Despite the risks and huge outlays involved, buying football clubs has never looked more attractive to billionaire investors. Lawrie Holmes explores the magnetic appeal of the beautiful game.

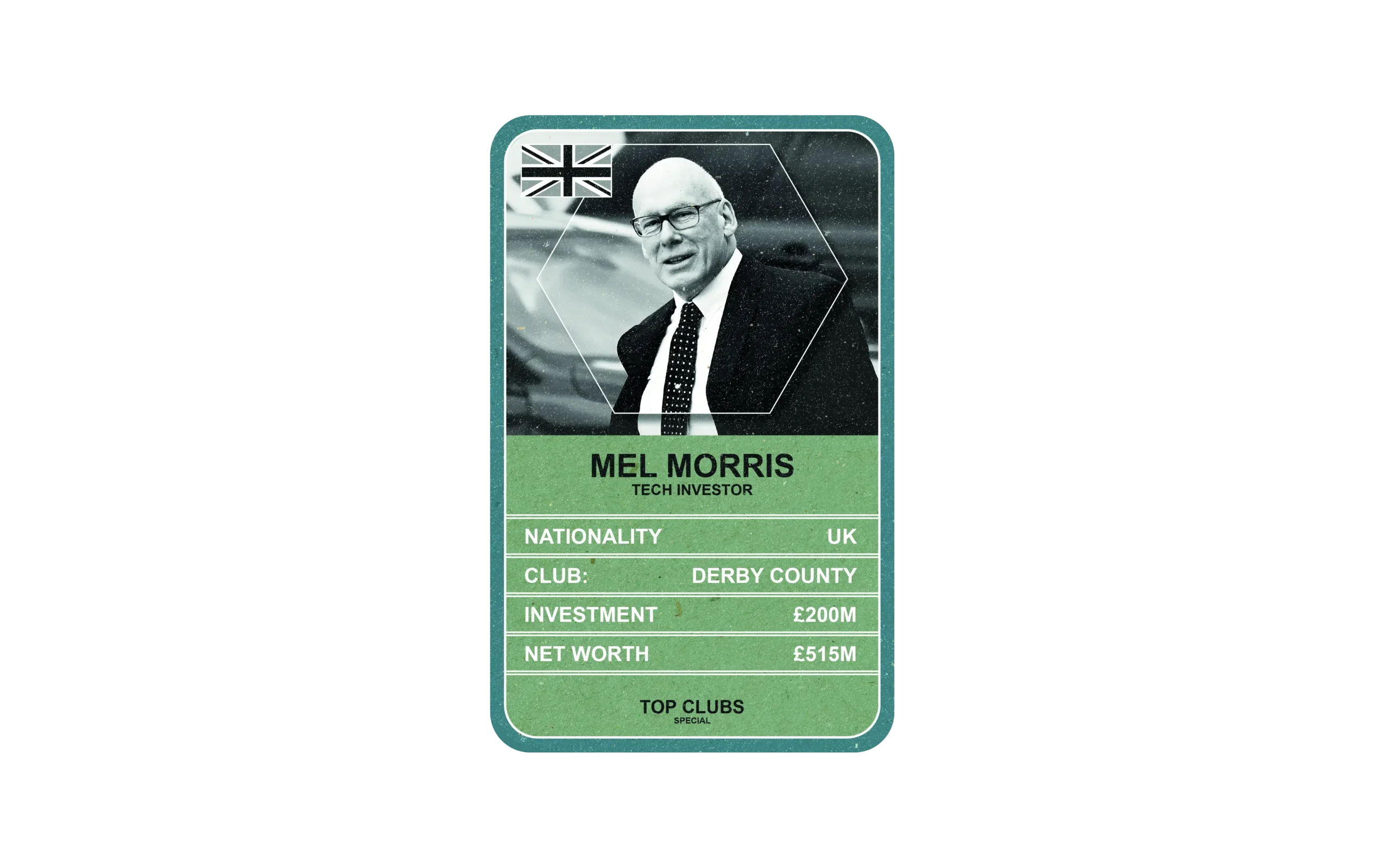

On a warm August morning in 2019, Mel Morris, the owner of Derby County Football Club, felt as if he was on top of the world. Outside the club’s gleaming 30,000-seater stadium he joined fans to pose for a picture, beaming with pride. Wearing a dark suit, white shirt and tie, he looked like he meant business, despite his friendly banter.

