Spear’s will be providing live coverage of the 2016 March Budget below.

Commenting on stability in tax policy, Piers Master, Partner at Charles Russell Speechlys, said:

‘Instability in tax policy, and frequent changes to the rules, can be as dangerous to the perception of the UK as an investor-friendly jurisdiction as increases to the rates of tax themselves. In comparison with many other countries, the UK remains a good place in tax terms for international investors to buy residential property, but those investors reasonably require certainty as to how they will be taxed. So stability and certainty in tax policy is very important. We hope the Government will now put the brakes on any further significant property tax policy changes for the rest of this Parliament.’

Harry Lewis, associate director at London-based real estate financial advisory firm, W. Coleman & Co., commented:

‘Many were expecting today’s Budget to bring an allowance for smaller property investors so news of the additional 3% levy will come as a substantial blow to them.

‘The extension of the stamp duty is really going to hit the residential market, particularly the prime central London (PCL) market which is dominated by investment from foreign investors, many of whom own multiple properties. Given the wider macro-economic issues in China and Russia, which are already putting significant pressure on property investment in the UK, these higher transaction costs are only going to reduce it further.

‘The Treasury says it will raise more than £600m from these measures but the reality is that with less foreign investment in the UK, Treasury revenues will in fact be weakened.’

Bruce Davis, cofounder and Joint MD of Abundance, a leading P2P investment platform soon to offer one of the very first ‘Innovative Finance ISAs’, said:

‘The LISA initiative is a welcome boost for millennials who have long been short changed by the financial services industry. But there are plenty of investors under 40 who would be better off in a pension with higher rate tax relief and many younger employees auto-enrolled into a pension by their employer will face some tricky decisions to choose between employer contributions or easier access via a LISA. Whichever route they choose though, Abundance will offer its unique ISA and pension invested in 100% renewables, which gives the win win of profitable ethical investment the millennials are looking for.’

Commenting on salary sacrifice, Greg Moss, Senior Wealth Advisor at Bond Dickinson said:

‘It was widely anticipated that salary sacrifice arrangements were under threat in relation to employer pension contributions. However, in the event, the Chancellor suggested this was not the case, and in fact expressly stated that the government’s intention is that pension saving should continue to benefit from income tax and National Insurance Contribution relief when provided through such arrangements. This is excellent news for employers who choose to use salary sacrifice as a means of maximising the tax efficiency of pension contributions on behalf of their staff and directors.

‘In a similar vein, the Chancellor confirmed that pension tax free cash would also continue to receive the same tax treatment for the time being. Again, this is good news for those who are relying on being able to receive a proportion of their pension savings tax free in the future.’

Commenting on business rates reform, Stacy Eden, Head of property and construction at Crowe Clark Whitehill, said:

‘We are delighted that the government is planning to reform the business rates system as well as improving the planning process.

‘Unfortunately they are still targeting the property sector with additional taxes. Increasing SDLT by 3% for all buy to let purchasers and 1% for significant commercial purchases will end up reducing transactions in both sectors and ultimately damage development. The former is particularly penal due to the importance of the private rental sector to the UK housing stock.

‘Any restriction of interest deductibility could also be very damaging to the UK property sector as gearing is a large finance source for property developers.’

Commenting on online entrepreneurs, Lucy Brennan, Partner at Saffery Champness, said:

‘The chancellor has clearly hoisted the white flag in relation to the Air BnB generation. He has accepted that it is extremely difficult to tax online micro-entrepreneurs and so at the smaller end he has granted them an allowance of £1,000 per year for trading profits. It will be interesting to see whether this is extended over the years or whether he clamps down on those whose profits are over the £1,000 threshold.’

Commenting on insurance premium tax increase, James Hender, Head of Private Wealth at Saffery Champness, said:

‘Mr Osborne announced a 0.5% increase in insurance premium tax, which, while not sounding much, will be welcome by those who live in flood prone areas – or like certain biscuits made in Carlisle and who have had to wait for their favourite snacks whilst the factory dries out.’

Commenting on offshore evasion, John Cassidy, tax investigations partner at tax and advisory firm Crowe Clark Whitehill said:

‘Under the ‘strict liability’ offence for offshore evasion it will be automatically assumed that the taxpayer’s actions were criminal in nature without HMRC having to prove it.

