Author: Chloe Barrow

IF YOU’VE GOT IT, FLAUNT IT

The Shepherd’s Bush Westfield is perhaps the last place one thinks about philanthropy. After all, its ultra-hygienic, super-shiny version of capitalism — buy me, buy me, your life will be better (but only yours and only for a while) — hardly inclines you to think of the less fortunate, who are by definition unwelcome on its precincts. But what if the money you spend there in fact fuels philanthropy? It turned out recently that it does.

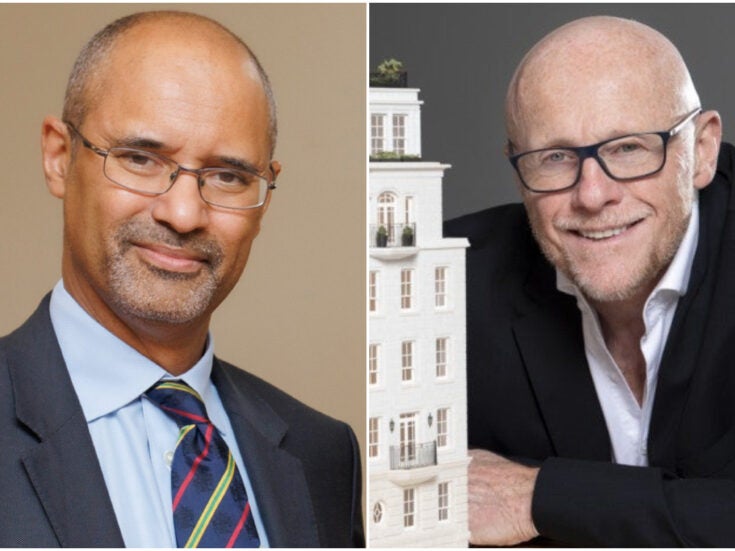

Westfield’s billionaire co-founder and owner Frank Lowy has revealed that he has given away $350 million (£200 million) over the past ten years, making him Australia’s top philanthropist. He says he hopes his legacy will live on through his giving: ‘I like to think that when I am gone people will think well of me.’

So he wants to blow his own trumpet — but at least he’s being open about giving. Lowy is not the only philanthropist in favour of frankness. The Institute for Philanthropy released a report in November, ‘Towards Greater Transparency in Philanthropy’, which said that 24 out of 33 donors would be interested in further discussing the possibility of a standard for sharing information about philanthropic activities with other foundations.

However, there is some contradiction across research in this subject. According to a report by Forbes Insights published in May 2013, most philanthropists would rather not publicise their giving or actively promote their causes. The BNP Paribas Individual Philanthropy Index, which covers Europe, Asia and the Middle East, found that 77 per cent either insist on remaining anonymous or do not actively publicise their charity. This secrecy, Spear’s believes, is a bad thing for several reasons.

Silent minority

Completely anonymous donations are not commonplace, according to Philanthropy Impact executive director Sue Daniels. ‘There are a few examples of people wanting to remain absolutely anonymous, but it is quite rare.’ But, by its very nature, it can be hard to judge the exact level of silent giving. This is demonstrated in Coutts’ Million Pound Donors Report from 2012, which states: ‘We are aware that our data is likely to underestimate the true value of this upper level of philanthropy. This is due to donations that are either made anonymously, or for other reasons have not appeared in an identifiable form on the public record.’

There are many degrees of anonymity, ranging from entirely unknown to open but not publicised. ‘Very few of our donors give entirely anonymously,’ says Plum Lomax, deputy head of funder effectiveness at New Philanthropy Capital. ‘In many cases the charity knows where the donation has come from, although the author of the gift may well not want to make a big thing of it.’

There are a number of reasons why philanthropists favour subtlety over transparency when making a charitable investment. ‘People often don’t want to draw attention to themselves as they don’t want to be pestered by other charities asking for money,’ says Daniels. Online media, particularly social media, mean that news, good or bad, travels faster than ever before and is henceforth etched into Google’s eternal archives. People are therefore understandably more guarded about exposing personal information.

Another deterrent to openness regarding donations has to do with negative attention regarding tax relief: ‘The proposed change in charitable tax relief last year came with the accompanying message that some donors are tax avoiders — this had the damaging consequence of causing some people to become less open about what they give,’ says Lomax.

And, of course, some donors’ reticence is based on moral and religious grounds, particularly in the Jewish community, where scholarly tradition says that shouting about acts of charity in fact diminishes the good deed.

It takes quite a will of effort and expense to remain completely anonymous, especially given the need for transparency in the source of the money and the risk of reputational damage. ‘It’s quite complicated, particularly for larger sums,’ says Lomax. ‘In the world of increased compliance and money laundering, some charities might ask who’s behind an anonymous donation as they want be sure it’s clean money.’

Mystery prize

However, while they may be complex and risky to execute, anonymous donations are, surprisingly, still permitted, and official guidelines on this subject are conflicting.

‘Charities can find themselves between a rock and a hard place,’ says Ceris Gardner, founding partner at law firm Maurice Gardner Turnor. ‘On the one hand, Charity Commission guidelines say charity trustees are under a duty to know their donor and the provenance of funds. But they also say you are entitled to accept anonymous donations providing trustees look out for suspicious circumstances and put adequate safeguards in place.’

Charities may not wish to receive money from potentially immoral sources, but they also, understandably, don’t want to turn down valuable donations — particularly when, technically, it is above board to accept them. But the consequences of getting it wrong could be dire. ‘It would be very damaging for the charity’s reputation if a donation they had accepted with alacrity and glee turned out to be from some fraudster or criminal,’ explains Gardner. ‘This reflects badly not only on that particular charity but taints the charity industry as a whole.’

As a result of this tricky situation, the most acceptable way of receiving anonymous donations, say both Gardner and Lomax, is through a third-party intermediary such as CAF or Prism, which connect donors with other charities — granting donors the anonymity they seek, at least from the actual charity, while providing the charity itself with assurance that the funds are kosher.

Side-effects

But there are bigger problems with anonymous donations than the legality of the money: reticence actually stunts philanthropy. Anonymous donations reduce the amount charities are eligible to receive because of Gift Aid restrictions. ‘When a donor wishes to remain entirely anonymous, the charity itself can’t claim Gift Aid because the donor’s name and address must be registered in order to do so, which is a shame,’ says Gardner.

Perhaps more important is that acknowledged philanthropy sets a positive example and is an encouragement to others: anonymity produces no rallying cry nor any heroes to emulate. When philanthropists go public, they can explain their process, their reasons and their reservations and thus stimulate both discussion and further giving. ‘There is also an argument that withholding donor details may be passing over an opportunity to inspire others to give,’ says Gardner.

Speaking at the Spear’s Wealth Insight Forum in September, renowned businesswoman and philanthropist Dame Stephanie Shirley voiced her opinion that silent giving is a problem that needs to be addressed. ‘In Britain people don’t talk about money and what we do with it, so there is reticence in philanthropy,’ she said. ‘But we need to talk about it and have the conversation.’

Perhaps the most important reason why people need to have this conversation, as Dame Stephanie articulates, is that without transparency in the sector there is no clear lead for others to follow — and this could well prevent others from choosing to get involved.

Giving anonymously has a positive impact on a donation-by-donation basis, but if you want to give in a broader sense, thinking beyond that one donation, then the act of encouraging others to get involved in charitable causes is an even greater contribution. If only Frank Lowy could emblazon that message all over his shopping centres.