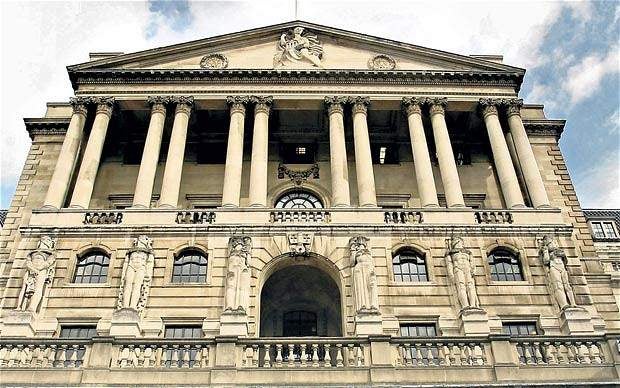

The Bank of England Monetary Policy Committee came close to deadlock on interest rates yesterday, and change is in the air, says Christopher Jackson

Inflation and elusive wage growth in the UK economy were under the microscope yesterday after a surprise vote by the Monetary Policy Committee of the Bank of England.

Although the eight-strong panel voted to keep interest rates at their historic 0.25 per cent low, the vote was closer than expected and reflects the presence of hawkish dissenters at the bank. Ian McCafferty and Michael Saunders joined MIT professor Kristin Forbes in voting to raise rates to 0.5 per cent.

After the meeting, the pound spiked against the dollar and the euro. Yields duly rose and markets were prompted to price in a 50 per cent chance of a rate rise in 2018, up from 33 per cent before the vote.

Geoffrey Yu, head of the UK investment office at UBS Wealth Management, said: ‘The 5-3 vote today is clearly one that markets were not positioned for and sterling’s reaction reflects this. There is a clear emphasis on the risk of a sustained inflation overshoot and the Bank of England probably does not want to be seen as being dismissive of such concerns.’

But recent economic data has hardly been encouraging, and many suspect that the tight vote was not conducted for appearances’ sake. The 5-3 vote followed on from a recent report by the Office for National Statistics showing that the UK inflation rate crept upwards to 2.9 per cent in May, from 2.7 per cent in April. This was, in part, attributable to the rising cost of goods, from foreign package holidays to imported computer games, due to a weaker pound post-Brexit. It has meant a 0.6 per cent dip in real wages on the year in April, as prices outstripped wage growth.

However, although there is further likelihood of a rise to interest rates if the pound continues to fall as a result of political uncertainty, other voices were urging caution. Credit Suisse released a statement arguing that rates will likely remain on hold ‘for the foreseeable future’, with inflation likely to recede ‘in a couple of quarters’. The bank also pointed out that the panel is shortly to see dissenter Kristin Forbes depart, having voted for the last time. It might be that this represented a high-water mark for the interest rate hawks.

Julien Lafargue, european equities strategist at JP Morgan, also doubts that yesterday’s vote will signal a sea change in monetary policy: ‘One silver lining is that producer prices appear to have peaked and this could help ease some of these tensions in the coming months. At this stage and given the lingering political uncertainty, we believe the BoE will refrain from tightening its monetary policy, even if this means that inflation has to run hot for a while.’

But uncertainty is just that – uncertainty, and other commentators were prepared to argue the opposite position. Joe Batarseh, director of wealth and investment management at Coutts, commented: ‘We would not be surprised if rates rise from here, more as a reversal of the post-Brexit emergency cut, as opposed to a response to inflationary threats as we believe that inflation will moderate next year.’

That showed a certain confidence in the UK’s inflationary position, and by association in the pound – indeed, none of the banks Spear’s spoke to was considering rebalancing their assets imminently. UBS’s Yu explained: ‘The bounce in GBP supports our existing underweight UK equities versus eurozone equities view, and we doubt GBP rallies will have legs in the foreseeable future.’ However Yu also said that if the current ‘assumption of an orderly Brexit proves incorrect’, things could change again.

Meanwhile Batarseh saw confirmation of Coutts’ own strategy in the outcome of the Bank of England vote: ‘Since the EU referendum, we have taken profits from international assets and bought Sterling, we have reduced exposure to long dated bonds for investors, particularly government bonds, and have selectively been investing in financial stocks as these would benefit from rate rises, which would have a positive impact on lending and deposit margins. We have also kept our UK equity exposure to modest levels,’ he told Spear’s.

But for now, with no deal yet agreed between Theresa May’s conservatives and the DUP, and with dizzyingly complex EU negotiations scheduled to begin soon, there is the sense that we might be approaching a tipping-point.

There was a little noticed detail in the minutes to the Bank of England meeting: it was observed that there was a risk that inflation might rise ‘above 3 per cent by the autumn’. That would trigger the need for Mark Carney to write an open letter to Chancellor Philip Hammond. The road ahead might be about to get bumpy.

Christopher Jackson is head of the Spear’s Research Unit