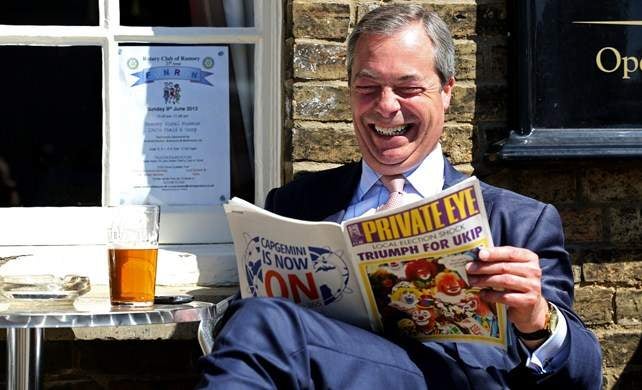

Shock victory for Farage and co. after the United Kingdom votes to leave the European Union. Read the reaction here from across the City as it comes in.

Dhana Sabanathan, Partner at law firm McDermott Will & Emery said:

“We do not think we know very much at this point about what Brexit means – either the timing of our cessation of EU membership, or its terms, what it will mean for EU citizens in the UK and UK citizens in the EU. It is difficult to say with certainty how it will impact on HNWIs and our clients.

“The biggest potential impact we can immediately see is on the various Non-dom reforms which were announced in the Summer Budget 2015… we were not expecting further detail on the proposed changes until after the referendum. Now that we have voted to leave the EU, and David Cameron has announced his effective resignation as PM with a new leader of the Conservative Party and PM taking over from or before October, there has to be an even greater uncertainty about the timing and perhaps even the future of the reforms.”

Matthew Braithwaite, Partner on Bircham Dyson Bell Private Wealth team said in a statement:

‘The instability arising from the UK’s decision to Brexit, including a weakened sterling, is likely to dent the UK’s reputation as a safe haven in an otherwise uncertain global market and prompt foreign individuals who own UK residential property to sell and look to invest elsewhere. For others, a weakened currency may well offer an opportunity to enter the London property market, which for many, until now, had become too expensive.

With the Government having to deal with the aftermath of Brexit and David Cameron’s decision to resign as Prime Minster, it is unlikely that we can expect to see the much delayed consultation documents on the new ‘non dom’ rules any time soon, despite hopes that they would be published following the referendum and before Parliament rises for its summer recess. This is likely to spell further uncertainty for UK resident and non-UK domiciled individuals (so called ‘non doms’) in the run up to the new rules coming into force on 6 April 2017 and means that the window for planning before then will be even shorter than had been anticipated.’

Alistair Peel, Director at Strabens Hall, said:

“It’s clear that the result has caused considerable volatility in markets but this is not Armageddon and investors should not be tempted to respond too hastily as it’s difficult to second guess markets and the reaction across all asset classes. We would therefore advise our clients to carefully monitor and analyse developments before rushing to restructure their portfolios.

“Some private banks and wealth managers we know, who have been building up cash positions, will be looking to deploy cash into the markets as clearly some sectors and stocks will be oversold so they will see this as a buying opportunity. Also, this decision could possibly have a bigger impact on European equity markets, as the UK has at least taken its decision while the EU countries need to respond and this uncertainty could dampen their performance considerably in the weeks and months to come.

“For now we remain in the EU and so from a regulatory perspective, all the financial directives and rules derived from the EU remain in place and the FCA will continue to enforce them so investors should be mindful of this. However going forward, for private wealth and other investment managers, their status may change. If the UK decided it did not want to continue to follow certain aspects of EU financial regulation, the UK’s regulatory regime might not pass the equivalence test that allows managers to market in EU countries.

Overall; Brexit undoubtedly means there will be significant challenge, but also opportunities for the UK private wealth sector. It may well be that there is a period of uncertainty as the UK negotiates a new regulatory regime but there is also the potential for the UK wealth sector to shape a more flexible industry that can more easily respond to its diverse international client base and their increasingly global investment requirements.”

There could be significant changes to UK taxation after the UK leaves the EU, affecting individuals and companies alike, many are warning.

The Investment Association issued a press release in the wake of the vote to leave:

“The Investment Association notes the momentous result of the UK’s referendum on membership of the EU. Today the UK remains a member of the EU and the rules and regulations governing asset management remain unchanged, and the protections that were in place for clients yesterday remain in place today.