His team had just signed England’s most prolific goalscorer, Wayne Rooney – who had agreed to join as player-coach a few months later – as the club prepared to battle for promotion to the Premier League, the sport’s richest domestic competition.

It is an image that I have considered often over the past two and a half years as the club has lurched from one disaster to another and Derby’s efforts to win promotion crashed and burned. Morris and I spoke frequently over that period, often after the latest setback to bedevil the club.

Despite throwing vast sums at a seven-year campaign, Morris failed to secure promotion to the Premier League. Having been powerless to prevent injuries to star players, or the poaching of manager Frank Lampard by Chelsea, Morris finally called it a day last September after Covid had laid waste to two seasons’ revenues. By then the technology investor, who was an early backer of the online game Candy Crush, had lavished the best part of £200 million on the club, putting a significant dent in his personal wealth, estimated at £515 million by the 2020 Sunday Times Rich List.

The salutary tale of Mel Morris and Derby County, however, is not unique. He is just one in a long line of football club owners to have thrown good money after bad in the hunt for glory. Still, though, very wealthy people continue to be drawn to the beautiful game.

The era of billionaire football club owners

Almost 20 years after Roman Abramovich swooped on Chelsea, buying the west London club for a reported £140 million and launching a trend for the super-rich to inject vast amounts of wealth into Premier League clubs, the club can look back on a highly successful period, despite the ignominious way the Abramovich era is now coming to an end. It has won every available trophy and currently holds the Champions League and the World Club Cup.

Since then, major football investors have arrived from every corner of the world, with a range of different motivations and expectations. The most recent, at the time of writing, is Serbian media magnate Dragan Solak, who came up with £100 million to acquire Southampton from its Chinese owners in January. But entrepreneurs from all over the world have been tempted by the opportunity and excitement of the Premier League.

In 2021, Gino Pozzo, the son of Italian businessman Giampaolo Pozzo, who had sold the family’s toolmaking firm Freud, descended on Watford. His countryman Andrea Radrizzani, who amassed his wealth through investment firm Aser Ventures, acquired Leeds United in 2017. A year earlier, British Iranian steel billionaire Farhad Moshiri completed a takeover of Everton. There has also been plenty of stake-building that may or may not lead to a full-scale acquisition, such as Czech billionaire Daniel Kretinsky’s stake in West Ham United and the share of Leeds United held by the York family, which owns American football team the San Francisco 49ers.

Despite the fabled Premier League and FA Cup wins of Leicester City, owned since 2010 by Thailand’s Srivaddhanaprabha family of the King Power duty-free brand, few Asian business titans have found success in European football. That hasn’t prevented a recent influx of Chinese buyers, however, buoyed by premier Xi Jinping’s encouragement – and his view that Chinese ownership of Western clubs could boost the Chinese national team. It was Gao Jinsheng, the founder of Lander Sports Development, which constructs and develops sports sites, who acquired Southampton in 2017 before selling to Solak. Wolverhampton Wanderers, meanwhile, have been turned into a competitive outfit thanks to hundreds of millions invested by Fosun Group chairman Guo Guangchang, who has made billions from investing in insurance, pharma and property.

Italy’s Inter Milan, which is about to be sold, is the most high-profile of many European clubs that have seen huge sums of Chinese money pumped into them. In 2016 electronic retail giant Suning Holdings, which was headed by Zhang Jindong, bought close to a 70 per cent share of Inter for €270 million, which enabled the club to win Serie A last year, the first time for more than a decade. But current ownership of the club (which was joined by a minority stakeholder, Hong Kong private equity firm LionRock Capital, two years later) may change soon. Reports suggest the owners are keen to sell at least part of the club.

There’s certainly no shortage of individuals lining up to buy. My own experience attests to this. A decade ago I was asked to help find the buyer for a Premier League club that had fallen out with its advisers. A call to an intermediary turned up three billionaires from football-mad Mexico, who then baulked at the prospect of having to negotiate with the belligerent owner.

Investment in football: states vs private equity

Perhaps the biggest impact on the top flight has been made by Middle Eastern states and wealthy individuals from the Gulf. Sheikh Mansour, deputy prime minister of the United Arab Emirates and half-brother of UAE president Khalifa bin Zayed Al Nahyan, started things off in 2008 by sinking some of his fortune of over £20 billion into Manchester City through holding company City Football Group. Paris Saint-Germain was bought three years later by Qatar Sports Investments, a subsidiary of the state-run $300 billion fund Qatar Investment Authority, with former tennis player Nasser al Khelaifi being made president of the club.

