Some 260 millionaires have come together to ask for ultra-high-net-worth individuals like themselves to be taxed more in an open letter to global leaders gathering at Davos.

The campaign is led by Patriotic Millionaires (PM), a group of UHNWs whose mission is ‘to leverage the voice of wealth to build a more just, stable, and inclusive economy and to accelerate the end of extreme wealth.’

[See also: These multi-millionaires want you* to pay more tax]

The letter, titled Proud to Pay More, is released alongside a survey report of the same name which found that 75 per cent of millionaires support the introduction of a 2 per cent wealth tax on billionaires, as proposed by the EU Tax Observatory in October 2023. The same proportion of respondents supports the introduction of a wealth tax for individuals worth more than $10 million.

‘The request is simple: tax us, the very richest in society’

The letter reads: ‘Our request is simple: we ask you to tax us, the very richest in society. This will not fundamentally alter our standard of living, nor deprive our children, nor harm our nations’ economic growth. But it will turn extreme and unproductive private wealth into an investment for our common democratic future.’

It continues: ‘Our drive for fairer taxes is not radical. Rather, it is a demand for a return to normality based on a sober assessment of current economic conditions. We are the people who invest in startups, shape stock markets, grow businesses, and foster sustainable economic growth. We are also the people who benefit most from the status quo. But inequality has reached a tipping point, and its cost to our economic, societal, and ecological stability risk is severe – and growing every day. In short, we need action now.’

[See also: Is this the death of Davos?]

Who signed the Patriotic Millionaires letter?

Among the signatories are American philanthropists Valerie Rockefeller and Abigail Disney, scions of two of the world’s most famous dynasties, as well as members of Patriotic Millionaires’ UK offshoot, who gathered in 2023 for a Spear’s symposium on inequality and the responsibilities UHNWs have to give back financially to society through the tax system.

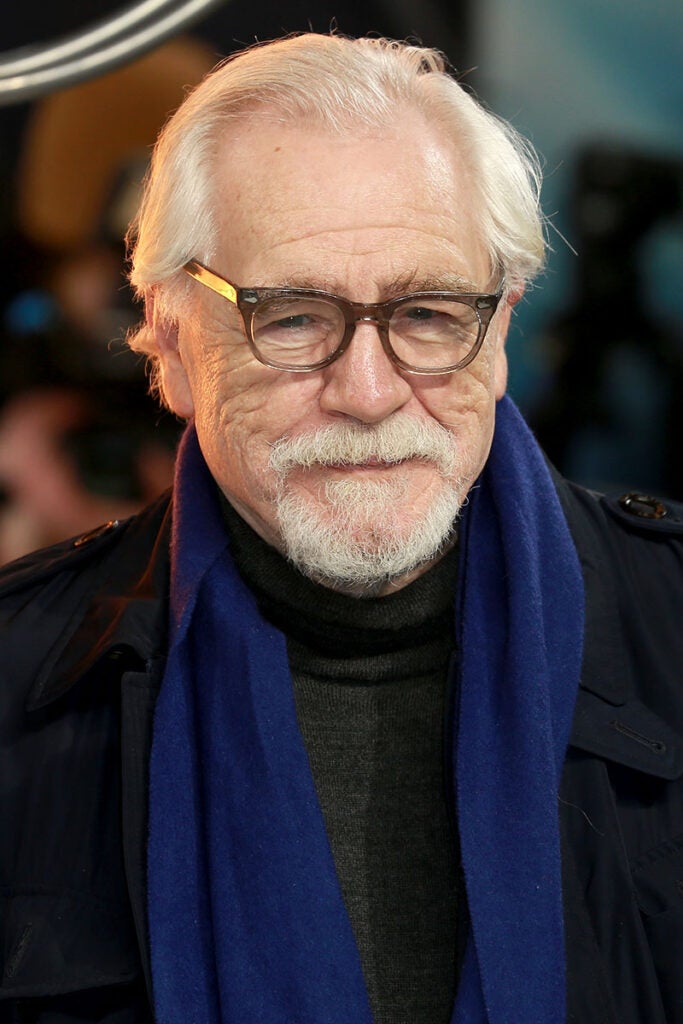

Emmy-winning actor Brian Cox, best known for playing the Rupert Murdoch-esque Logan Roy in Succession, said of his decision to sign: ‘Billionaires are wielding their extreme wealth to accumulate political power and influence, simultaneously undermining democracy and the global economy. It’s long past time to act. If our elected officials refuse to address this concentration of money and power, the consequences will be dire.’

The majority of millionaires want change

The Proud to Pay More report publishes from the findings of a December 2023 poll of more than 2,300 millionaires across G20 countries, each of whom holds more than $1 million in investable assets. The survey, conducted by Survation, found 74 per cent of respondents are in favour of higher taxes on wealth, both to address cost-of-living challenges and to bolster public services.

Just as many (75 per cent) support a 2 per cent tax on billionaires globally, a proposal mooted by the EU Tax Observatory in October. Then, world-renowned economist Joseph Stiglitz joined its calls for global policymakers to take action to get billionaires to stump up more in tax receipts.

Nearly six in 10 respondents support a 2 per cent levy on wealth on all assets held above $10 million. (Patriotic Millionaires UK member Julia Davies told Spear’s last year that this modest rate should be applied to anything above £10 million). More than half of respondents (54 per cent) agreed extreme wealth was a threat to democracy.

Some Patriotic Millionaires members, including Marlene Engelhorn and Stefanie Bremer, are expected to present the letter at the World Economic Forum.

The group adds: ‘The true measure of a society can be found, not just in how it treats its most vulnerable, but in what it asks of its wealthiest members. Our future is one of tax pride, or economic shame. That’s the choice’.