“The focus in the short-term will be on how markets respond, but it is important that we adopt a collective long-term focus on how the UK can preserve the pre-eminence of its financial services sector including our highly successful £5.5trn asset management industry – the second largest industry of its kind in the world.

“How the UK’s role in the EU will change will become clearer over time, but there are likely to be challenges ahead and we look forward to helping the Government and our industry to navigate these.

Mark Davies, managing director of Mark Davies & Associates cpmments on the potential tax ramifications of Brexit for non-domiciled individuals in the UK:

“It is unlikely that the changes to the non-domicile regime announced in the 2015 budget will go through in 2017 as forecast, as there will be bigger fish to fry in the Treasury,” he says.

For any UK company with an EU subsidiary:

“UK organisations may be subject to higher withholding taxes on the receipt of dividends between UK parent companies and EU subsidiaries, leading to expensive double taxation in the two states.”

For UK businesses receiving royalty or interest payments from a European country:

“UK businesses may also suffer costly withholding taxes on royalty and interest payments, which are currently not incurred as a result of membership of the EU.”

For anyone holding assets through foreign structures or with foreign subsidiaries:

“The UK government will be free to review its areas of anti-avoidance tax legislation without the threat of being issued a notice by the European Commission.

“Anti-avoidance provisions preventing individuals from avoiding tax by holding assets through foreign structures may be amended; the EU has previously questioned these provisions as being discriminatory.

“Lastly, anti-avoidance provisions preventing companies from avoiding tax through foreign subsidiaries, the controlled foreign company regime, could be freely amended without threat of an appeal to the EU.”

Anyone receiving a pension from abroad:

“Recognised overseas pensions may come under attack, particularly QROPS providers. If there are no freedom of movement of capital provisions then the UK would be free to tax pensions if they are transferred out of the UK.”

For anyone buying shares:

“The UK may introduce additional Stamp Duty Reserve Tax charges, as once planned but blocked by EU law.”

For all consumers of UK goods and services:

“The UK government, in the event of Brexit, will have no need to comply with the VAT Directive set by the EU – could we see significant changes to the VAT rate, and the manner in which the tax is applied to certain goods and services? (E.g. The VAT rate on women’s sanitary products is set by the EU as a luxury good).”

Lukas Daalder, Chief Investment Officer of Robeco Asset Allocation said in a press release:

“Markets had been expecting a Remain vote, which means that this comes as a nasty surprise… This will lead to a lot of volatility and uncertainty in the days and weeks ahead, with risk-off pressures at first taking the upper hand.”

“Rather than focusing on this short-term volatility, we prefer to look at the outcome of the situation once the smoke lifts. A recession in the UK looks likely, due to the decline in investments taking place and uncertainty keeping consumer spending subdued. As for Europe, much will depend on the break-up tensions rising, as well as the negative impact of producer confidence. The most likely outcome is weaker growth, but not a recession. As for the US, the spillover should be limited.”

Aneil Balgobin, partner and employment law solicitor at Simpson Millar said:

“Employers will have been making emergency plans for weeks and months; employees will no doubt feel less prepared for the impact a Brexit might have on their jobs and that reality is about to hit home. Employers need to be swift in reassuring staff who could feel destabilised and may be looking outside Britain for a more secure role – triggering a talent drain at a time when many companies need their core capacity the most.

“The contingency plans of some businesses may well include restructuring exercises, which could also mean redundancies – not least in the financial services sector. But this is a time for calm while everyone takes stock. The worst thing employees can do is make rushed decisions which they may later regret.”

Christopher Findley, Partner in Private Wealth at Bircham Dyson Bell said:

“The agricultural industry will now face the removal of the Common Agricultural Policy and all its subsidies, compliance regime and environmental legislation. Farmers will need to have their concerns addressed quickly and urgent fiscal and political decisions are now needed. Without any support UK agriculture will face a deep recession and bankruptcy on a large scale.

Farmers have long criticised that whilst Brussels produced the framework legislation, UK legislators ‘gold-plated these with over-detailed rules resulting in a strict compliance regime and unnecessary red tape. It would be a false hope to think that Brexit will now lead to a bonfire of regulations and to a regulatory ‘light touch’ in respect of farm subsidy compliance and environmental control. It is likely that many aspects of the subsidy and compliance regime will be rolled over.”

