It is important to choose trustees carefully to ensure the trust will be managed properly, and the risk of future disputes minimised, writes Tom Deely

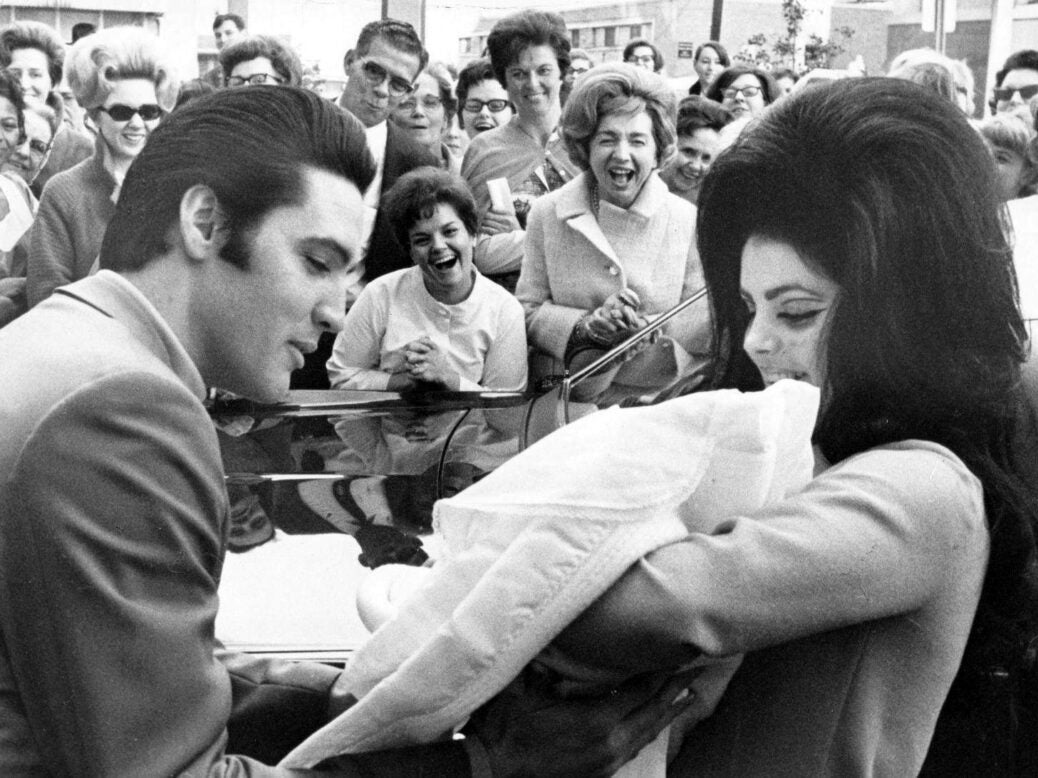

Last week it was reported that Lisa Marie Presley, the daughter of Elvis Presley, is bringing a claim against her former manager for ‘reckless and negligent mismanagement’ of the fund she inherited from her father’s estate. Ms Presley inherited her father’s estate, worth approximately $100 million (£71.5 million) at the age of 25.

Ms Presley claims that the balance of the trust fund, managed by her former manager Mr Barry Siegel for her benefit, is now less than £10,000.

Whilst this matter is in relation to an estate fund in the United States, similar complaints about trustees in England are not uncommon, and highlight the importance of choosing trustees carefully to ensure the trust will be managed properly, and the risk of future disputes minimised.

Trusts are typically established in order to manage and preserve assets for people who are unable to manage their own affairs at the time, typically due to a lack of mental capacity, or as in Ms Presley’s case, their age. In either scenario there is a risk that a beneficiary will not be able to appreciate fully the nature of the trust and the consequences of a trustee’s actions. Such beneficiaries are therefore vulnerable and at risk of financial abuse in the hands of an unsuitable trustee.

Trustees have a ‘fiduciary’ duty to the beneficiaries – that is a duty of trust and confidence. Trustees must act in the best interests of the beneficiaries which means, amongst other things not allowing personal interests to conflict those of the beneficiaries, or otherwise benefiting from their position as a trustee. Furthermore, they have a duty to manage trust assets responsibly – or as the Courts would put it, to deal with trust assets ‘as a prudent man of business’.

In the hands of an unsuitable trustee, a trust fund can very easily be mismanaged and significantly reduced (as in Ms Presley’s case) and not always intentionally.

Trustees have various powers, which, if applied unwisely, can cause damage to the trust.

For instance, trustees have the power to make investments on behalf of the trust, as if they were investing their own personal funds. Even in the absence of any wrongful intent on the part of the trustee, poor investment decisions can cause significant losses to a trust. This is central to Ms Presley’s claim against her trustee, as she contends that the trust lost millions as a result of a poor investment in Core Entertainment Inc., – the company behind American Idol.

Thankfully there are safeguards in place, in the form of duties that trustees must observe in order to protect beneficiaries. For example, prior to investing any of the trust funds, trustees have a duty to obtain investment advice from a professional who is qualified to advise on such an investment. Trustees also have a duty to regularly review the investments held in a Trust with a view to considering the suitability of each investment.

Nevertheless, it is important that the trustee is someone whom the settlor (the person setting up the trust) can trust to act with integrity and in the best interests of the beneficiaries.

It is always prudent to consider whether an independent professional should be appointed as a trustee, particularly where the trust may be complicated for any reason. A higher duty of care will apply to professional trustees and this creates an added safeguard and reduces the risk of wrongdoing and disputes later in time.

Trustees must act in accordance with the terms of the trust document, which will set out the trustee’s duties. It is therefore advisable to set out the duties clearly.

A useful method of minimising disputes arising later in time is to prepare a letter of wishes to accompany the trust document. A letter of wishes can be drafted in more personal terms than a trust deed and as such can be tailored towards the particular trustees and beneficiaries in mind.

This can help to ensure the trust is administered more smoothly and can mitigate the risks of a dispute occurring later in time.

Tom Deely is an associate at Russell-Cooke