Fulfilling long-heralded promises of growth, countries in Asia and Africa will see their numbers of wealthy individuals race up over the next decade, according to Knight Frank’s Wealth Report 2014, out today.

While all starting at low bases, Vietnam’s UHNW population (net worth $30 million-plus) will increase by 166 per cent to 293 by 2023, Indonesia’s by 144 per cent to 1,527 and the Ivory Coast’s by 116 per cent to 54. Also showing great growth are Kazakhstan (109 per cent), Mongolia (100 per cent) and India (99 per cent), say WealthInsight, who have provided the data.

FIGURE 2: FASTEST-GROWING UHNW POPULATIONS BY COUNTRY TO 2023

However, the world’s largest economies will still have the highest overall numbers of UHNWs in 2023: America (47,000), Japan (19,000) and China (14,000), with Germany and the UK a little behind. Interestingly, however, Russia will have the third highest number of billionaires in 2023 but won’t be in the top ten for UHNWs, indicating its wildly uneven distribution of wealth.

Given current events, the prediction that Ukraine will go from 14 billionaires to 24 seems optimistic.

Six of the ten cities expected to have the greatest UHNW growth are in China (Ordos, Foshan, Ningbo, Xiamen, Taizhou, Chongqing), but the top two cities are in fact Ho Chi Minh City (173 per cent) and Jakarta (148 per cent). At the bottom of the list is Boston, expected to lose 6 per cent of its UHNWs.

FIGURE 4: FASTEST-GROWING UHNW POPULATIONS BY CITY TO 2023

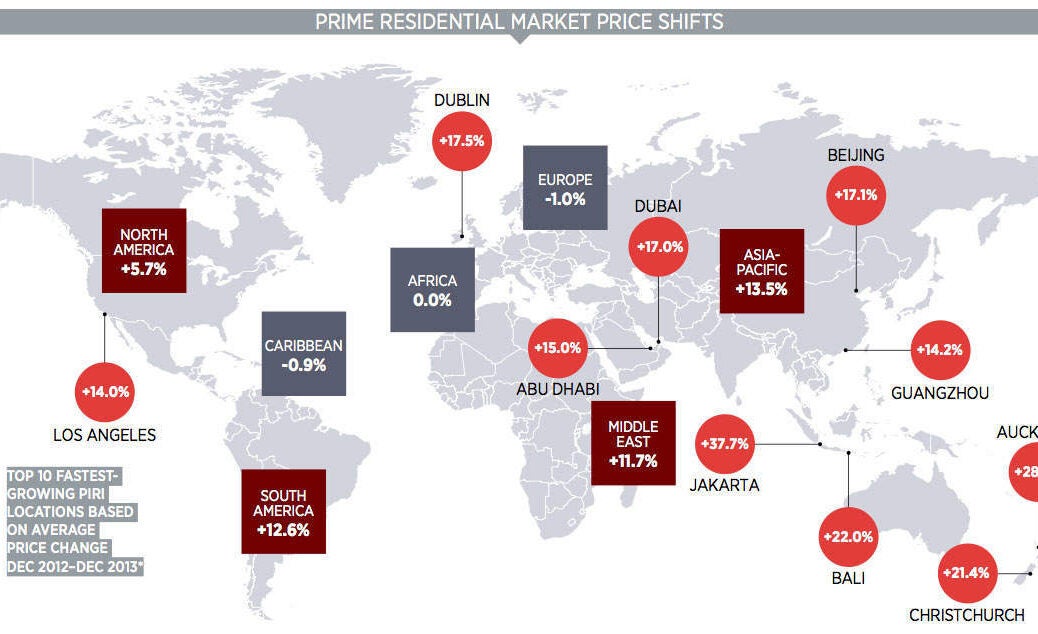

Knight Frank, the world’s largest independent property consultancy, has again produced its Prime International Residential Index, which shows movement in domestic property prices at the top end, as part of the Wealth Report. Jakarta increased most in 2013 – by 38 per cent – followed by Auckland (29 per cent), Bali (22 per cent) and Christchurch (21 per cent). Both of these countries (Indonesia and New Zealand) represent relatively small markets.

FIGURE 3: PRIME RESIDENTIAL MARKET PRICE SHIFTS IN 2013

In more established prime locations, Beijing increased by 17 per cent, Dubai by the same and Tokyo by 13 per cent. London had a modest 7.5 per cent increase.

Two-fifths of locations fell in value, including Singapore (0.8 per cent) and European luxury destinations like Sardinia, St Moritz, Provence and Meribel (between 4 and 10 per cent). Many of these have fallen several years in a row even as the general global economic situation has recovered.

Over five years, London has now increased by 54 per cent, Beijing by 82 per cent and Singapore by 27 per cent. Moscow has flatlined with a 3.4 per cent increase.

London and New York retain their places at the top of the most influential cities list, but by 2024 New York is expected to have taken over.