we realised this thing hadn’t had much love in 50 years structurally. We decided we needed to fix the electrics, the plumbing, [to put in] a brand new kitchen. It became a much bigger project than initially anticipated, most of which nobody will ever see.’ So how over budget did he go? ‘We spent £250,000-300,000 less than my worst-case scenario,’ confides Thesleff, who adds: ‘My top-end number was going to be £1.5 million all in. We’ve spent £1 million plus change. That’s not bad.’

Name dropper

New C. Hoare & Co. partner Abigail Malortie – only the 52nd since 1672! – has to go back through her family 200 years to find a previous partner at the private bank. That was Henry of Mitcham, a partner from 1777 to 1828 who married one Lydia Malortie. Since then the Malortie name has cropped up as a middle name – until she made a bold decision to drop the Hoare.

[See also: C. Hoare & Co. appoints 10th generation family member as newest partner]

‘It’s not the easiest name to have when you’re growing up,’ she says. ‘Obviously when I made that choice I had no idea that I was going to end up as a partner of the bank.’

Trouble in clubland

News that Chief, the American women’s private members’ club that opened last year in Bedford Square, is closing down comes hot on the heels of the announcement that the House of St Barnabas was also closing with immediate effect (blaming too many ‘rainy days’).

[See also: London’s best private members’ clubs: the definitive list]

Meanwhile, even Soho House, that titan of international clubland, is having problems. Nick Jones’s behemoth put a cap on new memberships in three cities amid complaints about service and the fallout from a scathing report on the firm by GlassHouse Research.

So what’s going on?

‘It’s not that unusual,’ opines one phlegmatic watcher of clubland. ‘Ninety per cent of London clubs have gone bust – there used to be 400 historic London clubs; there are now 40.’ However, with around 100 clubs in all of London – including 60 newer ones such as the Groucho, 12 Hay Hill or 5 Hertford Street, the scene has arguably rarely looked rosier.

‘We’re clearly in a recession, but on the other hand interest has not been this big for decades – even centuries,’ says my club bore.

This feature first appeared in Spear’s Magazine: Issue 91. Click here to subscribe