In an unprecedented move, an anti-tax avoidance campaigner has written to the Queen to complain that Britain’s Overseas Territories and Crown Dependencies are blocking tax transparency and blackening Britain’s reputation.

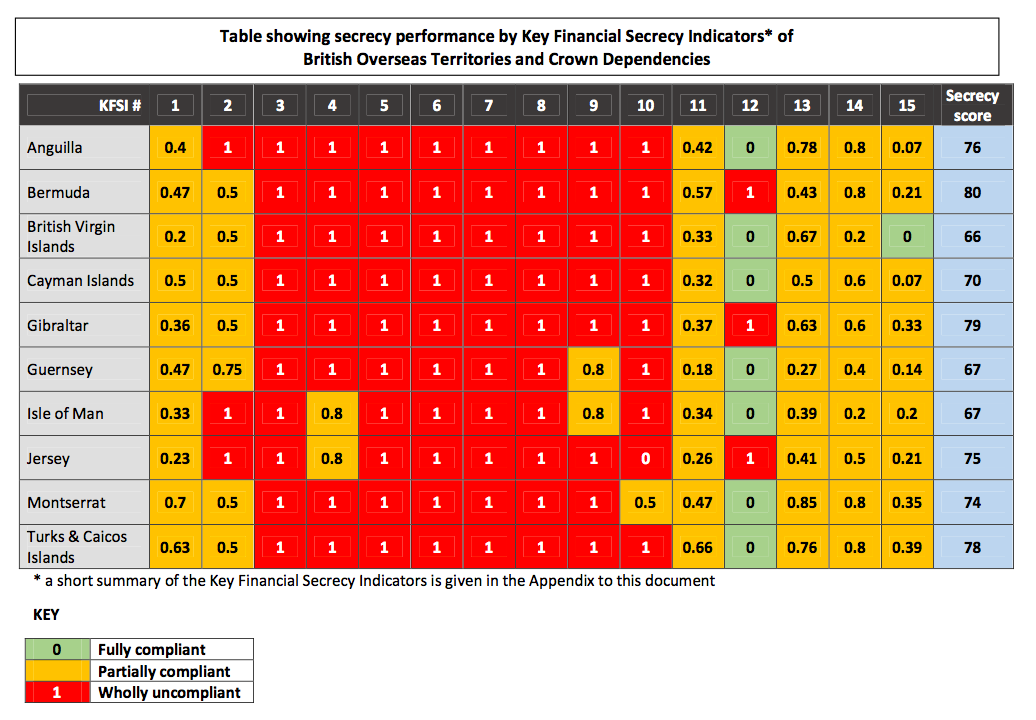

John Christensen, director of the Tax Justice Network, writes that these jurisdictions, which include ‘tax havens’ like Jersey, Guernsey and the British Virgin Islands, ‘still fall woefully short of acceptable standards of transparency, having made only modest reforms since 2009, when the G20 led by your government committed itself “to take action against non-cooperative jurisdictions, including tax havens.”‘

Read more on tax avoidance from Spear’s

Christensen points out that in June this year David Cameron ‘undertook to tackle the global problem of offshore financial secrecy’ and was claiming success yet had achieved little.

He urges the Queen ‘to exert all possible influence to address one of the most harmful faultlines in the global economy. While constitutional propriety militates against direct public intervention in the politics of the United Kingdom, longstanding convention preserves your right to advise, encourage, and warn your Prime Ministers.’

The letter coincides with the release of the 2013 Financial Secrecy Index, produced by the Tax Justice Network, in which Switzerland retains its place (held since the 2011 index) as the world’s most secretive jurisdiction, although its score has fallen.

The TJC concedes that ‘in recent years, in line with a shrinking international tolerance for financial secrecy, Switzerland has made a few not insignificant concessions on secrecy, agreeing to exchange information on a limited basis with selected other jurisdictions.’ But it says this process is two-faced, ceding to America and the EU, but not to developing nations.

Read more on offshore banking from Spear’s

The rest of the top ten most secretive jurisdictions are Luxembourg, Hong Kong, the Cayman Islands, Singapore, the USA, Lebanon, Germany, Jersey and Japan, although all are quite a way behind Switzerland. The United Kingdom itself comes in at 21st.

Positions are assigned ‘according to their degree of secrecy and the scale of their trade in international financial services’ based on quantitative and qualitative measures. These include co-operation with information exchange processes, trade in international financial services, compliance with money-laundering norms and lack of transparency.