In the wake of reports that Chancellor of the Exchequer Rishi Sunak’s wife may have avoided paying a significant amount of tax by declaring ‘non-domicile’ status — a regime meant for people who do not intend to make the UK their permanent home — James Heathcote, chartered tax adviser, explores whether taking advantage of non-dom status has a reputational cost

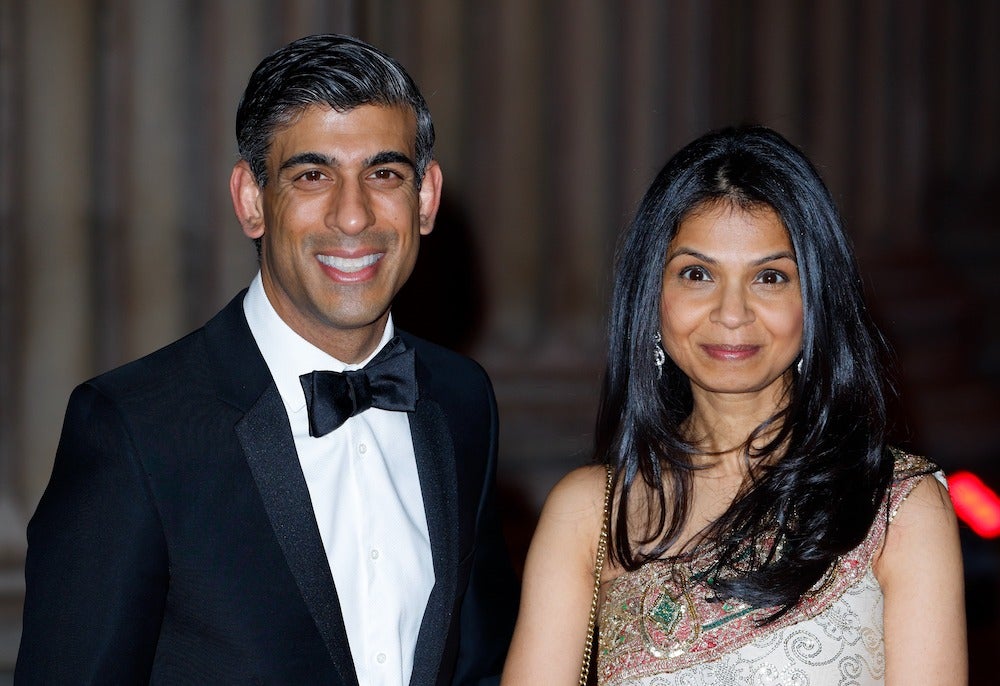

Rishi Sunak has this week found himself at the centre of a political storm that has sent journalists gleefully skipping down Fleet Street. The Labour Party is up in arms, crying hypocrisy and double standards. Tax advisers are becoming increasingly apoplectic every time domicile is described as a ‘scheme’. The revelation that the Chancellor’s (independently wealthy and successful) wife, Askhata Murthy, benefits from the UK’s non-domicile regime has divided opinion and raised important questions about the moral standards to which politicians’ families should be held.

Murthy was born in India, and is the daughter of an Indian billionaire businessman. Although she has lived in the UK for the past nine years, she spent most of her formative years in the US. The scale of her and Sunak’s wealth has never been denied, but the majority of Murthy’s personal wealth is believed to be outside the UK.

Whilst UK residents are normally taxed on their worldwide income and gains, those who are non-UK domiciled may, subject to a number of conditions, elect for the ‘remittance basis’. This means, in broad terms, that they pay UK tax on their non-UK income and gains only to the extent they are brought to or used in, the UK. This week’s PR headache has arisen because Murthy claims the remittance basis.

Domicile is an English common law concept that has existed since the 18th century. In brief, everyone has a domicile at birth, usually inherited from the father. Murthy therefore appears to have a domicile of origin in India. It is possible for one’s domicile of origin to be displaced; but, in this case, the burden of proof would be on HMRC to prove that Murthy had formed an intention to remain in the UK permanently or indefinitely. Seemingly, therefore, either HMRC have not yet asked this question of Murthy (though one wonders if their inquiries may now be accelerated), or Murthy has sufficient evidence that she does not intend to remain in the UK forever.

The political fallout cannot be underestimated. Tax advisers will be fast to point out the inaccurate, often false, picture painted by the media of ‘non-doms’ as tax-dodging oligarchs privately jetting between tax havens. In reality, non-doms have, in fact, been shown to make a huge financial contribution to the Treasury’s purse (far more per year than the increase in National Insurance is forecast to raise).

There have been many calls over the years for the non-dom regime to be abolished. Non-doms wishing to claim the remittance basis now have to pay an annual charge once they have been UK resident for more than seven years, and are treated as though they are domiciled in the UK for tax purposes once they have been here for more than 15. Non-dom status also means non-UK situs assets generally fall outside the UK Inheritance Tax net.

Whether or not to claim the remittance basis often depends on the economic benefit (or otherwise) of paying the remittance basis charge, which is up to £60,000 a year. But Murthy’s story highlights a far more important question: what is the reputation cost of using a law that only really applies to those with sufficient income and capital to benefit from it?

The non-dom regime is very poorly understood by the public and the media. It is therefore all the more surprising that the political maelstrom was not foreseen when Sunak was appointed Chancellor. It is not difficult to see how it might scream ‘one rule for them…’ for many, not least at a time of rocketing costs of living. So does Murthy, as the Chancellor’s wife, have some sort of moral obligation to pay more tax than she legally needs to? That seems difficult to reconcile. If the law applies equally to all, that must include being able to avail oneself of favourable tax rules.

Sunak’s position is more nuanced. Whether he, as the person in charge of the country’s finances, should be seen to indirectly benefit from a law not applicable to most of those upon whom he is implementing real-terms tax hikes, is a question of politics and perception. It undoubtedly feels uncomfortable outside the limited sphere of people who understand what being non-domiciled means (and also amongst many of those who do). And it highlights why tax cannot be viewed in its own isolated bubble, but should be seen in a far wider context of reputation and transparency.

It is incumbent on advisers to have frank discussions with clients about public scrutiny, negative publicity and the reputational impact of tax planning.

After all, technicalities and accuracy only count for so much in the Court of Public Opinion, where the ultimate penalty may be a high-profile and lonely fall from grace.

Image: Max Mumby/Indigo/Getty Images