The late Labour politician and former chancellor Denis Healey used to talk about the importance of ‘hinterland’. When you enter the new offices of Stonehage Fleming on St James’s Square – where on the floors above, rather reassuringly, is the mining major Rio Tinto – you are greeted with evidence of hinterland in abundance.

Elevating the sleek corporate interior – hard black metallic surfaces, clean wooden lines, marble and plate glass – are works of art from the Fleming family collection that was begun, I’m told, in the 1950s and is now held in trust.

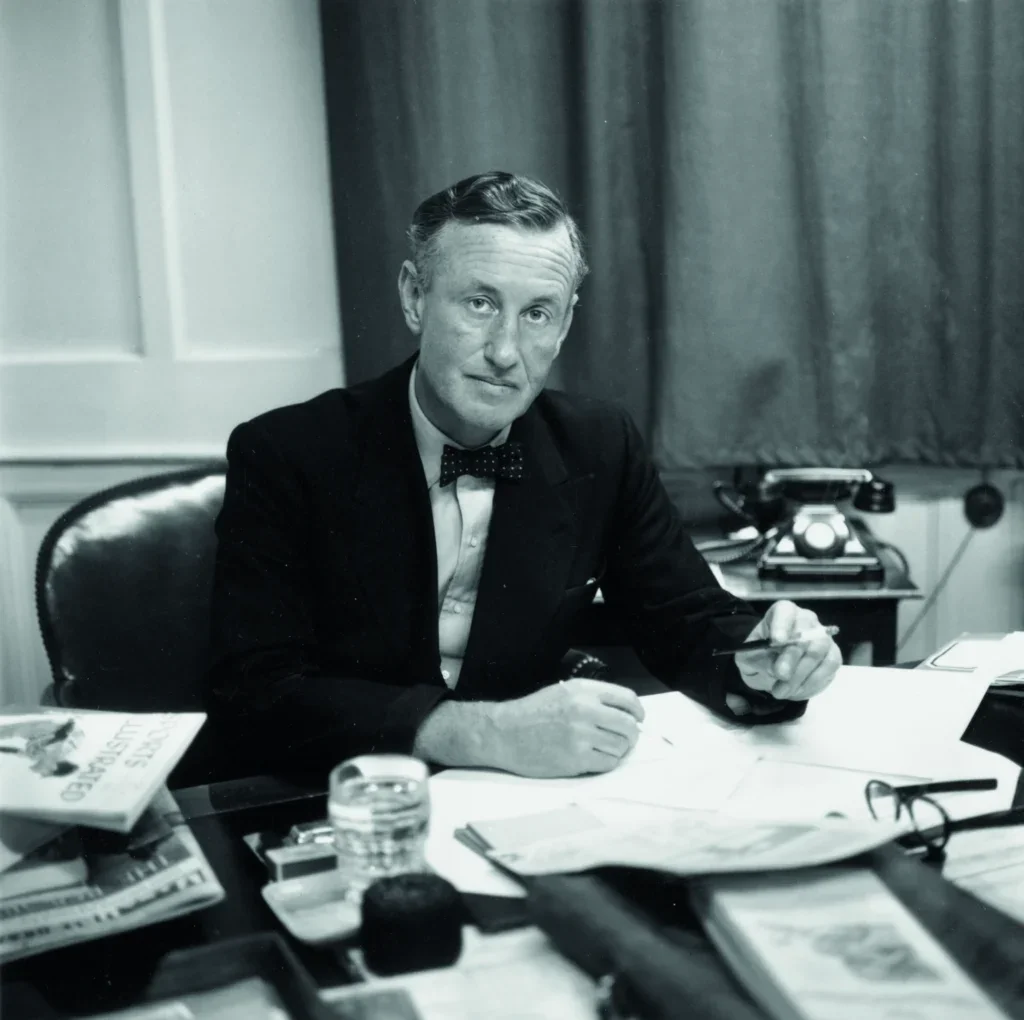

The paintings – by the greats of the Scottish Colourists movement, Peploe, Cadell, Hunter and more – along with a bronze bust of Ian Fleming, the creator of James Bond and scion of the house, point to hinterland and the kind of cultural capital that only one of the world’s most successful and enduring film franchises can bring.

