Last year we compiled the inaugural Spear’s Power List – an index that acknowledges the people who shape the world of private wealth and the lives of wealthy people.

In contrast to our other indices and rankings that focus on expert advisers and specialist service providers, the Spear’s Power List showcases the figures who wield power behind the scenes, and whose everyday work is not based on client relationships.

A year later, we can now present our 2024 Power List, some of whom are household names, while others prefer to keep a lower profile but are no less influential.

If the list is indicative of anything, it is the rapid pace of change at the top: 42 of our 100 from 2023 have been displaced in the rankings by new entrants.

A select few debutants are profiled below – with the complete list of the Power List Top 100 and Power List Notables featured in the interactive table below.

Spear’s Power List 2024: Names to know

Melinda French Gates

Stepping out of her ex-husband’s shadow

Sector: Philanthropy

Company: Pivotal Ventures

Title: Founder

In May, Melinda French Gates sent shockwaves through the world of UHNW philanthropy when she announced she was leaving the Bill and Melinda Gates Foundation, which she established with her then-husband, Bill Gates, in 2000.

Despite separating in 2021, the couple had continued to work together and served as co-chairs of the organisation – now known as the Gates Foundation – which is the largest private body of its kind and is a powerful force in the fights against disease, poverty and climate change. The group has given away nearly $80 billion since its inception and held an endowment of more than $75 billion as of December 2023.

As part of an exit agreement, French Gates was given an additional $12.5 billion to commit to her work on behalf of children and families. Microsoft founder Gates, one of the world’s richest men, thanked his ex-wife for her ‘critical’ contributions to the foundation and said he was ‘sorry to see her leave’.

The first step in the next chapter of French Gates’ philanthropic work was announced via Pivotal Ventures, a non-profit organisation she founded in 2015 which is focused on removing barriers to opportunity for women and minority groups. French Gates committed an additional $1 billion up to 2026 to ‘advance women’s power globally’, including $200 million in grants aimed at supercharging the work of organisations that are fighting in the US to protect women’s rights, among them reproductive freedom.

The announcement marked the first time French Gates had entered the political fray in such a public way. It also coincided with her first-ever endorsement of a presidential candidate: first Joe Biden and, after he decided not to run, Kamala Harris.

‘I knew I had to speak out in favour of women’s rights, and if there was a candidate who is against women’s rights and says terrible things about women, there is no way I could vote for that person,’ she said in an interview at the time.

Amid a period of personal and philanthropic transformation, French Gates is clearly ready to forge her own path.

Sam Altman

The public face of AI

Sector: Tech

Company: OpenAI

Title: CEO

That it took until March 2024 for Sam Altman’s name to appear on the usual lists of billionaires might seem like an oversight. After all, the 39-year-old chief executive and founding member of OpenAI has become one of the most celebrated names in Silicon Valley history following the arrival of ChatGPT, the globe-conquering AI interface released to the public in the closing days of 2022.

For all its success, ChatGPT didn’t make Altman rich. OpenAI may have recently been valued at $80 billion, but it was founded in 2015 as a non-profit, meaning its founders didn’t receive equity in the project. The San Francisco-based outlet transitioned to a ‘capped profit’ model in 2019, but Altman still didn’t receive the typical tech windfall.

Instead, his $2 billion net worth comes from his stakes in other successful tech ventures, notably his early investment in both Reddit and Stripe, as well as his more recent bets on fusion research outfit Helion and anti-ageing biotech Retro.

Generative AI has created other billionaires, though. The explosion around the technology, and the resulting scrambles for processing power, has apparently minted eight new billionaires already. They include semiconductor magnate Kwak Dong Shin, Supermicro co-founder Charles Liang and robotics visionary Brett Adcock. As the AI revolution unfolds, there are likely to be many, many more.

Rachel Reeves

The UK’s first female chancellor

Sector: Politics

Company: HM Government

Title: Chancellor of the Exchequer

The first female chancellor in the Treasury’s 800-year history, Rachel Reeves was central to Sir Keir Starmer’s 2024 electoral campaign, preaching a message of sound management of the economy and a new ‘fiscal lock’ law announced in the King’s Speech. The law will allow the Office for Budget Responsibility to conduct its own independent assessments of any budgetary commitments representing more than 1 per cent of the UK’s GDP.

After studying philosophy, politics and economics at the University of Oxford – where, she once revealed, her contemporaries gave her a framed portrait of Gordon Brown because of ‘how much I loved the Treasury’ – Reeves cut her teeth as an economist working at the Bank of England and in the mortgages team of HBOS.

