‘The top rank of Britain’s independent schools really are the best in world,’ says historian Niall Ferguson, a senior fellow at Stanford and Harvard universities in the US and one of the UK’s most internationally respected scholars.

It’s a view widely held by discerning parents as well as distinguished educationists. From Benenden, Brighton College and Charterhouse via Eton and Harrow to Wellington, Winchester and Wycombe Abbey (to use the Spear’s Schools Index 2024 ‘top 25’ as an alphabetical guide), these often centuries-old institutions offer an unmatched combination of teaching excellence, extracurricular breadth, pastoral care, networking connections, history and tradition.

[See also: Introducing the Spear’s Schools Index 2024]

Top North American schools boast more luxurious facilities; ultra-exclusive and expensive Swiss schools have more jet-set cachet; but British private education is a heritage brand admired the world over.

That makes it a significant export earner, both in fees from overseas parents and in revenues from offshoot schools that carry the British brand abroad. Just as our university sector is or should be, private schooling is also a ‘soft power’ asset, creating long-term personal loyalties and economic ties to the UK.

[See also: The business of education: the question of VAT on private school fees]

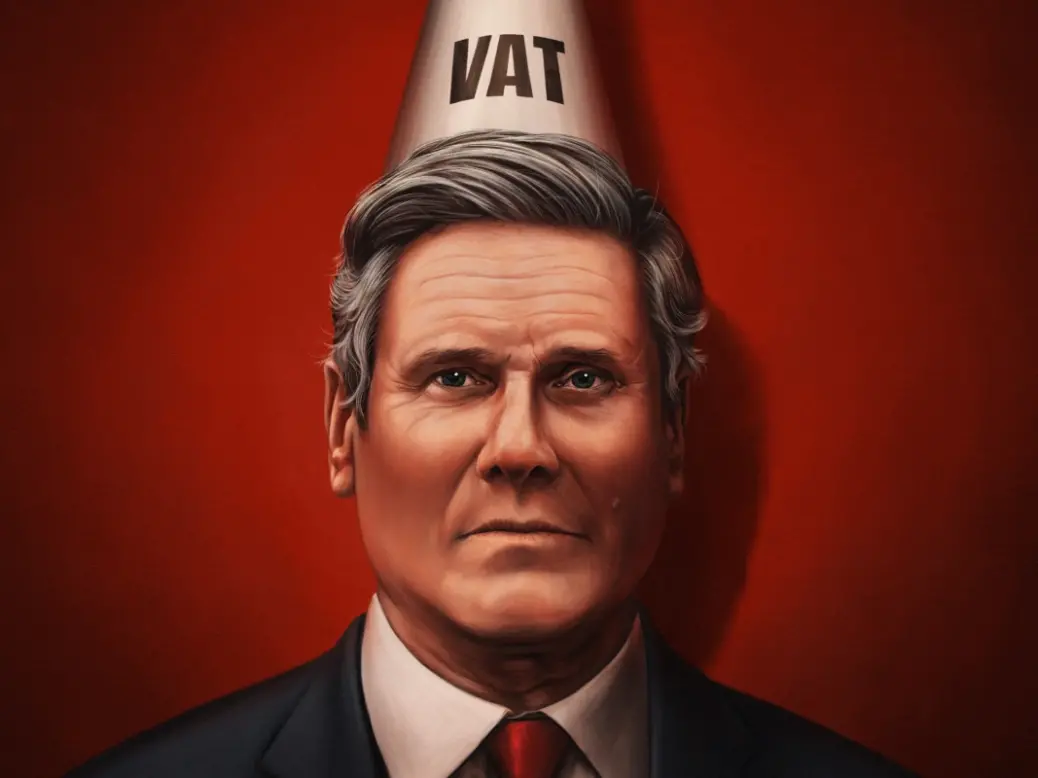

Sir Keir’s big plan

The UK’s wider independent sector, made up of almost 2,600 schools of all shapes and sizes, is a £16.5 billion contributor to the UK economy that sustains 328,000 jobs, according to 2022 research by Oxford Economics. The sector’s 620,000 pupils (around 10 per cent of them from abroad) represent a £4.4 billion saving to the Exchequer by not taking up taxpayer-funded state school places.

[See also: Private school enrolments fall amid Labour VAT concerns]

All of which, you might think, constitutes a powerful argument for any British government to refrain from damaging private education. But that is exactly what Sir Keir Starmer’s Labour Party plans to do, by imposing 20 per cent value-added tax on independent school fees (previously free of VAT, as school fees are almost everywhere else in the world). He also plans to apply business rates (taxes for local services) to those schools which, as charities, would normally be exempt.

The positive impact, Labour claims, will be £1.6 billion per year of additional tax revenues, to be spent on recruiting new teachers, paying good ones better and providing ‘breakfast clubs’ for primary pupils. But that loosely estimated sum is a drop in the bucket of total state education spending of £116 billion for 2023-24.

And analysts have cast serious doubts on Labour’s arithmetic: a larger-than-expected migration of pupils from the private to the state sector, plus closures of a significant number of tax-generating independent schools, could reduce the net benefit to pocket change – or even less than nothing.