Which is not unimportant for a company that sets out its stall as ‘the adviser to many of the world’s leading families and wealth creators’.

After all, it takes one to know one.

Today Stonehage Fleming – which was formed by the 2014 merger of Fleming & Partners with Stonehage – advises on £60 billion of client assets, while structuring and managing £16.3 billion of client money.

Stonehage was set up in London in the 1970s to provide fiduciary and family office services to mainly South African clients.

It would later establish a Swiss base and be largely acquired by a major South African bank in the late 1990s.

But the other part of the firm’s modern name speaks to its long history.

It was 150 years ago this year, in 1873, that Robert Fleming founded a merchant bank in Dundee.

He was successful, investing in the growing American economy, and moved his business to London in 1909.

Since then the company and the Fleming family have continued to flourish, thanks to the careful control and management of the family’s assets through trusts and holding company structures dating back to 1923, but also through commercial partnerships such as that which saw the formation of Jardine Fleming investment bank in Hong Kong in 1970.

However, in 2000, after 127 years, the Fleming family decided to get out and sold up to Chase Manhattan Bank for £4.8 billion, netting 60 members of the family a windfall of £1.4 billion (the family’s holding was 30 per cent by this point).

In possession of this fortune, family members set up Fleming Family & Partners (FF&P) to manage their financial affairs, later throwing open the doors to paying customers in 2002.

And thus, the first multi-family office on this side of the Atlantic was born.

‘At the time it was definitely how we saw it,’ confirms Matthew Fleming, who joined the firm in 2002 after a career in the army and as a cricketer, playing for England and captaining Kent as a right-handed batsman who bowled a bit of medium pace.

[See also: Stonehage Fleming appoints new CEO for ‘fresh ideas and new direction’]

Stonehage Fleming’s ambition to ‘become the leading multi-family office’

Now a senior partner at Stonehage Fleming, this great-great-grandson of Robert Fleming explains that by the time the financial crisis hit, FF&P was looking after 50-60 families.

‘We were an OK business, a nice family office,’ he recalls.

‘But families then were beginning to ask themselves, “How do we manage our international ambitions? How do we think about fiduciary responsibilities and requirements as well as our investment management requirements?” A true family office was needed, to do more than we were doing.’

This called for another partnership, preferably with a firm with a strong hand in trust and fiduciary work – and with an international network. FF&P had already worked with Stonehage, explains Fleming, and soon a ‘sensible idea’ blossomed.

‘It made sense if we both had ambitions to be a serious family office to bring the two together, and I’m really grateful to say that it’s worked thanks to the hard work of lots of people.’ He adds: ‘It’s worked incredibly well.’

Stonehage Fleming today has a headcount of 900 and 14 global offices, with its largest centres being London, where its headcount is 200, and South Africa, where it has nearly the same number across three sites.

Its Swiss, Jersey, Isle of Man and Mauritius bases are all ‘70- to 100-person locations’, according to group CEO Chris Merry, who joined the firm in 2019.

The newest office was opened last year in Miami, providing a gateway to South America.

Merry trained as an accountant with Coopers & Lybrand (now PwC), before rising to run the firm’s Shanghai office which gave him ‘a taste for being in charge rather than advising other people’.

He says the Miami office is indicative of the firm’s desire to put its ‘depth and breadth of resource’ where clients want it.

So what’s its strategy? ‘Our ambition remains to become the leading multi-family office – that’s all about quality, reputation, ability to provide service,’ he states.

‘It doesn’t mean we want to be thousands and thousands of people.’ But, he adds: ‘We recognise that in order to provide that service that scale needs to continue and probably to have a wider geographical footprint.’

With that in mind, the recent absorption of 300 staff from last year’s acquisition of Maitland, as well as the deal to acquire Cavendish Asset Management (which added another £1 billion of AUM) in 2020, both fall into perspective.

Indeed, you get the sense of a boxer of putting on the muscle for the next big fight.

‘If you go back to client needs,’ continues Merry, ‘there isn’t really a true, global multi-family office – but there are truly global families. So there are gaps in the market.’