Now in the driver’s seat as chancellor, the MP for Leeds West and Pudsey has already introduced fresh tax rules targeting non-doms, private schools and private equity executives. This has left many in the world of private wealth wondering just how much further she and her colleagues could go…

Jane Fraser

Wall Street’s Braveheart

Sector: Investment banking

Company: Citigroup

Title: CEO

When Jane Fraser took on the top role at Citigroup almost four years ago, Wall Street ob- servers weren’t shy in describing the mammoth task in front of her. At the time the US banking mainstay

was widely regarded as a laggard, with its share price well below its bulge bracket peers. Even worse,

it had been lumbered with one of the biggest regulatory actions in US financial history, with federal regulators issuing a $400 million fine, on top of a major probe into its risk-management systems.

Scottish-born Fraser, a McKinsey veteran and former head of Citi’s private bank division, insisted she was unfazed by it all, even describing the regulatory clampdown as a chance to ‘galvanise’ change. True to her word, Fraser would shortly pledge an overhaul of the banking behemoth, promising to eliminate bureaucracy and speed up decision-making.

At the time of writing, the Fraser revolution looks set to eliminate 20,000 positions – equivalent to 8 per cent of Citigroup’s entire workforce. Fraser’s former parish, Citi Private Bank, has not escaped the axe, with 7,000 jobs reportedly set to go.

The new boss has also shown similar ruthlessness when it comes to the big governance questions. This autumn it was reported that she had stripped the group’s long-standing chief operating officer of sole responsibility for the compliance issues of interest to federal regulators. Insiders say Fraser wanted the task completed more quickly – even if it meant bruising egos.

Citigroup’s board appears convinced by her tactics. Last year it voted to boost her salary by 6 per cent, granting an annual compensation package worth $26 million. The board says the decision was taken in respect of her overseeing the bank’s biggest organisational change since the great financial crash.

Whether it will succeed or not is less clear. In the event that Fraser triumphs, she may well secure her place in Wall Street history.

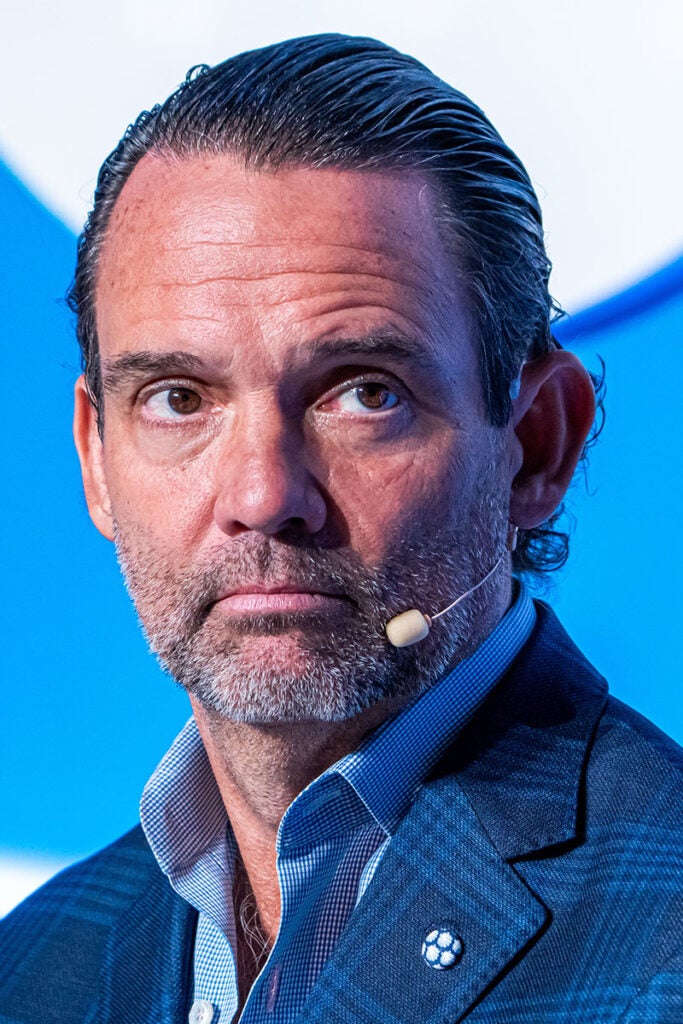

Sir Paul Marshall

The hedgie making waves in media

Sector: Hedge funds/media

Company: Marshall Wace

Title: Chairman

Financial moguls are fiercely competitive, including when it comes to philanthropy. Spear’s suspects, then, that Sir Paul Marshall, co-founder of hedge fund Marshall Wace, will be proud of his position as Britain’s most charitable person in the 2024 Sunday Times Giving List.

