Brazilian entrepreneur Eike Batista said he could become the world’s richest man. Fast forward a few months and things aren’t as promising, says Giulia Cambieri

In the spring of 2012, Brazilian entrepreneur Eike Batista said he could become the world’s richest man in ten years’ time. By 2022, he said he could be worth $100 billion, $28 billion more than Bill Gates today.

Fast forward a few months and things aren’t as promising as they seemed: for a start, Batista’s oil exploration giant OGX filed for bankruptcy protection last week. Having already lost many of his assets in the past few months, OGX going bust could bury Batista’s dreams of ever topping the Forbes world’s billionaires list – or even staying on it.

Read more on Forbes’ Billionaires List from Spear’s

But is Batista’s story that uncommon? The Credit Suisse Global Wealth Report 2013 found that wealth mobility has become high in the short run.

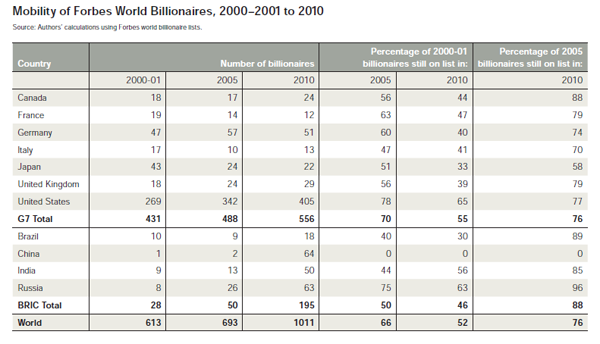

For example, fewer than two-thirds of billionaires in the 2000 and 2001 Forbes world’s billionaire lists remained in the 2005 edition, and about half by 2010. Mobility was particularly high in the BRIC countries, where the number of billionaires almost doubled between 2000 and 2005, and nearly quadrupled between 2005 and 2010.

China’s billionaires saw their wealth rise collectively and fall individually particularly fast during that period. In 2000, for example, the country had only one billionaire. In 2005, that billionaire wasn’t on the list any more but there were two other billionaires in China. Both of them had left the list by 2010, when there were 64 billionaires in the country.

At the same time, the number of billionaires has recently declined in France, Italy and Japan.

According to the report, these fluctuations depended on a number of factors, including market volatility, exchange rate oscillations and mortality, as billionaires tended to be older than the average adult. (When they die, they exit the list even if their wealth is passed on to their heirs.)

Batista may have been an exceptional case, but it seems like we may see similar stories in the coming years.