‘Investors will have to live with the positive impact of improving economics alongside the negative impact of tighter money in this next phase of the global recovery’

Were Mr Bernanke, Mr Carney and other central bankers to have met at the symposium in Jackson Hole, Wyoming, as they have in previous years, there might have been a mildly self-congratulatory air. After all, the US recovery continues, alongside a convincing turnaround in housing and construction in the UK, and even the eurozone is showing tentative signs of economic life.

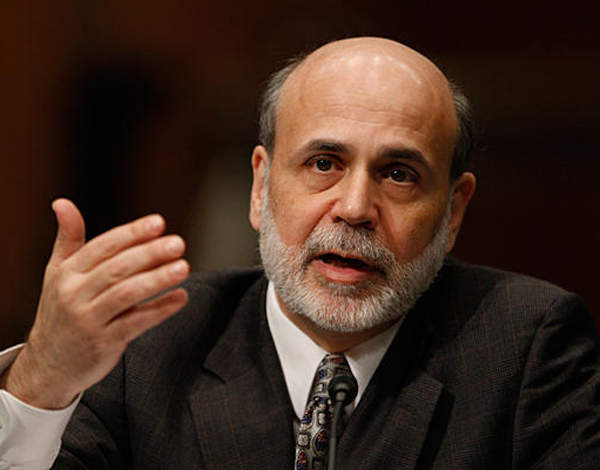

However, in a break from tradition, few big names attended this year’s Jackson Hole symposium. Chairman Bernanke, moving towards the end of his tenure, stated that he could not attend the gathering due to a ‘personal scheduling conflict’ — the first time a Federal Reserve chairman has not attended since 1988. Still, among those ‘moderators’ present was Janet Yellen, Bernanke’s deputy and a key contender in the race to replace him.

Read more on Ben Bernanke and the Federal Reserve

One of the hot topics, unsurprisingly, was the winding-down of the ‘successful’ era of quantitative easing and its gradual replacement by the policies of ‘forward guidance’, the monetary philosophy that now dominates thinking at the Fed, the European Central Bank and, most recently, the Bank of England.

These past five years of QE, championed by Bernanke, will be missed by global investors — the combination of regular asset purchases has been good for virtually every asset class. Since QE was first introduced in 2008, equities have risen by around 80 per cent in the US, by 55 per cent in Japan, by 50 per cent in the UK, and by 20 per cent in Europe (the same as their Chinese equivalent!). Gold — despite recent declines — has still risen by 80 per cent over the same period, while US ten-year bonds are now little changed after the recent back-up in yields.

New brooms

Bernanke’s exit from the Fed is planned for early 2014, and his former opposite number at the BoE, Mervyn King, bowed out for Carney in the summer. So what will the post-Bernanke/King era hold for investors, and what are the risks of le déluge?

If QE promised unlimited asset purchases by central banks, and the forcible repression of interest rates, ‘forward guidance’ simply tells us how and roughly when such conditions might end. In other words, it points the way to a controlled normalisation of monetary policy. In one sense this is negative for markets. The prospect of rising interest rates — even over several years — is often difficult for asset prices, especially those promising a fixed rate of return (as we have seen in the persistent back-up in bond yields).

However, forward guidance also contains a positive message, namely that growth and employment are starting to improve, and this now necessitates guidance on how monetary authorities will respond. The evidence of economic recovery that lies behind this will support profits and dividend growth, while the measured and transparent response of central banks should allow markets to avoid a disorderly interest rate shock.

In short, investors will have to live with the positive impact of improving economics, alongside the negative impact of tighter money in this next phase of the global recovery. So far, central bankers have calibrated this carrot-and-stick approach rather well; a steady upward trend with continuously falling volatility has been the result for global equities, coupled with a manageable but persistent sell-off in bonds.

The move to tighter monetary policy ultimately implied by forward guidance was always going to alter market leadership and trigger a repricing of many fixed-interest and related assets. I continue to believe that these adjustments, if managed within the frameworks outlined by Bernanke and Carney, may see market volatility rise somewhat.

Ceiling deals

Meanwhile, on the fiscal front, like a bad penny, debt-ceiling negotiations came around again. This was once a perfunctory, near-automatic process, but the recent negotiations have been overlaid with political point-scoring. Meanwhile Europe had an uncertain time in autumn thanks to Germany’s tight federal elections in late September, and the political troubles and human tragedy in the Middle East continue to mount.

However, I do not believe that this will be enough to undermine a continued re-rating of global equities, further robust dividend growth and (for selected companies) strong thematic underpinnings that will continue to power top-line growth. Yes, the risks of a further bond sell-off are clear, alongside growing evidence of emerging-market stagflation and stubbornly high oil prices, but global thematic equities appear to remain the best way to keep one’s head on one’s shoulders.