Overall, Marshall’s donations to charitable causes totalled £145 million in one year. Even more impressive was the fact that the born-again Christian took the top spot not on the size of his donations alone, but also the fact they equalled more than 16 per cent of his entire fortune.

It wasn’t the first time Marshall has been celebrated for his philanthropy. In 2016 he was knighted for that very reason. Though these days the financier is best known as something different: a media mogul. First, he ploughed £50 million into GB News, the right-wing broadcaster that is courting those dissatisfied with the BBC.

This year Marshall set his sights on even bigger prizes: the Daily Telegraph and Spectator. The titles went up for sale in 2023 when creditors seized them from their previous owners. This September it was announced that Marshall was buying the Spectator for £100 million, and at the time of writing his consortium bid (backed by US billionaire Ken Griffin) is still a contender in the Telegraph race.

Nik Storonsky

At the cutting edge of fintech

Sector: Finance

Company: Revolut

Title: CEO

The over-cautiousness of UK regulators is a common grumble among the new generation of financial entrepreneurs in the City. Yet few grumbles have been more widely reported than those to have emanated from Nik Storonsky’s company.

The Russian-born physics graduate relocated to London in his early twenties, where he worked at Lehman Brothers and Credit Suisse. In 2015 he left the trading desks to create an online payments app called Revolut. Within a year, the business had become one of London’s fastest-growing financial companies, with a dedicated millennial customer base drawn to its promise of low-cost foreign exchange transfers. Valuations soon put the company in the ‘unicorn’ bracket, on the assumption that Revolut would be able to offer more conventional financial products in time.

In 2021 Storonsky applied for a retail banking licence with the aim of doing just that. It was a move that would begin a three-year back-and-forth struggle, with regulators objecting to everything from Revolut’s share structure to its inconsistent accounting processes. This July the saga ended, as regulators announced they had approved Revolut’s banking licence, allowing it to offer loans and mortgages to its 9 million UK customers,

as well as providing full retail banking services (including guaranteeing

customer deposits in line with UK regulations). An employee share

sale subsequently valued the company at $45 billion, of which one-fifth still belongs to Storonsky.

As for relations between Revolut and the City establishment, the question is whether the fintech giant will be listed in London or New York. Storonsky has previously hinted at

the latter, though such a decision would be a symbolic blow to his adopted home city.

Sheikh Tahnoon bin Zayed Al Nahyan

The man with the golden wallet

Sector: State investment/security

Company: Abu Dhabi Investment Authority

Title: Chairman

Even by the standards of the Gulf, the rapid rise of Sheikh Tahnoon bin Zayed Al Nahyan – the Abu Dhabi security chief turned trillion-dollar money man – has been remarkable.

One of 19 sons of UAE founder Zayed bin Sultan Al Nahyan, the Sheikh was officially confirmed as Abu Dhabi’s deputy ruler in 2023, shortly after his brother, Mohamed bin Zayed Al Nahyan, became the UAE’s third president. However, the most important source of Sheikh Tahnoon’s power is his brother’s decision to bestow upon him a much more modern position: control over Abu Dhabi’s gargantuan sovereign wealth fund.

With more than $1 trillion under management, the Abu Dhabi Investment Authority (ADIA) ranks among the largest state-owned funds in the world. By some estimates it has now eclipsed neighbouring Saudi Arabia’s.

As well as overseeing the ADIA, Sheikh Tahnoon also chairs a number of other financial institutions, including the UAE’s largest bank (First Abu Dhabi Bank), the biggest entity on the Abu Dhabi bourse (International Holding Company) and the state-run AI venture known as Group 42 (G42). Such unprecedented influence over one of the Middle East’s largest capital markets would be a story in its own right. Yet Sheikh Tahnoon has done something interesting with his positions, harnessing them to further the UAE’s ambition to become an active player, rather than just a major investor, in the AI revolution.

Initial signs are promising. G42 is already partnering with OpenAI, the creator of ChatGPT, to build a new UAE-based supercomputer, enabled, in no small part, by the clusters of data centres popping up across the Emirates. The chief executive of the $3 trillion chipmaker Nvidia, Jensen Huang, has also been spotted on a visit to Abu Dhabi.

In April came the news that G42 would receive a $1.5 billion investment from Microsoft – the clearest sign yet that Silicon Valley regards Abu Dhabi as a regional partner. The deal was announced with a photo of a grinning Sheikh Tahnoon standing behind Microsoft president Brad Smith and G42’s chief executive Peng Xiao as they sat signing papers. Was it a deliberate move to have the Sheikh hovering over them in such a power position?

