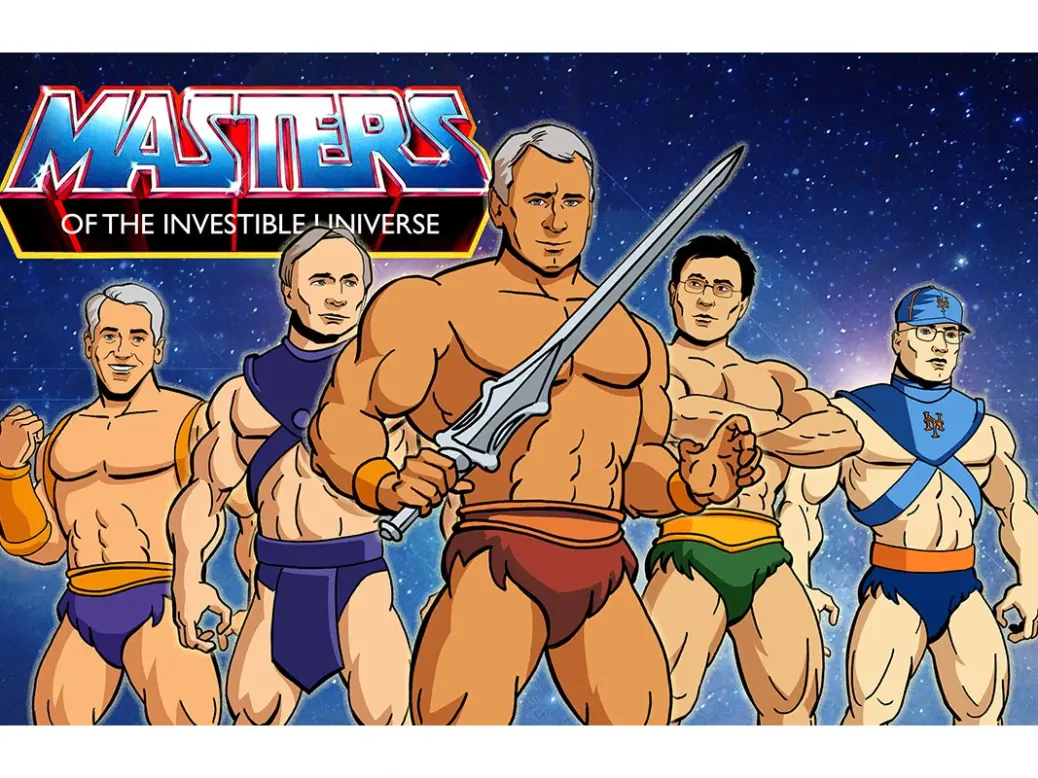

Before the crash of 2008, it sometimes seemed as though hedge fund managers really were ‘masters of the universe’. The eye-popping returns of US macro stars such as Paul Tudor Jones and Louis Bacon helped them to make billions, while George Soros famously had the power to ‘break the Bank of England’ in 1992.

[See also: Top hedge fund investment tips for 2024, according to insiders]

These titans were famed for the alpha returns they could create in rising and falling markets, as well as the two-and-20 fee model which saw them pocket a fifth of all profits on client money. But the long bull market of the 2010s proved hostile territory. Delivering alpha proved more difficult in an era of surging stocks and low, zero or even negative interest rates. Market volatility fell and opportunities diminished in the age of quantitative easing, giving central bankers a form of revenge as their old foes struggled.

Average hedge fund returns were either negative or single-digit positive in the eight years between 2011 and 2018, according to Chicago-based tracker HFR. As the bull market rode on and investors could get double-digit annual returns on a regular basis via low-fee products such as ETFs, hedge funds lost their lustre.

[See also: The challenge of ‘consumer duty’]

Some hedge fund managers have left their old stomping grounds of Mayfair and Manhattan, preferring to decamp to Silicon Valley in search of tech riches or to ride the private markets wave (which by contrast grew rapidly over the decade). Former portfolio manager Rishi Sunak opted to become a different type of PM altogether, rather than stay in the $4 trillion industry.

But many stayed the course. And what’s more, a comeback may be on the cards.

A perfect storm

‘We believe that there are good reasons to be more positive about the returns to hedge funds and other active strategies over the next few years than for much of our careers,’ says Adam Singleton, CIO of external alpha at Man Solutions, a department of the world’s largest listed hedge fund manager investing in other hedge funds. He sees ‘structurally higher inflation’ persisting, which ‘will keep asset volatilities higher on average’, and interest rates which are higher and less predictable than for most of the past two decades.

Higher rates, along with geopolitical uncertainty and macroeconomic volatility, are seen as key drivers of a hedge fund comeback. A key year was 2022, when stocks and bonds cratered in unison as inflation surged, with hedge funds protecting capital and many delivering double-digit returns.

[See also: Private markets: should individual investors take the plunge?]

HNWs and family offices – the main source of allocations last century (more recently replaced by pension funds) – appear to have taken note. Hedge fund allocations from family offices rose to 7 per cent from 4 per cent last year, according to UBS’s 2023 report (private equity allocations went the other way, heading from 13 to 9 per cent).

