Robots should recognised as drivers of economic growth and productivity, and investors should actively seek the ‘superstars’ who are leading tech, writes Jonathan Sparks

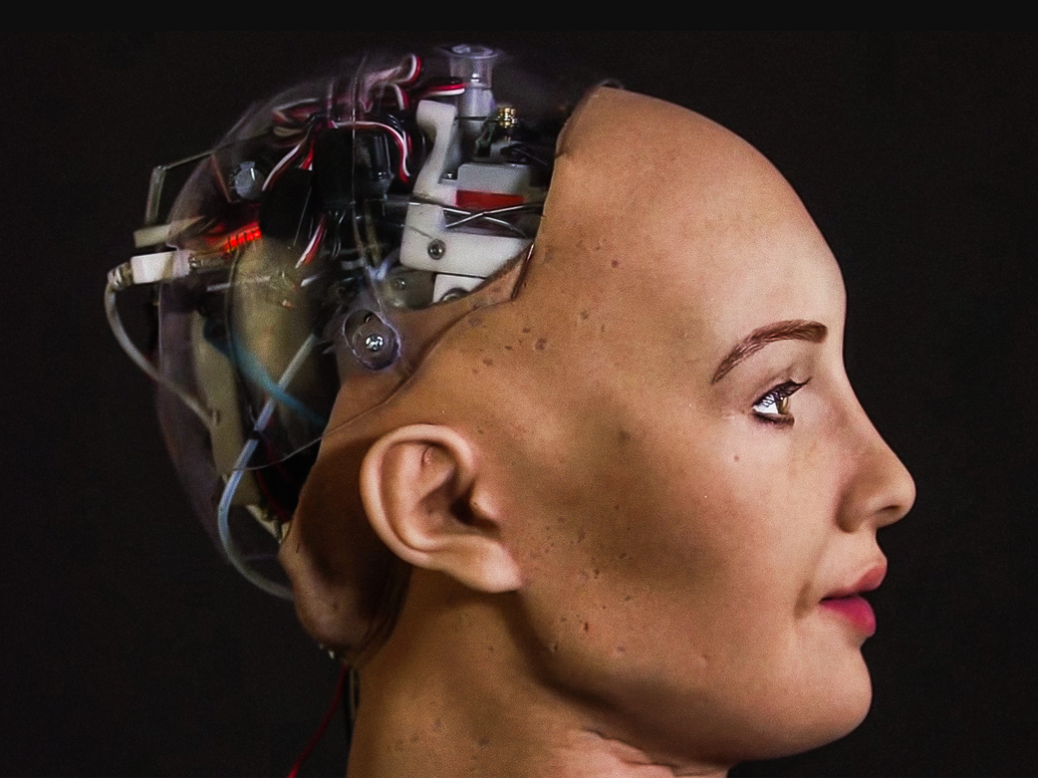

Robots are all around us. From gimmicky toys, to virtual ‘assistants’, to artificial intelligence that can detect malignant cancers, they play a part in almost every aspect of our lives. But many of us are still fearful of robots, and of a future where big data, artificial intelligence, internet connectivity and advanced materials science all meet. Our view is that there are plenty of reasons to be optimistic about technology, not least its potential to boost productivity, grow our economy and deliver returns to investors.

The biggest fear we have about robots is that they will destroy jobs. There is some evidence to back this claim, with many suggesting that the stagnant wage growth of the US middle classes is a symptom of increasingly advanced technology competing with labour.

Those that are more optimistic rightly point out that the revolution in technology, work and production we are facing now is the fourth ‘industrial revolution’ since the use of steam power allowed mechanised production. While each of these revolutions has bred similar fears over job losses, our past experiences have overall been positive.

Prior to the first industrial revolution, economic historians estimate that each generation’s living standards were about 0.3 per cent better in real terms than their parents’. Since the Industrial Revolution, suggests Bank of England research, each generation has been roughly 25 per cent better off than their parents. So it may be that the initial impact of a technological break-through destroys jobs, but ultimately those displaced workers find new, ideally more productive, jobs. Think of the decline of typing pools since the early 1980s, but the growth in jobs such as computer game design.

Looking at more recent history shows how growth and productivity are driven. Research by the US National Bureau of Economic Research (NBER), MIT and Harvard University outlines the process by which the most efficient company in any sector picks off market share from other companies in the same sector.

These ‘super-star’ firms are typically heavy users of technology. Increasingly, by offering intellectual and real financial reward, they also attract the best minds in physics, mathematics and computer science. Some of the most cutting-edge research is now being done on a tech campus rather than a university campus, as tech giants have greater access to data and funding. This is feeding into not just better products, but into entirely new categories of products, produced more efficiently than rivals can achieve and marketed in a more targeted way.

As those superstar companies gain market share, and less efficient companies die, an overall sector’s productivity is lifted substantially.

But for investors to really capitalise on this process, they need to identify the super-star firms, and eliminate the laggards from their portfolios. This makes an active approach to stock-picking more compelling. Investors who understand and are comfortable with alternatives should also consider the many equity long-short hedge fund managers which can profit from the differing fortunes of the superstars and laggards.

We believe that these superstars can increasingly be found by looking East as well as West. Silicon Delta, around the Pearl River, is China’s answer to Silicon Valley, and the innovation around the country’s three tech champions is intense. After the US, China is now consistently the world’s second biggest investor in tech-related private equity and the second biggest producer of patents.

For those who pick the superstars, the rewards of our current industrial revolution are clear. We should also not overlook its potential to sustain the current eight year-long global economic expansion, and to lift the lacklustre growth rate. What’s more, past experience suggests that the benefits of such growth may ultimately be shared in a balanced way between corporate profits and an increasingly higher skilled workforce. Given the growth they can bring and the new things they make possible, perhaps we should be less frightened of our robot friends.

Jonathan Sparks, Head of Investment Strategy, UK and Channel Islands, HSBC Private Banking