‘This is a massive step. Anyone found to have under declared tax related to offshore assets will be guilty of a criminal offence and therefore liable to prosecution if HMRC chooses that route.’

‘The Budget also confirmed that there will be new financial penalties faced by offshore evaders, including a new penalty that will take a portion of the asset that has been hidden.

‘In the past, penalties have been based on a percentage of the tax due whereas basing them on a percentage of the underlying assets inevitably leads to a greater figure so, even if HMRC decides not to prosecute under the new strict liability rule, a much greater financial penalty could be imposed.’

Commenting on what the Budget means to UK businesses, Simon Rogerson, CEO of Octopus Investments, said:

‘Today’s Budget makes it clear that the Chancellor recognises that our entrepreneurial, fast growing businesses are the engine of UK economic growth. It’s a Budget for entrepreneurial Britain to celebrate. The Chancellor has put ‘rocket boosters’ on the back of UK enterprise. From encouraging investment into unlisted companies through new tax relief to abolishing National Insurance contributions for the self-employed, he has put his money where his mouth is.

‘With today’s Budget revealing an estimated drop in predicted economic growth for the UK, it has never been more important for the Chancellor to turn his words into actions when it comes to supporting high growth small businesses. These companies are unparalleled drivers of local economic growth, creating one in three new jobs in 2014 and 20% of all economic growth despite representing just 1% of UK business. Creating an environment where they can best flourish will help drive a regional revival and support the Chancellor’s ambition of rebalancing the UK economy and narrowing the North-South divide. Today’s Budget demonstrates that the Chancellor is addressing the fact that a one size fits all approach to supporting British business does not work. HGSBs are unique – both in their sheer contribution to the UK economy and in their needs as a rapidly growing businesses.’

Commenting on the entrepreneurs’ relief, Withers partner Tim George said:

‘The entrepreneur’s relief changes could add further encouragement to investors to leave traditional listed investments or fund investments in favour of direct investments in smaller companies, which the proliferation of crowd funding websites is making more accessible and attractive.

‘Investing in small businesses could now trigger income tax relief on investment through EIS, an inheritance tax shelter during the holding period through BPR, and now a reduced rate of capital gains tax upon disposal. Many investment managers who specialise in building portfolios to benefit from the first two reliefs will be delighted. As will the crowd funding platforms. As will small businesses seeking financing for growth.

‘In fact, taking this a step further, if you are a res non-dom with offshore income to invest, you could bring that income into the UK claiming BIR to prevent an income tax liability upon remittance. You could then claim EIS to trigger a 30% tax reclaim against your UK earnings. You would then benefit from a 10% CGT rate on disposal. That’s a pretty attractive proposition!’

Commenting on extracting capital in a tax-efficient way, Simon Bashorun, Financial Planning Team Leader at Investec Wealth & Investment, said:

‘The increase in the distance between income tax rates and CGT rates will make drawing on capital each year as a form of ‘income’ even more attractive than it currently is. This reinforces the need for individuals to build up portfolios which can provide gains to draw down on tax efficiently in the future.

‘Alongside the changes to the taxation of dividends and the normal annual capital gains allowance, the reduction in CGT rates makes directly held stocks and share investments very attractive indeed in certain situations.’

Comment from Chris Moorcroft, senior associate at London law firm Harbottle & Lewis:

‘Whilst there were no headline changes to the taxation of resident non-domiciled individuals, some critical details on the upcoming changes next year were tucked away in the documents.

‘First, the Government have confirmed that non-doms becoming deemed domiciled in April 17 under the new regime can have the base cost of non-UK assets rebased to April 2017. It is not yet clear if this will be an option or automatic.

‘Second, the Government have announced that provisions will be introduced to deal with foreign income/gains arising pre-April 17 but which are remitted post-April 17 under the new regime. The terms of these provisions will be of enormous significance to clients worried about having to deal with two regimes concurrently.’

Tina Riches, national tax partner at Smith & Williamson:

‘The Chancellor’s plan to reduce capital gains tax (CGT) rates are a very welcome encouragement for entrepreneurs and others investing in businesses – but yet another disappointment for those invested in residential property who fail to benefit from this latest initiative.

‘Changes to the ISA rules are a welcome compromise between encouraging spending in the economy and encouraging younger people to save for their retirement. Increasing the ISA allowance to £20,000 will mean more people’s savings will be stay outside the tax net.