But this is, at heart, a political manoeuvre, not a calculated revenue-raiser: a red-meat gesture to left-wing Labour supporters, backbenchers and trade unions who detest the very concept of elite education for those whose parents can afford it. And the fiscal outcome is irrelevant: this VAT grab is happening anyway. While schools work out whether they can cushion the extra cost to parents by trimming the educational offer, parents are reconsidering the value of that offer and the available alternatives.

Tricky calculation for schools

‘It would be quite wrong to think all independent schools can cope with VAT the way the likes of Eton and Harrow might be able to do so,’ says Sir Anthony Seldon, a doyen of the sector as head of Epsom College and former head of Wellington and Brighton College.

[See also: British boarding schools have a low-tech solution for a very modern problem]

‘This will damage schools outside the South East, prep schools, niche schools and many other schools which don’t operate on significant margins.’

Every school bursar faces a tricky calculation. The size of the net increase in fees will almost certainly correspond to the number of parents who are unable or unwilling to keep paying them. And, of course, the larger the number of pupil withdrawals, the deeper the potential dent in school revenue budgets. The cost of getting the balance wrong could be to initiate a spiral from which a school’s finances would never recover.

Some brave institutions will simply test parents’ tolerance by adding 20 per cent VAT to an unchanged termly bill in one hit. Few schools are rich enough to ‘absorb’ VAT, even temporarily, by slashing their own revenues to protect their customers. Many more will try to mitigate the impact for parents to a more bearable 12-15 per cent, perhaps smoothed over several years. But whatever the chosen formula, cost cuts for schools look inevitable. And that means higher pupil-to-teacher ratios and the elimination of specialised subjects and extra activities. The chair of governors of a large southern independent school observes: ‘We’ve done an exercise that tells us there’s very little scope to squeeze estate costs and we’d be mad to cut spending on safeguarding and compliance. So we might have to look at 10 per cent off teacher numbers.’

[See also: Why Labour’s private school VAT pledge poses problems for divorced parents]

Warnings from teaching unions that Labour’s VAT policy will cost jobs seem to have fallen on deaf ears. Indeed, Labour spokespeople blandly retort that the sector will find smart ways to cope, pointing out that offsettable input VAT, particularly on school building projects, will also ease the pain. But that point highlights the irony that the VAT policy is likely to make private education even more elitist – in the sense that the strongest will ride it out relatively easily while weaker schools struggle and fail.

An even more elitist education

How so? Because top schools have more and bigger building projects in progress to generate offset VAT. They also hold more financial reserves to allow them to moderate the fee-plus-VAT rise. What’s more, the segment of the market they cater to is less sensitive to price.

Waiting lists for the most sought-after schools will accordingly lengthen year by year – but their ecology and marketing image will change if overseas pupil numbers rise above 20–25 per cent of the school population. Meanwhile, mid-market and lesser schools will be lucky to survive. And the best hope for smaller schools with lower fee levels – as a governor of several of them points out – is that ‘they might benefit from a flight from larger schools that lose reputation as cost pressures bite’.

In effect, all but the top echelon of the sector will be thrown into flux – and what remains may become more elitist in another sense, if private schools are less willing to bear the cost of offering use of their facilities to local state schools and less able to provide bursaries for talented pupils whose families can’t afford full fees.

One head for whom these issues loom large is Gareth Parker-Jones of Rugby School in Warwickshire. ‘We’ll cope with VAT as we’ve coped with every kind of change over the past four and a half centuries,’ he says. ‘It will sharpen our focus on a premium education and we will absolutely maintain our quality. Our concern is genuinely about what’s best for 100 per cent of the pupil population, not just our own.’

He adds that Rugby is committed to continuing its collaborative work with state schools and maintaining its means-tested bursaries, which are provided to one in eight of the school’s 865 pupils. ‘We just hope Labour will do a full impact assessment of this policy before it’s imposed – and we’d love to be involved in that conversation.’

[See also: Private school enrolments fall amid Labour VAT concerns]

‘A dog-whistle policy’

The unavoidable conclusion is that quality, choice and accessibility in the UK’s hitherto world-beating private education sector are about to suffer as a result of a cynical Labour exercise designed to appease left-wingers who suspect Starmer of edging towards the centre in other policy areas. At a time when educational standards and skills clearly need raising if the UK is to compete globally, this tax raid sends a bad signal to wealth-creators and investors – as well as to aspirational middle-class families who willingly make financial sacrifices for their children’s education so long as they know they’re buying excellence.

As for the international rich, especially those from Asia, market-watchers predict they will turn increasingly towards North American and Australian schools if the wider British offer deteriorates while top-level pupil places become scarcer. Tighter immigration and visa policies can only accelerate that trend.

Overall, Labour’s VAT raid is ‘a dog-whistle policy with no fiscal or moral sense to it’, says another head of a large urban private school.

Many other leaders in the education sector are reluctant to speak out, but Seldon sums up eloquently: ‘Labour has contemplated doing something like this before, in 1945, in 1964 and 1997, but pulled back. We have some of the most highly prized schools in the world, and I can’t see how damaging them is going to help the whole UK education system. After all, what country has ever improved anything by knocking out the best?’

Martin Vander Weyer is business editor of the Spectator and a governor of Ampleforth College in North Yorkshire