Francesca Bellettini

Kering’s lady in waiting

Sector: Luxury

Company: Kering

Title: Deputy CEO

Kering deputy CEO Francesca Bellettini, the investment banker turned fashion world power player, has become the favourite among certain members of the fashion world cognoscenti to replace French billionaire François-Henri Pinault when he chooses to relinquish the helm of his family-owned luxury retail empire.

After starting her career in London as an investment banker at Goldman Sachs, Deutsche Morgan Grenfell and Compass Partners International, Bellettini entered the fashion industry with positions at the Prada group. She joined Kering in 2003 and in the past two decades has held senior positions across some of the group’s biggest brands: Gucci, Bottega Veneta and, most recently, Yves Saint Laurent, where she continues to serve as president and CEO. In 2023 it was announced that she would become group deputy CEO, with all other brand CEOs reporting to her.

Built from the ground up by Pinault’s father, Kering has recently fallen behind rivals such as LVMH (overseen by fellow French billionaire and Spear’s Power Lister Bernard Arnault) and Hermès International.

There is also a next generation of the Pinault family waiting in the wings: François Louis Nicolas Pinault, François-Henri’s eldest son, recently replaced his grandfather on the board of Christie’s – a decision hailed as a ‘major succession move’ by industry press.

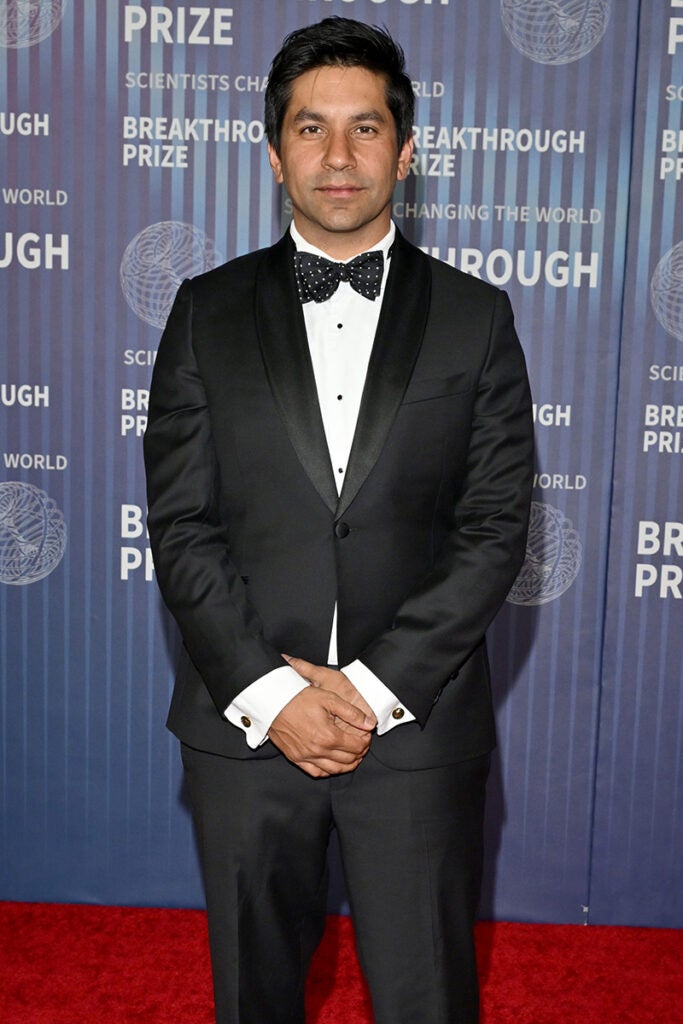

Varun Chandra

The City networker in Whitehall

Sector: Intelligence/Finance

Company: HM Government

Title: Special adviser

Like most left-of-centre political movements, Britain’s Labour party has rarely received a warm welcome from financial elites. Yet Keir Starmer, only the seventh Labour prime minister in British history, says he wants to square that circle by leading a proudly pro-business government.

Will the reality match the rhetoric? One sign that suggests such a shift may be under way is the hiring of Varun Chandra – a former investment banker who has left his role as the head of an investigations and intelligence outfit to take up a role as the Labour government’s attaché to the financial world.

Chandra isn’t a household name in Britain. Yet the 39-year-old is held in particularly high regard by many of London’s movers and shakers thanks to his stewardship of Hakluyt – a specialist advisory and consultancy firm staffed by former intelligence officers. He was already regarded as a master networker when he was appointed as its managing partner in 2019, aged just 34. And he must have done something right in the role; five years later, Hakluyt counts 15 of the 20 largest private equity firms among its client base.