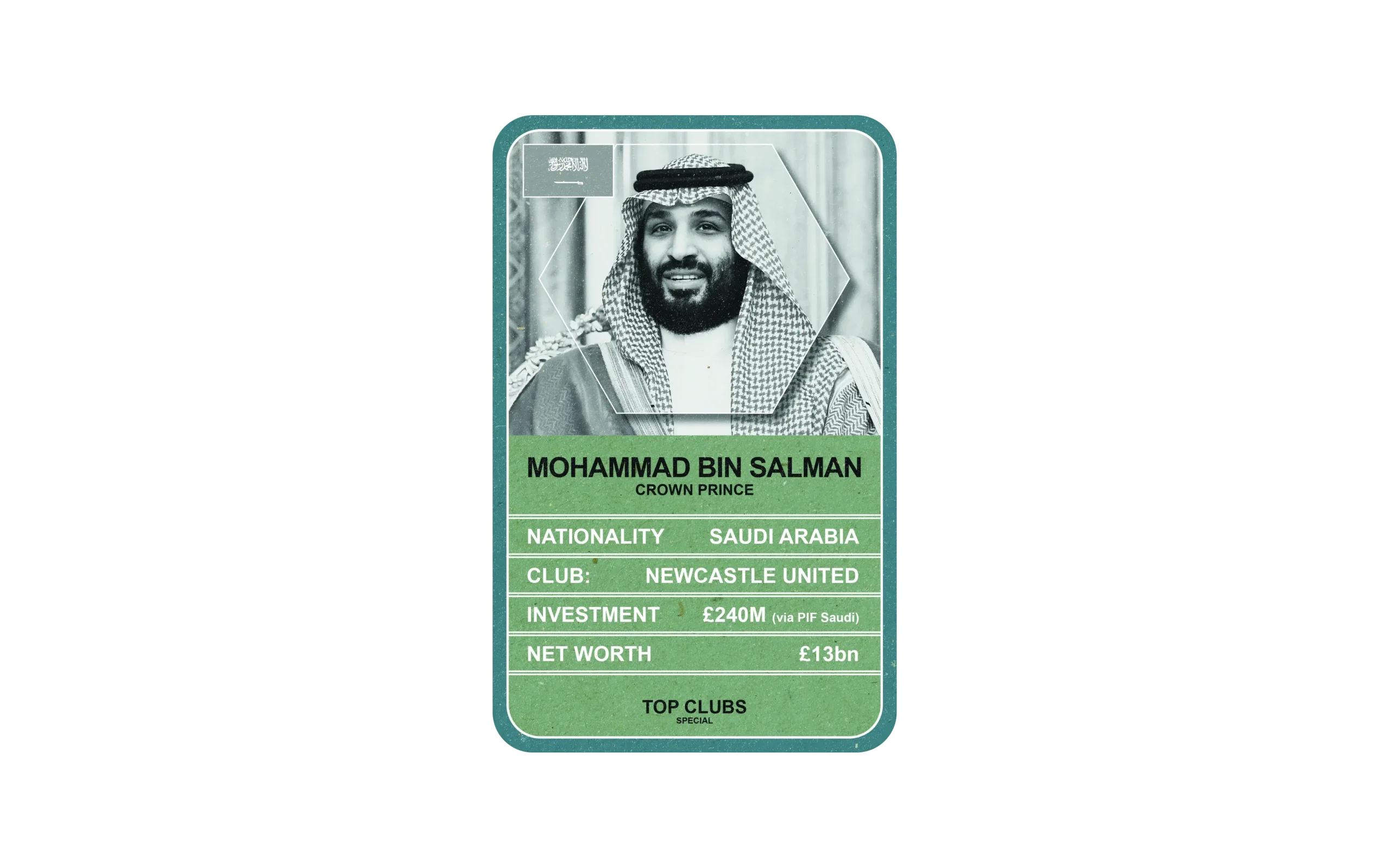

Then, last October, Saudi Arabia’s Public Investment Fund acquired 80 per cent of Newcastle United, with large minority stakes acquired by the metal tycoons David and Simon Reuben and by Amanda Staveley’s PCP Capital Partners.