Joanna Pratt, Head of Family law at Thomson Snell & Passmore commented:

“As the British public chose to leave, there is real uncertainty. Case law regarding habitual residence of children may need to be revisited, and Parliament may consider changing the Brussels II regulations. However a lot of the non-EU related international rules, such as the first in time rule regarding the issue of divorce proceedings, are unlikely to be affected by a Brexit decision and we do not expect a rush of changes to international clients’ divorce agreements.”

Nigel Green, founder and CEO of deVere Group, spoke out after the UK narrowly voted to leave the European Union:

Mr Green said in a press release: “Britain is filing for divorce from the EU – it’s a shock event. The Brexit victory is a victory for uncertainty across international financial markets. Brexit-triggered volatility is now only just beginning; we can expect it to potentially last up to two years.

“Due the far-reaching impact of this vote, Brexit will inevitably affect the British and the European economies and the wider global financial markets. The decision may have been taken in the UK but it will impact the rest of the world too.

“Investors around the world on Friday will pile into safety and prompt a significant shift in global markets from risky assets to safe havens.

“The world’s currencies, equities and bonds are now on magical mystery tour – at least in the short-term.

Richard Champion, deputy CIO, Canaccord Genuity Wealth Management said:

“Today we stepped off the economic and political precipice. We now need to work out how we extricate ourselves from the EU, while at the same time hanging on to our national integrity. Sterling, company profits, unemployment, economic growth – a big fat question mark hangs over everything. And we still have to navigate a path through austerity, weak global growth, geopolitical dangers and addressing the UK’s structural weaknesses: low productivity growth, poor education, and unsustainable debt. It was hard enough doing this in the EU. Now we all have to roll up our sleeves and make our new status work.”

Giles Williams, Financial Services partner at KPMG in the UK, said:

“Although it was well known that the referendum result would be a close call, the leave vote will send a shudder through the financial services industry. The harsh reality of the probable changes to passporting arrangements and market structure, our clients’ operating models and engagement with the wider economy across Europe will now sink in. Of course we will see short term volatility which is a natural consequence of a vote of this nature. The critical issue is how this will play out going forward.

“The Financial Services industry needs to quickly develop its ‘asks’ of politicians to make sure that financial services can continue to play its crucial role in the wider economy. It is critical that the negotiating teams fully understand the implications and consequences of dislocating European capital markets, banking, insurance and asset management on the economy both here in the UK and in Europe.

.

“In terms of priorities for the economy, the ability for Europe to access London’s well developed markets in insurance, securities and banking is critical. Equally UK-based firms must be able to continue to provide financial solutions to the market, corporates and individual citizens across Europe and internationally.”

Lawyers Irwin Mitchell Private Wealth have also been making their views known this morning.

Speaking to immigration concerns, Alex Ruffel, partner at Irwin Mitchell Private Wealth said:

“There are more than one million British people living in EU countries with nearly 500,000 in Spain and France alone. The legal status of expatriates is one issue that will need to be settled quickly. Will they be allowed to carry on living there or have to apply for residency? These are questions that need quick answers.”

On changes to non-dom status, Michael Taylor, partner at Irwin Mitchell Private Wealth said:

“The implications of Brexit on the rules governing non-doms – those wealthy foreigners who are tax resident but non-domiciled in the UK and may pay a fee not to be taxed on foreign earnings and assets – are unclear. Brexit, will not, of itself, change the personal tax regime. It is entirely possible that the UK could become even more attractive to this profile of individual if the tax benefits remain attractive or are improved. The UK could become the new Switzerland for international wealthy individuals and families. However, if economic uncertainty forces successive governments to raise more tax the reform of the benign legislation affecting the tax status of non-doms might be in danger.”

Not all are glum. Jeremy Leach, CEO at Managing Partners Group, believes Brexit will have little long term impact on the UK financial services industry.

He said: “Financial services will continue to be the UK’s biggest export for the same reasons it has been for the last 100 years, which is its pragmatism, innovation and desire to trade.

“Nor will the UK necessarily be excluded from the European Union’s pass-porting regime for financial products. Most of the EU’s regulatory processes were adapted from those of the UK’s Financial Conduct Authority anyway so negotiating a workable agreement will be more straightforward than for other EEC members that are still evolving on their regulatory framework.”

With regards to Sterling, Leach believes it will settle down and strengthen in the longer term: “As much as sterling has fallen today, the market will gravitate back to pre-referendum levels within a few days. In the longer term, sterling will strengthen against the Euro because the UK’s economy is in much better shape than many of its European peers.”