Stonehage Fleming, for instance, while ‘very strong’ in Europe, the Middle East and Africa, only has 30-35 staff in Philadelphia, its main base in the US, which Merry notes is ‘probably the largest wealth market in the world’.

As a result he is looking to establish an investment management presence in the US, where currently the firm offers only family office and fiduciary services.

‘We’ve seen from a number of different businesses coming together – whether that’s Tiedemann and Alvarium or Stanhope and Forbes – crossing the Atlantic is starting to happen.

‘I would hope that at some point in the next five years there’s the opportunity for us to do something similar.’

Tiedemann and Alvarium’s tie-up in 2022 created a Nasdaq-listed ‘global multi-family office’, which it says manages $60 billion in combined assets, with 450 staff in 10 countries.

Stanhope’s merger with Forbes investment trust in 2020 sets it up as a ‘global investment boutique’ with 140 staff in six offices across Europe and the US and $27 billion in AUM.

But there are big differences between these players, as Matthew Fleming makes clear: ‘The majority of people who call themselves “family offices” are fundamentally focused on management of assets.

‘For us, a true family office does much more than that because it recognises what the families are really worried about – where they see the risks, and where they would like help and support.’

He notes that 40 per cent of the firm’s turnover comes from investment management. ‘I think that would significantly set us apart from a lot of people who claim… who do apparently what we say we do.

‘That is a fairly significant benchmark for us.’

[See also: What’s the pathway to becoming a successful CEO?]

‘You don’t get to where we’ve got to without having been wounded a few times’

Because as well as advising on wealth, trusts, management of art and other assets, treasury, philanthropy and more, the crux of Stonehage Fleming’s service is its ability to offer families advice on managing themselves and their succession.

‘I lead the team that helps the family think through what happens next from a family point of view,’ explains Fleming.

Conversations revolve ‘around purpose, around family dynamics, around engaging the next generation, around roles and responsibilities, and thinking about the future in a broader way rather than just about wealth, which is obviously important but not the be-all and end-all’.

That much of this is informed by his own experience – the sale of the bank in 2000, the formation of the family office, the decision to go commercial with it, and then the decision to merge with Stonehage – only adds to this.

‘We genuinely understand at first hand, from experience, what the issues and challenges are,’ says Fleming, who says that looking back they might have been ‘more modest in their ambitions’ at first and waited before they started ‘building a business straight away’.

‘We might have focused on embedding us as a family, having gone through the sale process, because when you sell a family business it’s traumatic for a family and unintentionally you lose a sense of purpose, and helping the family redefine its sense of purpose would have been time well spent.’

Since the creation of Stonehage Fleming eight years ago, another family has joined the corporate story – the Cayzers, former shipping tycoons.

Caledonia Investments, a listed firm 48 per cent owned by the family, bought 36 per cent of Stonehage Fleming for £90 million in 2019.

The family has added its own knowledge and experience to the mix and, notes Merry, the majority of the firm is still owned by its management and staff.

This results in an important alignment of interest, as well as the motivation to succeed.

‘There’s a sense of having a family at our core – Matt’s name is on the door, as it were,’ he adds. ‘That does set us apart.’

So what does the 150th anniversary mean now?

For the CEO, 1873 is the beginning of a history, making this less a birthday and more ‘a celebration of both tradition and evolution’. ‘We’ve survived different iterations, we’ve got lots of shared experiences,’ he says.

For Fleming, it’s a reminder that families such as his are ones that ‘have survived and had successful intergenerational strategies and transfers of influence, leadership’.

‘You don’t get to where we’ve got to without having been wounded a few times.

‘And those wounds enable us to have very authentic conversations with families who are genuinely appreciative of the fact that we’re talking about lived experiences.

‘Families don’t set out to manage their wealth,’ he adds. ‘They start a business and hope that it succeeds.’

For his forebears it was no different; the family only began managing its wealth in 1923, when Robert Fleming set up the Southern Investment Trust after the death of his eldest son in the First World War.

‘So we’re probably 100 years old,’ says Fleming. ‘For me that’s the start of the family office, way before it was called a family office.’

So not 150 after all. But then, who’s counting? Because when it comes to families, numbers are the least of it, apparently.