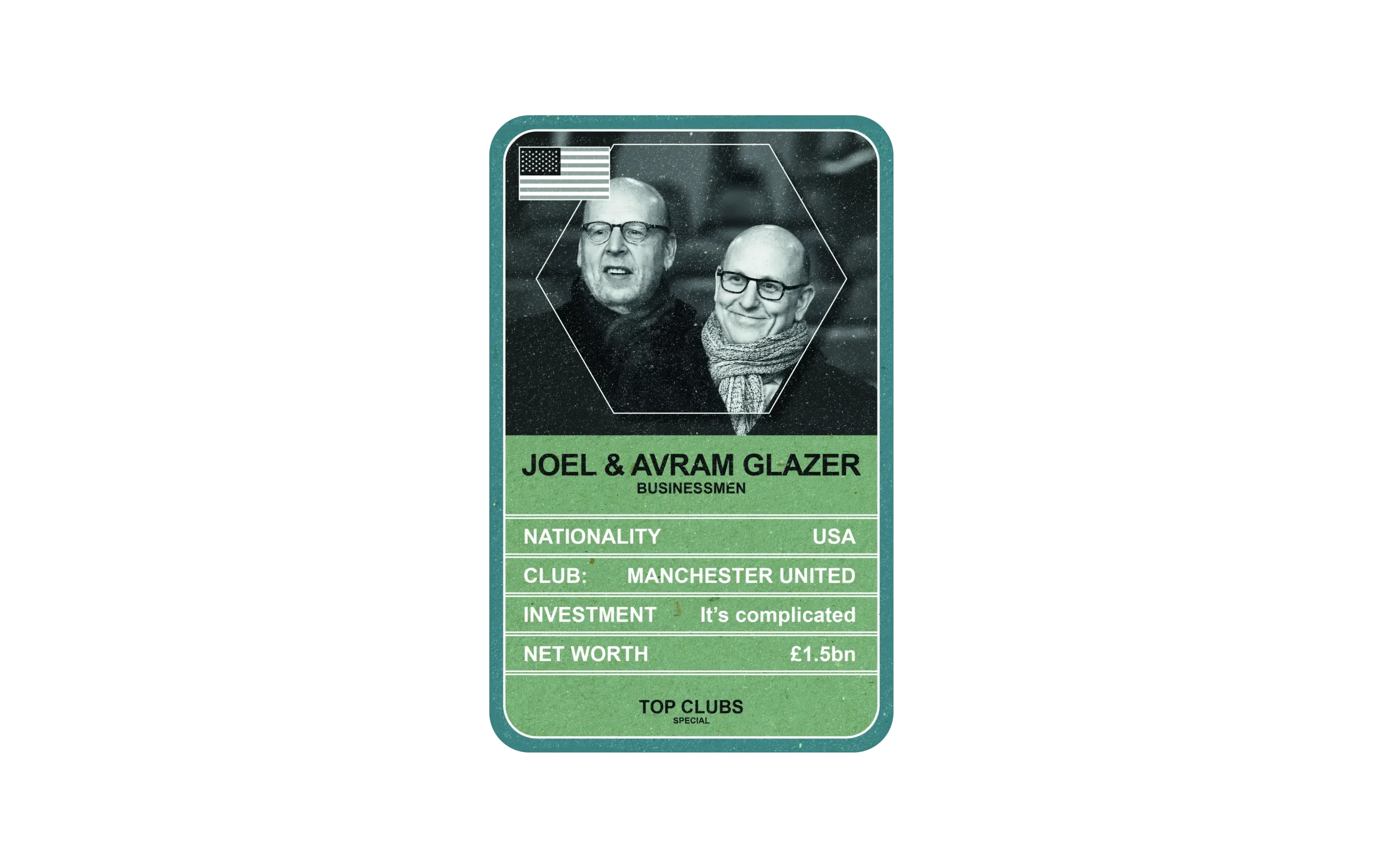

Acquisitions such as these have begun to create what some observers characterise as a ‘superclass’ of clubs with seemingly limitless resources. But the individuals and the sovereign wealth funds are competing with another dynamic model of football club ownership: one that uses leveraged buyouts (LBOs), a model finessed in US sport franchises. Take Manchester United, acquired by American Malcolm Glazer for £790 million in 2005 with a £600 million loan and now valued at around £3 billion – largely thanks to the marketability of the club’s huge following, especially in Asia. Glazer had already made a fortune by turning an outlay of $192 million in 1995 for the NFL’s struggling Tampa Bay Buccaneers into an investment worth $1.8 billion.