‘Finally, we can all sigh with relief on hearing the Chancellor say that pension tax will not change for the time being. What we also need from the Government is a longer term pensions’ tax plan so people can plan their retirement with some certainty.’

Rachel de Souza, Tax Director, RBC Wealth Management around key announcements in the March 2016 UK Budget –

Income Tax Changes

‘Despite the poorer than projected fiscal position, the Chancellor has moved to reduce the tax burden for higher or middle income earners. He has done this by raising the level at which the 40% tax rate kicks in to £45,000. This will directly put money into the pockets of anyone whose income currently exceeds £42,385 – but only from April 2017.’

Owner-managed businesses

‘A raft of measures was announced aimed at tightening up the corporation tax system. Broadly, these measures are aimed at large multi-national businesses which are perceived as not paying their fair share of tax. This tightening will raise revenue and thus allows the Chancellor to reduce the headline rate of corporation tax to 17% by April 2020; this is a very welcome move for all business owners and entrepreneurs who will have more funds to invest in their businesses or take home.’

Non-doms

‘The non-dom community has been waiting for the government to publish its detailed proposals relating to the changes announced last year. We welcome the announcement that non-doms who become deemed-domiciled in April 2017 can treat the base cost of their non-UK based assets as being the market value of that asset on 6 April 2017. This gives some certainty on how sales of such assets will be taxed after April 2017 when the remittance basis is no longer available and does away with the need for unnecessary actions to uplift the base cost in advance of the changes occurring. This is a much more generous approach that expected and is a practical solution.

‘Individuals who expect to become deemed UK domicile under the 15 out of 20 year rule in April 2017 will be subject to transitional provisions with regards to offshore funds to provide certainty on how amounts remitted to the UK will be taxed. This is also welcome news although the detail is yet to be published. The tax treatment of remitted offshore funds is complicated and we hope that the transitional measures will provide some simplification of the existing rules.’

Keith Sheehan, Head of Financial Planning at UBS Wealth Management on the new lifetime allowance:

‘It is surprising that the Chancellor did not address the new lifetime allowance that comes into effect from April 6th in his speech, given its far reaching implications. Over the years there has been much uncertainty around the lifetime allowance. It was not that long ago that the cap was £1.8m and a possible increase was on the cards.

‘The recent reduction of the lifetime allowance adds a level of complexity that, frankly, may put individuals off saving altogether. We’re now at the point where even individuals in their forties may be asking whether they should stop contributing to their pensions, for fear of exceeding the cap.’

Jeff Lynn, CEO at Seedrs equity crowdfunding, commenting on today’s Budget:

