There have been increasing calls for a renewal in our culture of giving – not least by prominent donors in a letter to The Times commending our philanthropic past, and the culture secretary recently saying we should ‘be unashamedly positive about philanthropy’.

Acknowledging and celebrating charitable giving could help to grow the number of people giving and the amount given, which we know is needed. Our research at the Charities Aid Foundation (CAF) increasingly suggests that fewer people are giving regularly, their average age is rising, and donations are being eroded by inflation.

[See also: The best philanthropy advisers for high-net-worth individuals]

The last few years have seen numerous global challenges come to the fore with conflicts emerging, the climate crisis increasing the risk and severity of natural disasters, and a difficult economic outlook for many.

In the face of these challenges, philanthropy is something that I feel hopeful about.

But collectively we tend to view philanthropy with suspicion. A case in point was provided by the news that Netflix co-founder Reed Hastings donated $1.1 billion, or 40 per cent, of his stake in the business to charity. Unfortunately, and seemingly inevitably, negative headlines followed.

Philanthropists under the spotlight

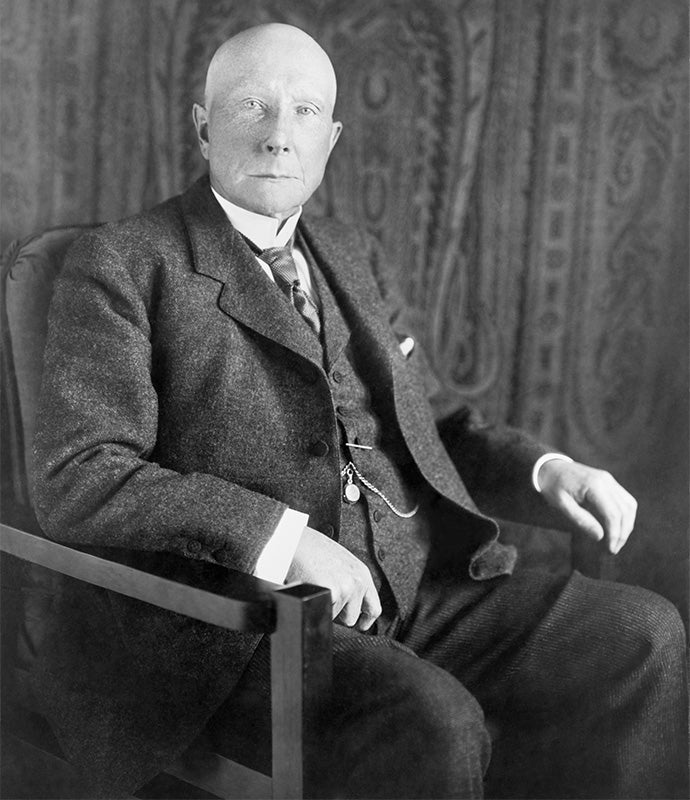

Scrutiny is to be expected. Critics have questioned philanthropy since its origins, and why the wealthy can decide how their funds are distributed, seemingly without accountability. Famous 19th-century philanthropists Andrew Carnegie and John D. Rockefeller faced criticism despite their unprecedented generosity. Their wealth was seen to have been made at the expense of others, namely, their employees, and questions arose about the ethics of distributing money to charities, instead of raising the wage of their workers.

[See also: Impact Award winner James Chen on taking ‘big bets’ in philanthropy]

However, the details about Hastings’ gift are important. His donation was made to the Silicon Valley Community Foundation, which provides expertise and grant-making services for donors to manage their charitable giving, usually to benefit local causes. Community Foundations, much like Donor Advised Funds (DAFs), provide an accessible alternative for donors to create their own charitable foundation, and ideally contribute to more strategic and impactful giving by granting to projects intended to make a real difference. Moreover, seeking the advice and guidance of a well-established and reputable nonprofit organisation, rather than going it alone, should be welcome.

Despite the usual headlines about tax, giving money away does not put philanthropists in a more favourable financial position. Even with income tax relief applied to charitable gifts, the donor is still giving up more than they gain. Secondly, in countries like the UK and USA, income tax relief applied to eligible charitable donations is a legitimate incentive by governments to encourage philanthropic giving and stimulate public good by private funds.

[See also: Lady Edwina Grosvenor on drugs, justice and keeping non-violent women out of prison]

Another criticism often levelled at philanthropy is about the privacy of donations. It’s true that many wealthy and high-profile donors sometimes choose to give through DAFs and community foundations to retain their anonymity. Importantly, funds that have been donated in this way have crossed the charitable threshold and must be used for charitable purposes. Donations cannot provide any kind of benefit to the donor or those connected to them and can never be returned to the donor. Therefore, since donations made must be used within strict charitable parameters (as opposed to donations to lobbying groups or political parties which do not offer the same tax relief) and understanding that philanthropy is a personal endeavour; should donors not be allowed to support causes they are passionate about without publicly announcing who receives their gifts?

And finally, whatever we think about the way wealth is distributed, surely it is to be celebrated that many individuals with wealth seek to distribute it for the benefit of others, rather than purely preserve it for themselves.

We should ask ourselves, what if these people did not give their money away at all? To tackle the societal challenges we face, we will need more people with wealth to invest in charities and social change. Founders at Patagonia, Bloomberg and Netflix, disrupted the status quo in their industries. Their landmark pledges to give away their profits to charity can help to bring about meaningful change, but they also offer the chance to disrupt the way we think about philanthropy, which is something I hope is acknowledged in the future.

Joe Crome is Head of Business Development and CAF American Donor Fund at the Charities Aid Foundation (CAF).