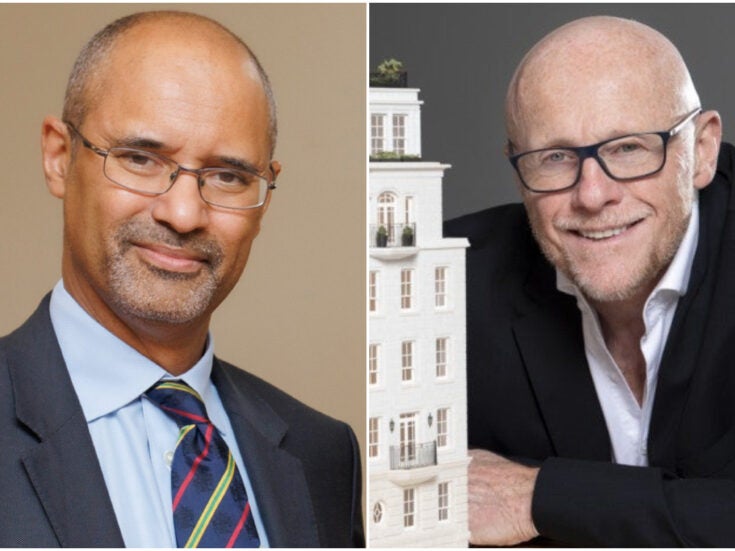

Clive Cutbill, head of Philanthropy at Withers, the legal partner of the 1 Per Cent Campaign, is answering your questions (for free!) on all the legal aspects of philanthropy. Email your questions to emily.rookwood@spearswms.com

Q I am on the board of a long-standing family foundation but worry that the other trustees are taking it away from its original purpose. What can I do?

A First, check the foundation’s constitution to see if there are legal restrictions on the causes its trustees can fund. If there are, the trustees must either work within them or consider whether the purposes should be widened.

If the trustees as a whole wish to widen the purposes, they should take legal advice to see if it can be done. What trustees cannot do is simply apply funds to purposes not permitted by the foundation’s constitution. If they do, they may have to repay the misapplied funds. If you are concerned that your co-trustees are misapplying funds in this way, you should explain this to them. If they take no notice, you should take legal advice as you could be personally liable if you do not take appropriate action, which could include reporting the matter to a regulator.

If, on the other hand, the purposes for which the funds are now being applied are not legally prohibited, the issue is simply about the appropriateness of the change in use of the foundation’s funds.

You say that the foundation is ‘long-standing’ and sometimes a change in circumstances means that foundations must change their approach. However, it may be that the founder left guidance about the application of the foundation’s funds; although not legally binding, the trustees should take any such views into account and consider whether the founder would have expressed similar views now.

If the foundation currently receives substantial donations from others, the trustees may also wish to seek their views.

While it is ultimately for the trustees as a whole to decide how best to achieve the foundation’s purposes in the current environment, they must operate within the limits of its constitution and should have thought through, and be able to explain, their actions.

Q My father was a respected local Anglo-Saxon historian and I want to donate to our local history museum in his memory. How do I go about doing this?

AI assume the reference to Anglo-Saxon history means that the museum is in England and you are a UK taxpayer. If so, the museum is likely to be a charity, but you should check (it may be a privately owned collection, though this is unlikely).

You do not say what you want to give, or whether you want to give now or on your death. However, the UK has a number of tax reliefs which may help you. For lifetime giving, Gift Aid helps you to give cash and obtain relief against your UK income tax and/or capital gains tax liability; you can also give land or certain types of securities to a charity and this can reduce your income tax (but not your CGT) liability.

If you want to give your father’s collection (or other assets) to the museum, the tax position is not so generous, however; the UK does not give lifetime tax reliefs for such gifts at present, though there are limited plans afoot to enable tax-efficient gifts of art to be made, effectively to the nation.

On death, property passing to the museum should be exempt from UK inheritance tax and, for deaths after 6 April 2012, if at least 10 per cent of the taxable estate passes to charity, the tax rate on the taxable part may be reduced from 40 per cent to 36 per cent.

If you pay tax in any other jurisdiction, you will need to take care as the rules will be different and a gift to the museum (as a UK body) may not be eligible for reliefs. In that case, you may need to make your gift to a charity in the taxing jurisdiction which, in due course, will decide to distribute your gift to the museum.

Q I love all things feline and wish to leave 20 per cent of my estate to the local cat sanctuary. What is the best way

for me to structure this gift?

A There are a number of things I would need to know about your personal position to be able to give detailed advice, but here are some of the issues which may be relevant.

First, how big is your estate, and how much is 20 per cent of it likely to be? If it may be a substantial sum; do you want it all spent shortly after your death, or do you want the capital invested to provide an income which can support the sanctuary in perpetuity?

What impact might this level of funding have on the sanctuary? Will your gift mean that the sanctuary has more than it can spend (on its current and planned work), and what will that mean for its other sources of support? If you can, you should ask the sanctuary about these issues to see what they think would help them best.

If the gift is likely to be substantial, you may wish to consider either a gift to a charity which can support a number of causes or even, if the size of the gift is likely to warrant it, creating a separate feline-focused charitable fund to provide flexibility, a charitable gift is likely to attract a tax exemption or a reduced rate of tax in most jurisdictions but, subject to some recent changes in EU law which have not been implemented by all EU states, most countries will only give that favourable tax treatment to gifts to their own charities. If you are liable to inheritance (or equivalent) tax in a different country, you may need specialist advice in planning your gift to maximise whatever charitable reliefs are available.

Spear’s and Withers will also be producing in June a free how-to guide with everything you need to know about philanthropy