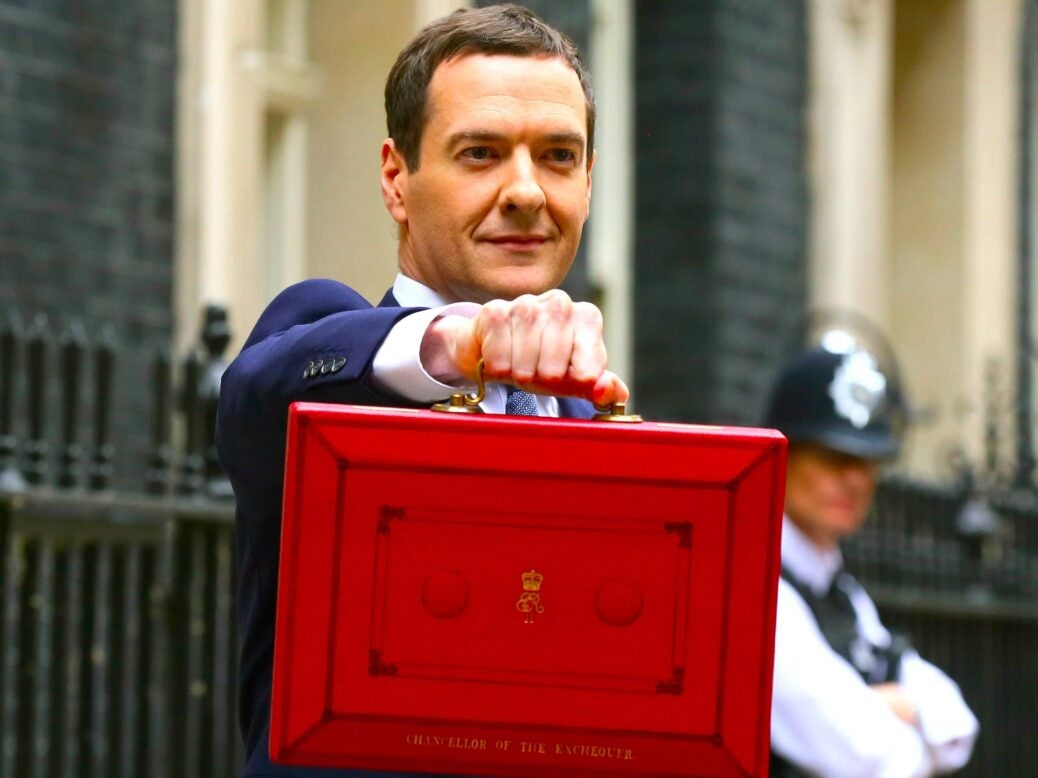

‘We welcome George Osborne’s ongoing support for small businesses through today’s Budget announcement that he will cut business rates. Indeed this means that 600,000 companies will pay no business rates at all and by basing rates on CPI rather than RPI, retailers will continue to work with more accurate bills and hence will support their long term future.

‘We also endorse the decision to abolish Class II National Insurance contributions for the self-employed from 2018 and the freezing of fuel duty for the sixth year in a row for which will help boost UK entrepreneurship. We believe that these announcements will further highlight the growing trend of investing in UK small businesses. Furthermore the slashing of capital gains tax rate and entrepreneur’s relief being extended at 10% to long term external investors who hold newly issued shares in unlisted companies from March 2016 for longer than three years further reinforces the growing appeal of small business investing. One way of doing this is through equity crowdfunding which has grown to more than £245 million and now makes up around 16% of all seed and venture-stage equity investment in the UK.

Calum Bennie, savings expert at Scottish Friendly, said:

‘George Osborne billed this as a ‘Budget for the next generation’. We had to wait until the end of his speech before the rabbit popped out of the hat. The Lifetime ISA the Chancellor has introduced in the Budget does at least offer scope for an incentivised and more flexible vehicle to help younger people save for their financial future.

‘This is perhaps a sad reflection that past and present government tinkering on pensions has put young people off saving for their future. The Lifetime ISA could be the beginning of the end for the current pension regime and given its sorry state, we won’t mourn for its passing.’

CBI Director-General, Carolyn Fairbairn, said:

‘After a year of surprises, this was a stable Budget for business facing global stormy waters. The Chancellor has listened to our concerns about the mounting burden on firms and chosen to back business to grow the economy out of the deficit.

‘Businesses will welcome the Chancellor’s permanent reforms to business rates – taking more small firms out of the regime and changing the uprating mechanism from RPI to CPI, which the CBI has long been calling for.

‘The reduction in the headline Corporation Tax rate sends out a strong signal that the UK is open for global business investment, and reforms to Interest Deductibility are in rightly in line with the international consensus.

‘Changes to the tax treatment of losses will make it harder for larger scale-up firms and companies that have been through tough times to play their part in the recovery.

‘Progress on some key infrastructure projects, from HS3 to 5G, are positive. Investors and companies will be encouraged by the greater clarity and simplification of the Government’s energy policy.’

Commenting on today’s Budget, Guy Ellison, Head of UK Equities at Investec Wealth & Investment:

‘Today’s Budget announcement was very small business friendly. Osborne has continued to close tax loopholes for international companies paying little or no taxation in the UK, and limiting interest deductibility for certain highly leveraged companies. There was a boost for savers through the much greater than expected increase in ISA allowances and the introduction of the Lifetime ISA for under 40’s and this should in turn provide a boost to the savings industry.

‘We saw a shot in the arm for North Sea Oil, with a reduction in supplemental taxes and the abolition of Petroleum Revenue Tax, backdated to the start of this year. Bookmakers and Insurance companies will both be breathing a sigh of relief with no additional taxes for the former and only a 0.5% increase on insurance premiums. The market had expected approximately a 3% increase.

‘Soft drink manufacturers are the most obvious losers today with the introduction of sugar levy for added sugar drinks while tobacco taxes continue to rise ahead of inflation, beer and spirits enjoy a tax freeze.’