‘There is a polarisation taking place within football, with state interests competing with US private equity,’ says Professor Simon Chadwick, director of the Centre for Eurasian Sport. ‘On one side of Manchester you’ve got a Gulf-owned club and on the other side of Manchester you’ve got PE investors. They’re very different entities that operate in very different ways, representing two very different approaches to investment in football.’

The benefits of buying a football club

For would-be buyers, there are plenty of non-financial attractions. ‘Owning a big club gives you a celebrity status which other factors which surround your wealth cannot buy,’ says Kieran Maguire, who teaches the foot-ball industries MBA at the University of Liverpool. For wealthy people from certain countries, owning a major club might also be considered a safe way to store wealth, or perhaps an insurance policy against unwanted attention from one’s own government.

For the Middle Eastern investors with links to a nation state, the desire to build soft power to help further their country’s interests may be attractive – notwithstanding accusations of ‘sportswashing’. But if you can capture these benefits while also making money, then why wouldn’t you? The business of football is changing, and key to understanding today’s financial opportunities is recognising the global appetite for the game, says financier Mehmet Dalman, who chairs Cardiff City. The club reached the Premier League after it was bankrolled by Malaysian billionaire Vincent Tan, but now lies in the Championship, the second tier of English football.

‘The global distribution of football is enormous and continuing to grow,’ says Dalman, who played a key role in brokering the deal for Glazer to acquire Manchester United, advising the American of the huge global following of the club – especially in Asia – that could be translated into long-term value. ‘At the time we didn’t know how to value Manchester United, so we looked to Louis Vuitton and Ferrari as comparable brands,’ he says. Since then, Liverpool, another club that has developed a vast global following thanks to past and current success on the pitch, has seen its value grow exponentially since it was acquired by America’s Fenway Sports Group for £300 million in 2010. It is now valued at around £2 billion.

Television revenue has grown markedly for top clubs, with every Premier League club set to receive at least £100 million a year in TV revenue for the first time next season. Manchester City is currently top of the broadcast rights table: for the 2020-21 season, revenue from TV money was worth £297.4 million to the club from a combination of domestic and overseas rights.

Sponsorship and merchandise are significant too. Despite the impact of Covid, Manchester United was still able to achieve £232 million in commercial revenue for 2020-21, from sponsorship of £140 million and £92 million from a combination of retail, merchandising, apparel and product licensing, according to its latest annual report. However, it is hard to boost gate receipts without rebuilding a stadium, or to make money from player transfers without sacrificing success (and therefore TV revenue). With that in mind, owners are seeking new opportunities for long-term revenue growth – particularly those provided by social media and the intersection with other entertainment forms such as Netflix documentaries, which may still be in their infancy.

Charlie Methven saw an opportunity for this at Sunderland, one of England’s best-supported clubs, which had slipped from the Premier League to League One under previous owners. When he came into the club in 2018 – with investor Stewart Donald, who sold his controlling stake last year – Methven sought to capitalise on the club’s vast following on social media by developing a global profile. It now has almost a million Twitter followers. Since then, the Netflix documentary Sunderland ’Til I Die, in which suave southerner Methven seeks to ingratiate himself with the club’s more down-to-earth staff and supporters, is thought to have been watched by 20 million viewers over its three series – offering huge potential for developing a following worldwide.

Manchester City and Tottenham Hotspur have done similar things with their more stage-managed Amazon All or Nothing documentaries, but Methven saw ’Til I Die as a way to develop a new business model. ‘Ultimately, football clubs will be responsible for their own audiovisual audience,’ says Methven, who retains a stake but stepped down from the club’s board on completion of the sale to a consortium. ‘Rather than being pinned down to the amount of people in the town your football club is based in, suddenly you’re fishing in a much bigger pool of hundreds of millions of people who may be interested in what you have to offer.’

Differing models for football investment

The American franchise model sees cities pay sports teams a fee for the privilege of hosting them. Although this revenue stream is not open to football clubs, the sport continues to interest American investors who value the opportunity for growth in a global sport, given their home market may have already been maxed out. In August 2021 Forbes said the average value of NFL franchises was $3.48 billion, with the most valuable being the Dallas Cowboys, which has not made it to the Super Bowl in 25 years.

Patrick Tsang, chairman of Hong Kong-based Tsangs Group, an innovation-focused global family office that bridges East and West, says natural advantages of the US sports model come from the scale of its consumer market and the approach taken to running teams. ‘It’s looked at as a business with far less emotional attachment,’ he says.

