The Knight Frank report, entitled Taxing High Value Homes, shows that a mansion tax on homes worth £2 million or more would raise only £1.3 billion, not the £1.7 billion minimum estimate being made by Labour and the Lib Dems and nowhere near the £2 billion top figure.

Crucially, the report also identifies the cost to homeowners if the proposed £2 million threshold is held regardless of inflation and rising house prices. Doing that would see 775,500 homes ‘dragged into the mansion tax net’. A home costing £540,000 today would reach the threshold in 25 years assuming property prices continue to rise apace. This would mean that many homes bought with the government’s Help to Buy scheme at under £600,000 would end up qualifying as mansions within a generation.

Knight Frank refrain from trying to navigate the political minefield of ‘fairness’ but do make a counterargument suggesting the new owner of a £3 million property would potentially pay £4.29 million in various taxes on it over a lifetime. This rebuts Nick Clegg’s statement earlier this year ‘the underlying issue which could not be ducked was that properties worth tens of millions of pounds were paying the same council tax as ordinary family homes.’

Read more on the mansion tax from Spear’s

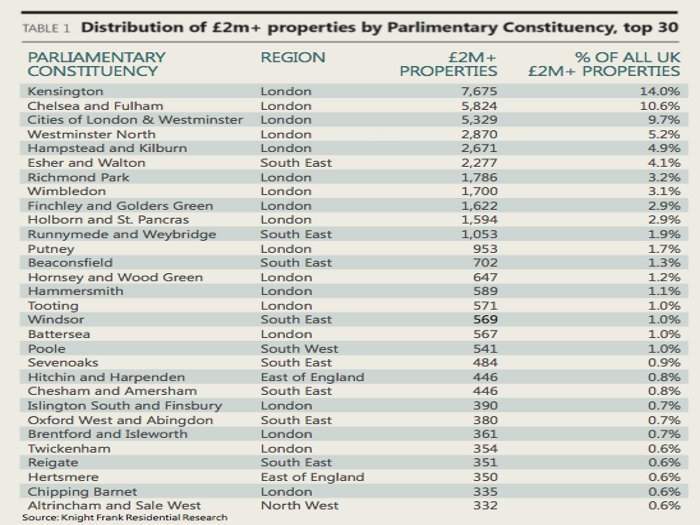

A mansion tax could also have unexpected consequences for the market, holding them artificially low to avoid the tax and stifling the very growth it would benefit most from. It’s also being seen as a tax on London, which has almost 50 times as many ‘mansions’ as Scotland.

One of Spear’s main concerns – protecting Britain’s heritage – would also be damaged by a mansion tax, according to the report: ‘High value properties are disproportionally likely to be listed by English Heritage, suggesting that they are more likely to form part of the UK’s built heritage… The imposition of an average annual tax charge of £23,595 sits awkwardly with the obligation for owners of listed buildings to maintain and protect their properties for future generations to enjoy. Exempting all listed buildings would reduce the potential tax take by nearly a quarter to around £0.98bn.’

When Mark Carney says of the rising property market, ‘We are watching it closely and we will as appropriate make our views known in terms of the degree of this risk and the potential action that should be taken to address it,’ he isn’t just pointing to the risk of a housing bubble but the opportunism of banking on one for a quick tax take.

Read more on prime property from Spear’s