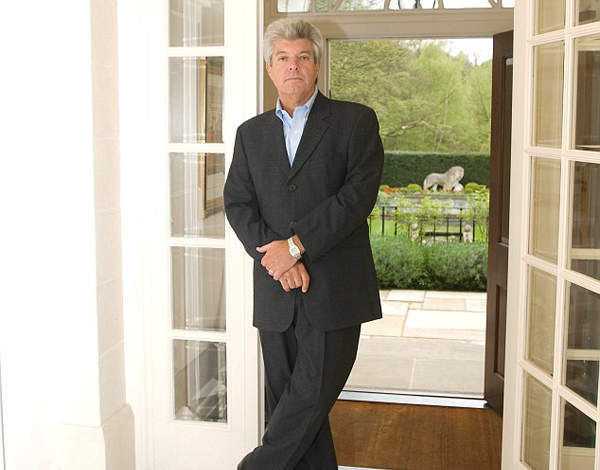

Trevor Abrahmsohn, known as the King of Bishop’s Avenue for his company’s grip on sales on the ultra-exclusive road, has fired a volley at the government after Nick Clegg announced plans to introduce Capital Gains Tax on foreign HNWs selling British property.

Read more on the government’s recent Capital Gains Tax proposition from Spear’s

He told Spear’s, ‘The imposition of Capital Gains Tax will be a further impediment to foreign buyers purchasing in the UK and when you add the spectre of Mansion Tax to this I am worried that it could have a profound effect on the middle to upper sectors of the residential property market especially in the capital.’

Highlighting the burden of property tax already faced by UK homeowners and businesses, Abrahmsohn referenced recent rises ‘from the budget of 2012, Stamp Duty for corporate vehicles has increased by 300 per cent from 5-15 per cent, plus, a management fee to the Treasury of up to £150,000 per annum. Together these have already attenuated the numbers of international buyers seeking properties in the UK. If their purchases were personally organised they would still confront a Stamp Duty increase of 40 per cent.’

Abrahmsohn underlined the importance of a favourable political, economic and tax climate warning that a bad tax policy could mean ‘become[ing] user-unfriendly, it could be very damning for the UK and, in particular, London.’

Read more on tax and trust from Spear’s

Having worked in the capital for decades, with some of the city’s biggest sales under his company Glentree Estates’ belt, the legendary property adviser emphasised that London does not owe its prosperity to additional taxes: ‘Over the last 40 years London has transformed itself from a souvenir town to the most desirable and electric metropolis in the world. Most important transactions are conducted through the financial services of London, much to the irritation of the Europeans who would like Berlin or Paris to be in this exalted position. London has even overtaken New York as the most actively traded market in the world.

Dangerous precedent

For Abrahmsohn the idea of capital gains being taxed on certain properties represents the traction of a dangerous precedent: ‘We are active lobbyists against the Mansion Tax that is odious and punitive and is a socialistic-inspired penalty against success. In our view the imposition of Mansion Tax would cause complete disarray at the higher end of the property value scale with properties halving with great illiquidity and this would soon percolate down to the lower price ranges. Before your know it the market will be in a full blown recession.’

When it comes to political responsibility Abrahmsohn doesn’t pull his punches: ‘The proposed Capital Gains Tax has clearly been inspired by the Lib Dems and is a Tory “sop” against the imposition of Mansion Tax that itself will have a devastating effect on the market. The futility of this Capital Gains Tax is such that it will generate so little money it will not even pay enough to collect the tax but will certainly put off a number of international buyers. It is a further illustration that these socialistic ideals are indulgencies borne by politicians who just don’t get it.

The principle of tax must always be to raise as much money for the Treasury to use as it chooses for welfare purposes, encouraging employment, growing the economy and investment in Britain. The socialists have a Marxist inspired ideal of distributing wealth that is not shared by any intelligent pragmatist. The best way to improve people’s standard of living is to make everyone wealthier and not the wealthy poorer. Margaret Thatcher was the prime proponent in demonstrating that higher taxation earns less money.’

Abrahmsohn leaves no room for doubt on which side of the fence he’s on, ever keen to champion London’s property owners’ rights, be they local or not: ‘We must remember, if London is to remain the greatest city on earth it needs to have a fiscal culture that encourages inward investment that the economy needs and its part of the wealth of the nation. These investors bring foreign earnings, invest in businesses, employ people and the Metropolis certainly needs a good supply of them. We have to be careful not to design fiscal impediments to their entry.’