That said, Tsang is excited by the prospective value of football, despite the jeopardy created by the relegation threat that US sports models do not have to fear. It is notable that the proposed JP Morgan-backed breakaway group of 12 elite clubs that failed to form a European Super League last year included a non-relegation component in its plan.

Another possible defence against the risk of relegation has recently emerged in the shape of the multi-club model, which sees owners or ownership groups spread their risk by building stakes across several clubs. Last August American John Textor, who made his fortune running sport-centric streaming company Facebank (now known as fuboTV), acquired a minority share of Premier League club Crystal Palace alongside compatriot Josh Harris, a billionaire private equity investor. He is now focused on acquiring a slug of Portuguese giant Benfica.

His compatriot Robert Platek, a close associate of computer billionaire Michael Dell who lends to many clubs through his MSD Capital vehicle, last year added Italy’s Spezia to Sønderjysk in Denmark and Casa Pia in Portugal to his family’s portfolio. Luca Scafati, chief revenue officer of Spezia, which broke into Serie A in 2020, says the model also offers commercial synergies through ‘increasing the fanbase and appealing to sponsors who want to have visibility and network across different markets’.

The most high-profile exponent of this model is City Football Group (CFG), which is 78 per cent owned by the Abu Dhabi United Group (ADUG), 10 per cent by American fi rm Silver Lake and 12 per cent by Chinese firms China Media Capital and CITIC Capital. As well as owning 100 per cent of Manchester City, Melbourne City, Montevideo City Torque and Sichuan Jiuniu, CFG also owns 80 per cent of New York City FC, 65 per cent of Mumbai City, 44 per cent of Girona, 20 per cent of Japanese club Yokohama F Marinos, as well as majority shares in Belgium’s Lommel SK and French club Troyes AC.

Although rules have been tightened on the ability to move players from one club to another in a multi-club setup, there are plenty of benefits of scale. ‘The re-sources and money that City Football Group brings to the table provides the patience and comfort needed for the top management to go and do their work. As a result, they’re open to new ideas in terms of markets and technology,’ says Tsang.

In November 2021 it was revealed that Manchester City was collaborating with Sony to create a global fan community that would be at ‘the cutting edge of the market’. The club said the community would be ‘where fans can interact with the club and each other within an online “metaverse” which will be a virtual recreation of the Etihad Stadium’. In Janu-ary, Capital Block CEO Tim Mangnall said all 20 Premier League clubs were exploring the launch of NFTs (non-fungible tokens).

‘I believe the metaverse and NFTs are go-ing to be big in football,’ says Tsang. ‘There’s a lot of potential from both developments, which could help clubs and players generate new revenues. We recently made an investment in an NFT platform for football fans called fanz.com. You have to be visionary, to see how you can merge the real world to social media to digital strategy to be successful, like what Liberty Media has done with Formula One. However you also have to nurture top football clubs like luxury brands. If you don’t properly nurture a club it can quickly turn into a money pit, requiring constant in-vestment just to maintain ownership.’

For Mel Morris’s part, with the rollercoaster of running Derby County behind him, he is now able to turn his attention back to tech investment, the thing he does best. Reflecting on his quixotic footballing journey, he speaks with the benefit of hindsight. ‘It is a model built on quicksand,’ he says.

Is buying a football club worth it?

But no matter how professional, strategic or successful the management of a club be-comes, the joy of owning a club should not be forgotten, says Charlie Methven. ‘You don’t go into club ownership unless you’re passion-ate about sport, otherwise you’d be spending too big a chunk of your life involved in a subject matter that didn’t interest you,’ he says.

What’s more, Prof Simon Chadwick believes the real power of football lies in ancillary benefits it can provide to owners, with political and business relationships forged through networking in directors’ lounges and corporate boxes. ‘There’s something much bigger happening around Premier League clubs and the power of football more generally, that high-net-worth individuals under-stand and are keen to engage with,’ he says. Indeed, an attendee of a Real Madrid match once told me that 15 of Spain’s most powerful people – from royalty to political leaders and heads of the country’s biggest corporates – could be found rubbing shoulders in the same executive suite.

It goes to show, Prof Chadwick says, that ‘you can do incredible things in business and political networks by owning a football club’. Even some of those who have lost a little money along the way would probably agree: it’s worth it.