As well as accepting a substantial pay cut as a result of leaving Hakluyt for public service, Chandra also gave up his role on the board of trustees of the British Asian Trust, which he had taken up in 2021.

His bonds with Labour were forged well over a decade ago, when he helped Tony Blair found his own private advisory business. His new boss, however, may be a rather tougher sell to the international business community. Mooted and rumoured changes to the tax regime have given many of Chandra’s old friends some cause for concern.

Given the parlous state of UK public finances, there is likely to be more bad news coming for high earners and wealth creators. If so, Chandra’s charm offensive will be much needed.

Jack Selby

Silicon Valley’s man in Hollywood

Sector: Tech/Finance/Film-making

Company: Thiel Capital LLC, AZ-VC

Title: Managing director

There has never been a stronger link between billionaires and Hollywood. Most of the time the former tend not to be the ones who are actually on screen, but there could be a few more exceptions to this rule if Jack Selby gets his way. The investor and former PayPal executive has bought the rights to make a film about the so-called ‘PayPal Mafia’ – the network of nascent tech founders who would go on to shape much of modern Silicon Valley.

‘I just want the story to be told properly,’ Selby has said of the project, notionally titled The Founders. A noble sentiment, perhaps, but one that will inevitably prove to be more complicated given the egos involved. Famous ‘Mafia’ members include Peter Thiel, Elon Musk, Reid Hoffman and David Sacks.

This loose fraternity of tech billionaires has provided occasional snippets of juicy gossip over the years – not least in autumn 2000, when Musk was unceremoniously removed from his original perch at PayPal at the behest of Thiel. Things have stepped up a gear recently, thanks to the ultra-polarised climate of the US election.

After the attempted assassination of Donald Trump in July, both Musk and Sacks made public attacks on their fellow ‘Mafia’ member Hoffman, best known as the founder of LinkedIn, insisting that his generous funding to anti-Trump campaigns and lawsuits had contributed to the climate of violence.

With the film understood to be focusing on the ear- lier parts of the PayPal mafiosi’s careers, this recent spat is likely not to make the final cut. But the vendetta shows the challenges that may lie ahead for Selby, a hedge fund executive turned budding film-maker, in telling the story. He does at least have some commercial success in Hollywood: one of his first productions, an acclaimed independent film called His Three Daughters, was recently bought by Netflix.

That said, Selby doesn’t look to be leaving his day job any time soon. Having co-founded Clarium Capital with Thiel more than 20 years ago, he now runs Thiel’s family office, Thiel Capital, as well as heading up his own venture capital fund, AZ-VC.

Sir Nicholas Coleridge

The publisher who’s gone back to school

Sector: Media/Education

Company: Eton College

Title: Provost

Media and publishing giant Sir Nicholas Coleridge, who spent decades overseeing an empire of magazines at Condé Nast, returned to his alma mater in September to take up the post of provost of Eton College.

The appointment, which was formally approved by King Charles III, sees Coleridge installed as head of the board of governors of the school, which was founded in 1440 and has educated 20 British prime ministers and the current Prince of Wales.

It comes against the backdrop of what has been called the ‘modernisation’ of Eton under headmaster Simon Henderson. Dubbed ‘Trendy Hendy’ by the tabloids, Henderson has been publicly criticised by some for pursuing a ‘woke’ agenda and has faced calls for his resignation over a number of decisions, including the sacking of a ‘beak’ (teacher) who refused to remove a lecture on ‘The Patriarchy Paradox’ from his YouTube channel. The dispute was leapt upon by the press and framed by some as a battle for freedom of thought and expression.

Coleridge began his career as a journalist and was for 30 years successively editorial director, managing director, president and chair of Condé Nast International, the global publishing house whose stable of magazines includes Vogue, GQ and Tatler. Previously chair of the Victoria & Albert Museum, he is now chair of the Historic Royal Palaces and was co- chair of the Queen’s Platinum Jubilee Pageant. He was knighted in 2022 for services to museums, publishing and the creative industries.

Educational experts are divided over exactly how much control Coleridge will exert over Henderson and the day-to-day running of the school, but some signals suggest he will be more likely than his predecessor, Lord Waldegrave of North Hill, to be in favour of Eton retaining its historic character and traditions.

Coleridge, whose family has deep ties to the school, has spoken warmly of his time as a student and is reported to have said that he ‘prefers the company of Etonians to the company of people from any other school in the world’.

Spear’s Power List 2024: The complete rankings

Each of the individuals in the Spear’s Power List 2024 appears in the table below; click on the links to read more at spears500.com.