The hangover from the glory days lingers like a taxi driver by Berkeley Square awaiting his next fare. Almost two-fifths (38 per cent) of respondents to BlackRock’s family office survey last year expressed disappointment with hedge fund performance. One US family office dismissed ‘a lot of equity long/short [as] just equity beta’, meaning any gains were often the product of the market, rather than of outperformance. That perspective was not unique, with almost $150 billion in net outflows from the strategy over the past five years, according to eVestment, a US data provider.

But the sophisticated skills of hedge fund managers are still in demand among wealth managers. ‘We favour strategies where we believe there is a structural opportunity that requires specialist skills to access,’ says Alastair Baker, a portfolio manager with Sarasin & Partners, naming trend-following by commodity trading advisers (CTAs) and equity dispersion as examples.

[See also: The UAE is attracting HNWs – and wealth managers are following]

However, managers need more than reputation to draw capital, and demonstrable process is key. ‘We have a much higher hurdle for managers that is based purely on their skill, as it is difficult to attribute between luck and genuine ability and the repeatability of the outcome.’

Peter Albinsson, CEO of UCAP Wealth Management Switzerland, sees two drivers for the strong interest in hedge funds from private clients (HNWs and family offices) as well as institutions.

‘Recent market gyrations have shown that such traditional concepts have offered limited diversification benefits in times of market stress,’ he says. ‘Secondly, future returns stand to benefit hedge funds given increased market volatility and higher yields – volatility as it creates trading opportunities and the ability for managers to generate alpha; higher yields in turn boost returns on the underlying cash allocations within the funds.’

The hedge fund renaissance

A wave of new fund launches is also boosting confidence in the sector. Start-ups began to outpace closures midway through 2023, according to HFR, whose president Ken Heinz says the pandemic, rising volatility and a ‘generational’ increase in inflation created an environment in which investors were less willing to take a risk on backing new funds. ‘There is a lot of latent demand.’

[See also: Wealthy families use this crucial tool to protect their assets]

Jon Caplis, the founder of PivotalPath, an industry research firm in New York, observes: ‘Our research indicates we will see over 40 new launches in 2024 from $1 billion-plus hedge fund firms. That’s something we haven’t seen for years. It indicates a new confidence from talented managers to go out on their own. The market and trading environment for hedge funds generally is good, especially credit, which is why we are seeing a lot of interest in sub-strategies like distressed and long/short credit.’

This renaissance owes much to the one corner of the hedge fund industry which continued to grow during the lean years: multi-managers, known in the trade as ‘pod-shops’, which run multiple strategies through many (often hundreds) small groups of traders.

Firms such as Citadel and Millennium, which both run about $60 billion, have delivered consistently strong returns, especially during the pandemic when they provided high returns and low diversification to other investments. High fees were accepted because of excellent net returns.

[See also: Where have all the UK billionaires gone?]

Many of the biggest new and planned launches (below) are led by traders previously at those two firms. ‘A lot of new fund launches in recent years had been swallowed up by the growth and popularity of multi-strategy “pod-shop” platforms,’ adds Caplis. ‘These firms remain popular but their growth may have peaked and investors feel fully invested, especially after single manager firms outperformed the multi-strats (on a net basis) last year.’

Could the masters of the universe be back in business? Memories of the QE era will be hard to shake, but hedgies are determined to make sure this isn’t another false dawn.

New launches to watch

Freestone Grove

Founders: Todd Barker & Daniel Morillo

AuM $3.5bn

The ex-Citadel duo launched the multi-manager outfit in January after styling it as the antidote to ‘pod-shops’ – still running teams of investors across different strategies, but not on the same mass scale.

Taula Capital

Founder: Diego Megia;

AuM TBC

Diego Megia, a top Millennium money manager, is behind the biggest London-based launch in years. He will start his macro firm later in 2024, reportedly with sizeable backing from his old firm and a day-one total above $4 billion.

Ilex Capital Partners

Founders: Jonas Diedrich & Dave Sutton

AuM $1.85 bn (July 2023)

When the London-based duo of former Citadel traders started their long/short equity fund it was the biggest day-one fundraise of 2023 and attracted money to an out-of-favour strategy.

30th Century Partners

Founder: Kurt Baker;

AuM TBC

Fundraising is under way for what could be Asia’s biggest launch in years. Kurt Baker, a former head of prime brokerage at Morgan Stanley with Millennium pedigree, reportedly aims to start his firm with $3bn later this year.

Jain Global

Founder: Bobby Jain

AuM TBC

Founder Bobby Jain’s pedigree as the first co-CIO at Millennium means no launch has generated as many headlines as New York-based Jain Global, which begins trading later in 2024. It is expected to raise billions.

SurgoCap Partners

Founder: Mala Gaonkar;

AuM $1.8 bn (Jan 2023)

The biggest hedge fund ever launched by a woman founder began trading last year – an overdue milestone for a male-dominated industry. Gaonkar’s New York-based firm focuses on technology investments.

Will Wainewright runs Alternative Fund Insight, providing intel and research on hedge funds and private markets.

This feature was first published in Spear's Magazine: Issue 91. Click here to subscribe