But only at the very highest end of the market says Marina Griggs.

The dramatic headline ‘World art market stalls for first time in years’ as reported in various guises last week, belied a somewhat less explosive story within: fewer people today are buying ‘cheap’ art than they were five years ago.

‘Cheap’ art should of course be qualified, as the international art world classes works which are less than a million dollars in this category (an auction house’s view of a cheap painting is therefore possibly not what many would see as affordable). Nonetheless, if you know your Modiglianis from your Mondrians, you may be aware that, as trading of ‘cheap’ art has declined, the expensive works (and this is expensive by anyone’s standard) continue to make headlines.

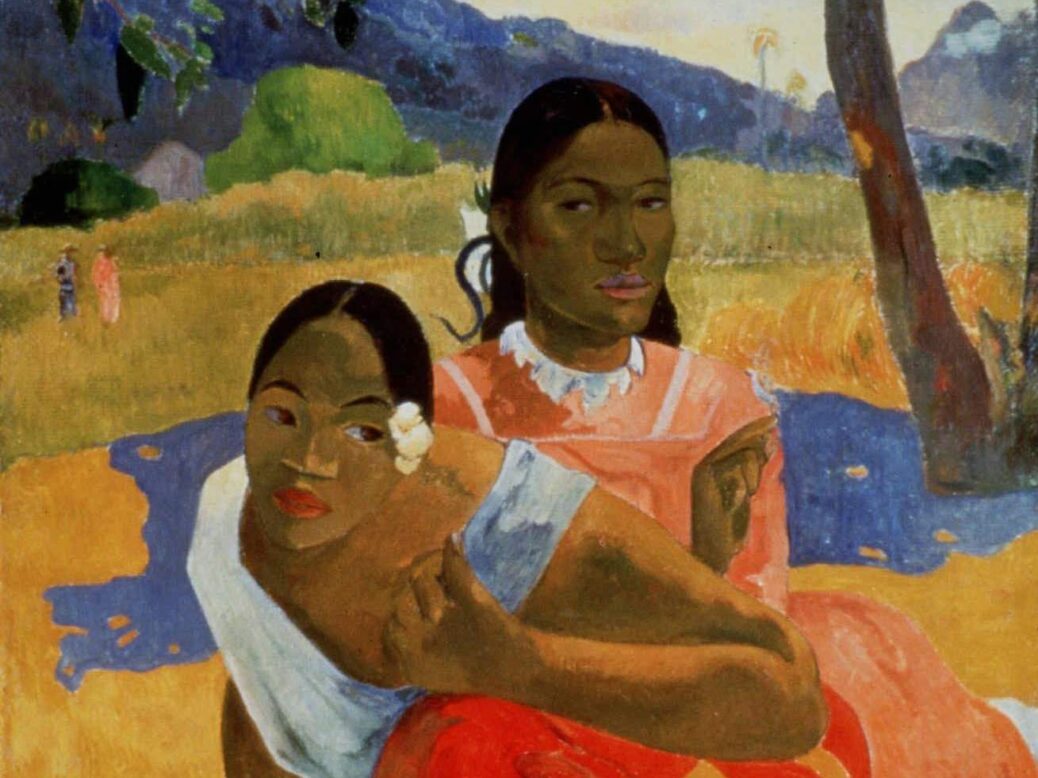

So, whilst an annual survey says that £45 billion worth of sales generated by global art in 2015 represented a fall of 7 per cent on the previous year, last year a Qatari collector still paid £200 million for Gauguin’s When Will You Marry and a record auction price of £115 million was fetched for Picasso’s Women of Algiers.

The concept of art as investment is not new, and therefore the concept of protecting your art as part of your estate is something of which most collectors of high-value pieces will be aware. In relation to inheritance tax (IHT) for example: where HMRC deems that a work is important to the UK’s national heritage, IHT can be deferred on that property, potentially indefinitely, as long as set rules are complied with. These rules include the requirement that a claim must be made to HMRC on any gifts into trust or transfers of value, and perhaps more significantly, the recipient of the work is required to give specific undertakings to HMRC (which include allowing public access and preserving the property).

In order to be ‘heritage property’, the work must appear to HMRC to be pre-eminent for its national, scientific, historic or artistic interest and if it is found to be so, Capital Gains Tax (CGT) can also be deferred, as any capital gain from the lifetime transfer of the work will not be treated as a chargeable gain. If the donor gives the undertakings to HMRC described above, the recipient is treated as acquiring the asset at the donor’s base cost.

A ‘heritage’ art work will also benefit from an IHT exemption where, if a work usually kept outside of the UK would become liable to IHT because it happened to be in the UK at the relevant date, the liability will be waived if it is brought here for public exhibition, cleaning or restoration. Although, in the current climate, even claiming a statutory IHT exemption may lead to rabid cries of ‘tax avoidance’ in the press…

One would hope that, having paid an eight-figure sum for a famous painting, HMRC would agree that the Gauguin hanging above your fire-place (presumably with some sort of bullet-proof glass and theft detection system in place) is of pre-eminent artistic interest. If not, perhaps the only answer is to buy a cheap painting for one million dollars and worry (slightly) less about the future IHT liabilities that might arise.

Marina Griggs works at boutique private wealth law firm Maurice Turnor Gardner LLP.