COUTTS

With a May 2015 election on the horizon there has been media speculation and lobbying from certain politicians for the Budget to include a raft of tax cuts, says Dominic O’Connell, head of tax, trust and estate planning at Coutts. We don’t envisage any wide-ranging reductions, although further targeted cuts for the lower paid and certain businesses could feature.

Read more on past Budgets from Spear’s

Read more on tax and trsut from Spear’s

Income Tax changes

A further increase in the Personal Allowance to £10,500 seems likely and would be welcomed by many who have not seen a real rise in incomes in recent years. There has also been talk of raising the lower threshold for paying tax at 40%, to ease the burden on middle-class taxpayers who have suffered from ‘fiscal drag’. We’d be surprised if this were introduced, though, particularly given previous announcements of further savings that still need to be found.

A more innovative, and potentially fairer, change could involve lowering the threshold for the 45% rate in conjunction with scrapping the Personal Allowance clawback for higher earners.

Cap on ISAs/tax-free lump sums

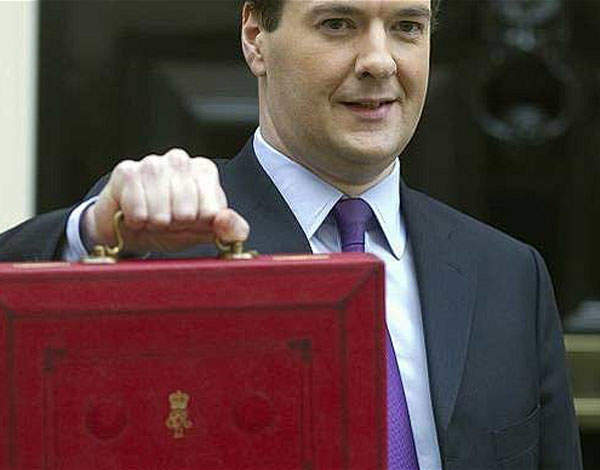

Despite recent signs of economic recovery, George Osborne has often repeated the need to make further difficult decisions during 2014. One such decision could be to cap ISA ‘pots’ and / or restrict the tax-free amount that can be withdrawn from pension schemes, although we believe it would be misguided to introduce such measures before economic recovery is complete. Such measures would inevitably damage public confidence in both the UK’s tax system and savings mechanisms.

IHT tax-free band

The inheritance tax nil-rate band is due to stay at £325,000 until 5 April 2018. In light of the election in 2015, and with some talk of another housing bubble, the chancellor may revisit this area. While raising the tax-free band appears unlikely, it could be one way to generate political support at a relatively modest cost to the government.

Read more on inheritance tax from Spear’s

Top-end property

Despite recent provisions that charge CGT on non-UK-resident property owners and restrict private residence relief, the government could find further tax revenues from UK property. Although a ‘mansion tax’ appears unlikely at present, Stamp Duty on high-value properties could be increased as part of an overhaul of the current ‘slab’ system, whereby the percentage applied to the whole price increases when the price simply crosses the requisite threshold (even by £1).

Read more on property from Spear’s

Anti Avoidance

The distinction between ‘reasonable’ tax planning and unacceptable tax avoidance is often blurred, and the Budget is likely to announce further measures to curtail artificial and abusive avoidance schemes and close specific loopholes.

Read more on tax avoidance from Spear’s

Social investment

Many of our clients are eagerly awaiting further announcements on social investment, particularly in relation to the proposed rate of income tax relief, as this could be an important factor in their philanthropic strategies.

Read more on social investment from Spear’s

BERWIN LEIGHTON PAISNER

With the British economy now on the path to sustained recovery, the debate continues on what growth measures should be included in this Budget, one of George Osborne’s final high-impact announcements ahead of the general election in 2015. According to experts at international law firm Berwin Leighton Paisner, the Chancellor needs to abandon the recession mindset and focus on creating a tax policy for recovery.

Peace for non-doms in our time

Damian Bloom, a partner in the private client team, concludes that it is important to stimulate investment by both individuals and businesses:

‘Businesses are run by people and personal tax plays an important role in retaining the UK’s position as an attractive investment location. International property investors and non-doms have come under continued assault from the tax system in recent years.

‘Tax policymakers would do well to remember that rules such as the non-doms regime are not a blemish on the tax system, but a feature that has been developed and sustained for fair and justifiable reasons. The best thing a Chancellor could do in this Budget would be to recognise this, and either leave the international investors alone, or better still, introduce legislation that actively encourages inward investment.’

Read more on non-doms from Spear’s

Bank levy: the cigarettes and alcohol tax of the business world?

Michael Wistow, partner and head of tax, warns on the danger of further anti-bank measures. He says:

‘Stability and predictability are cornerstones of an effective tax system. The banking sector in particular will be hoping for more of this in the Budget after seeing numerous tax changes in recent years, especially as the bank levy rate has more than doubled since it was first introduced in January 2011.

‘Banks have shouldered much of the blame for the global financial crisis and the bank levy is now in danger of becoming the business equivalent of taxes on fags and booze. It’s hard to wean a Chancellor off raising vice taxes to boost the public purse and similar considerations are starting to apply to banking.

‘Yet this could prove a dangerous policy. International banks are not bound to the UK and the continued uncertainty and cost of the bank levy will prompt them to consider other locations. As the recovery picks up steam, there will be more business for banks to write. The question is whether they will write it from the UK.’

VIEWS FROM ENTREPRENEURS

Businessmen give their views on what they want to see in the forthcoming Budget, soon to be announced by Chancellor George Osborne.

Anthony Rushton, CEO of leading online advertising auditing company Telemetry (www.telemetry.com)

“I want the government to announce solid Research and Development tax benefits for internet based tech providers. Also, there should be an increase in Entrepreneur Relief from £10 million to £25 million with improved terms for activation. Finally, I think the Chancellor should announce a reduction in stamp duty in the housing market.”

Scott Fletcher, chairman and founder of Cloud Specialists, ANS Group (www.ans.co.uk)

“There should be a focus on encouraging business investment using the tax system, in particular for employment of young people, capital investment, and digital economy.

“They should also abolish business rates for start-ups, and abolish university fees in science, technology, engineering and mathematics as we need thousands more engineers.

“The Chancellor can save billions by investing in the Cloud, something that the government is not yet fully taking advantage of. It has proven to be more flexible and better value for money for businesses up and down the country. It could save the government billions, reducing the need for so much austerity and allowing government to reduce business taxes to encourage investment, something that is needed alongside our consumer led recovery.”

Will Davies, co-founder and managing director of leading property maintenance firm, aspect.co.uk

“As proposed, the Mansion Tax seems like a crazy idea as it will hit many UK nationals given the number of properties out there over the £2 million threshold that has been suggested, as opposed to hitting foreign investors which is the main intention.

“We think it will hit our market as large chunks of London home owners will have to fund this additional money annually and that will hit the amount they have to spend on improvements to their homes. Surely there must be a more efficient way to tax foreign money investing in UK property?”