Bob Scott, senior partner at LCP reacts to the ISA news:

‘Could the Lifetime ISA be a precursor to more wide-ranging reform once the dust has settled on the EU referendum? Perhaps leading to the scrapping of pensions tax relief in a year or two’s time, which we understood George Osborne favoured.’

Lucian Cook, Savills UK head of residential research:

‘The failure to give relief from the additional stamp duty levy for large investors could inhibit the development of a much-needed institutional private rented sector. While purchases of 6 or more residential properties can be treated as a non residential transaction, the reform of stamp duty on commercial properties is likely to mean greater entry costs for large scale residential investors one way or another. Our recent analysis suggests there will be demand for another 1 million private rented households in the next 5 years despite policies to boost home ownership.

‘Keeping the old rates of CGT on residential property will make it more difficult for existing buy to let investors (who face a cut in income tax relief on interest payments) to reorganise their portfolios towards better performing property. It will also act as a longer term disincentive to invest in residential property compared to other asset classes which may put further pressure on the supply of private rented homes against the backdrop of rising demand. That may well put upward pressure on rents.’

eMoov CEO and former Brentwood First councillor, Russell Quirk, commented:

‘A very disappointing budget from a property point of view and for UK buyers and sellers. The capital gains tax reductions, whilst bold, are a missed trick and a kick in the teeth for those second home-sellers, that will not benefit from a reduction in capital gains tax on their property sale. This was hardly a budget to assist hard working people with more than one property, not to mention Mr Osborne’s total failure to address the issue of housing supply that has been touched upon in previous budgets.’

Elliott Silk, Head of Employee Benefits at Sanlam comments on the Insurance Premium Tax increase in today’s Budget:

‘The worrying thing is that it is an easy win for the Government, as the general public are just not familiar with Insurance Premium Tax. We will have seen a 66% increase in this tax in a very short period of time, if VAT were increased by this percentage there would be an outcry, yet IPT can go through without notice or at least until employers have to pay more for their PMI, Dental and Travel Insurance costs. With this in mind, employers urgently need to assess the options that are available to them. Self-insurance or setting up a Healthcare Trust to mitigate any price rise could be an option but they need to take advice before making alternative plans.’

The current threshold for SMEs will raise from £6000 to £15,000 as a maximum threshold, offering welcome tax reliefs for SMEs. Robert Gordon, CEO of Hitachi Capital, commented:

‘We welcome these changes to simplify the outdated business rates system, which currently places a huge burden on the UK’s 5.4 million SMEs – the backbone of our economy. Reducing red tape and giving businesses clarity over the amount of tax they have to pay is fundamental at a time when many are struggling with an overly complex regulatory environment.

‘Over half of SMEs (55%) think that business growth is best achieved by keeping down fixed costs. Today’s announcement will give SMEs crucial breathing space to invest in future growth.

‘To capitalise on these opportunities, businesses also need to ensure they are educated on alternative methods of funding to boost confidence, financial security and productivity in the short-term.’

Elizabeth Bradley, head of the corporate tax team at international law firm Berwin Leighton Paisner, said:

‘Much of the British property industry will be very disappointed with today’s Budget changes. The property sector is effectively being used to placate the Government’s back benchers.

‘The Chancellor has acknowledged the need to build more homes but the extension of the extra SDLT rate on buy-to-let to large investors will discourage investment in the private rented sector.

‘Overall, increased tax costs will not be offset by the reduction in corporation tax rates to 17% by 2020.’

Commenting on the reduction of corporation tax to 17%, Neal Todd, Partner at Berwin Leighton Paisner, said:

‘Britain may be blazing a trail for other countries with the reduction of corporation tax to 17% by 2020. Yet this is being paid for by the crackdown in interest deductibility to 30% for large firms and the earning stripping restrictions on losses. Together, these will add a significant additional burden to the tax planning roadmap for major UK businesses.’

Regarding the Budget announcement on capital gains tax, Eleanor Metcalf, Partner and Head of the Private Client Group at Wedlake Bell LLP said:

‘Slashing CGT from 28% to 20% and 18% to 10% was a surprise and will give a boost to investors but yet again landlords and second home owners will lose out as the Chancellor announces they will remain on the present rates and will pay the confirmed SDLT higher rates from April 2016.’